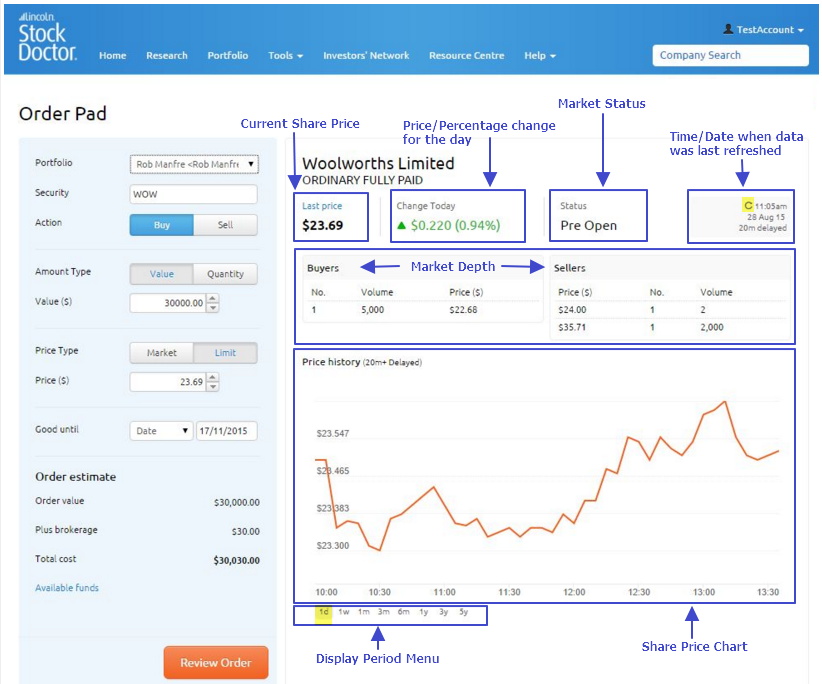

The desktop order pad will open in a new browser tab with the Stock Doctor menu at the top of the screen.

When you select to enter a 'Buy' trade, the order pad will appear in Blue. If you select to enter a 'Sell' trade, the order pad will appear in Red.

Portfolio

Portfolio drop-down menu, lists all portfolios that are linked to a Bell Direct account. These are sorted alphabetically.

Security

Typing in the Security code field shows ordinary securities matching the code or name. Other security types will not show up in the results list, but you can still trade these by entering their full security code.

Action toggle buttons (Buy/Sell)

Buy

- When Buy is selected, the background of the panel changes to blue.

- The total at the bottom is titled Total cost (inc brokerage).

- Total cost is calculated as Value + Brokerage or Quantity * Price + Brokerage.

Sell

- When Sell is selected, the background of the panel changes to red.

- The total at the bottom is titled Net proceeds.

- Net proceeds is calculated as Value - Brokerage or Quantity * Price - Brokerage.

Amount Type toggle buttons (Value/Quantity)

Value

- When Value is selected the text box below is titled Value ($) and the text is removed.

Quantity

- When Quantity is selected the text box below is titled Quantity and the text is removed.

Price Type toggle buttons (Market/Limit)

Market

- When Market is selected the Price ($) field is hidden.

Limit

- When Limit is selected the Price ($) field is shown and repopulated with the last price from Bell Direct for the security if one is selected, otherwise it will be empty.

Good until

- The validity of your order can be selected from the Good Until drop-down list with options either 'Day end', good until 'Cancelled' or 'Specified expiry date'.

** A Day End order will be valid for the rest of that day if the market is open. If the market is closed, your Day End order will be placed on the market on the next trading day and valid for the whole of that day.

Order Estimate

Order Value

- Order value is either Value entered or Quantity * Price.

If Price type = Market then the last price is used.

Brokerage (Estimate only)

- Brokerage is $15 or 0.1% of order value, whichever is more.

It is Plus brokerage for buys and Less brokerage for sells.

** Actual brokerage may be less than if you’ve made more than 10 trades this month.

View full list of brokerage fees

Total cost

- Total cost for buys (order value - brokerage)

Net Proceeds

- Net Proceeds (order value + brokerage) for sells.

Available Funds

- Opens a new Bell Direct window showing available funds.

Review Order button

The Review Order button is disabled until the following are entered:

- Portfolio

- Security

- Action

- Quantity or Value

- Price ($) if type is Limit.

- Expiry date on or after today if Good until is Date.

When Review Order is clicked it displays the following page:

- Value could be Quantity if that was selected on the entry page.

- Price could be a number (if limit) or Market

- Good until is either Day end, Cancelled or a specified date (dd/mm/yy).

- Clicking Adjust order returns to the entry page.

Place Order button

Clicking Place Order button will place the order, then if successful displays the following confirmation page.

View Orders button

Once the order is confirmed, you can click on the Place Order button which will open the Bell Direct > Orders webpage in a new tab.

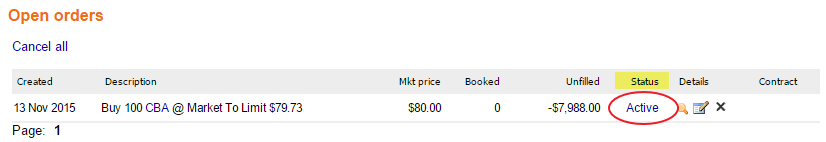

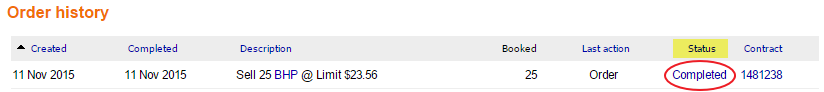

On the Bell direct orders webpage you can view the Status of the placed order.

** Completed trades may take up to 5mins to appear in the Stock Doctor portfolio manager

If there is an error placing the order, it will display a bulletlist of errors on the order pad like the following:

Clicking Adjust order button returns to the entry page.

If you have difficulties placing an order, please call Bell Direct on 1300 786 199 and select option 1.

How to place a trade online through Stock Doctor?

Placing a trade online from the Mobile order pad

What is the difference between Limit and Market orders?

Placing a trade online directly from the Portfolio Optimiser or Constructor