IMPORTANT: If you do not have short selling functionality enabled, please read the following article before proceeding. (See article: How do you enable Short Sell functionality?)

Stock lenders generally require that short selling transactions must be made through an account separate to your regular trading accounts. This account needs to be set up as a separate account in the portfolio. (See article: How to create a new cash account?)

For instructions on entering a new Short Sell or Covering Buy (See article: How do you enter a short sell?)

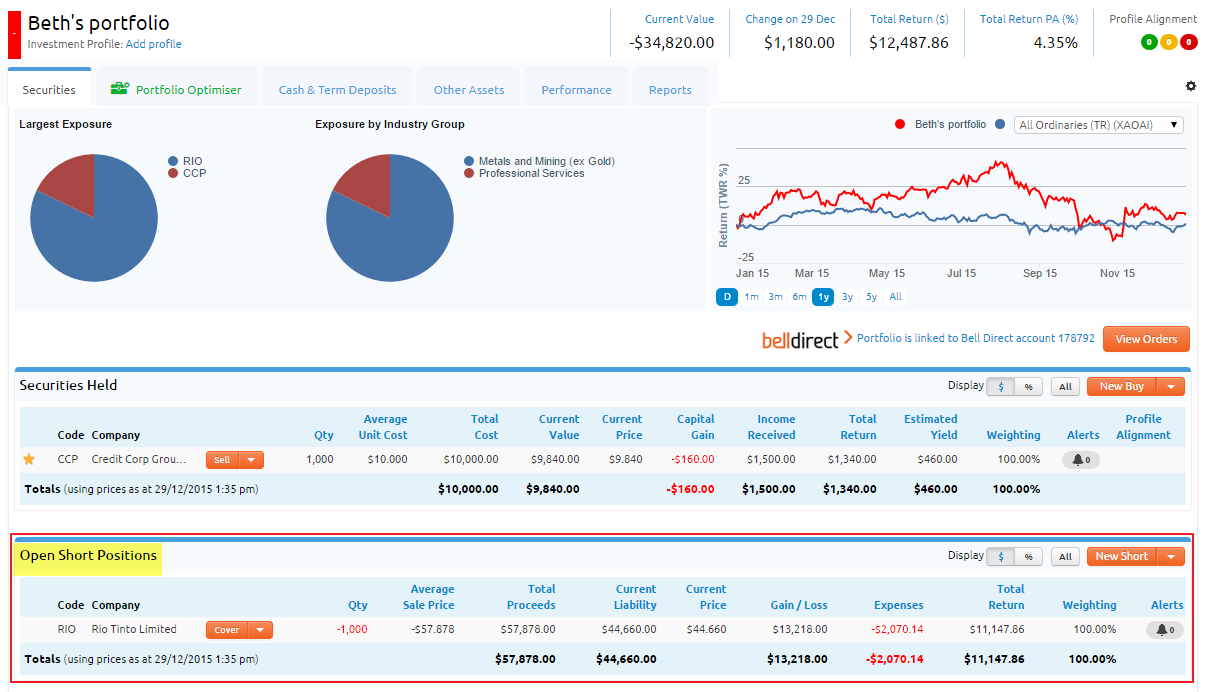

Once Short Selling functionality is enabled, there will be a new section in the Portfolio Manager - 'Open Short Positions'.

| Column | Description |

| Code | Security code |

| Company | Related company name |

| Buttons | Cover button that opens the dialog to create a new “Covering Buy”, i.e. a buy to cover the short. |

| Qty | Total quantity of the security that has been short sold and not covered. |

| Average Sale Price | Average sale price (net of fees) of the uncovered shorts. |

| Total Proceeds | Proceeds from open shorts, i.e. the amount they were sold for after sale fees are deducted. |

| Current Liability | Cost to cover the open shorts at the current security price. |

| Current Price | Current security price. |

| Gain/Loss | Total Proceeds – Current Liability |

| Expenses | Sum of expenses (interest and dividends paid to the stock lender) associated with the open shorts. Expenses will be negative. When showing percentages, this is shown as a percentage of Total Proceeds. |

| Total Return | Sum of Gain/Loss and Expenses. When showing percentages, this is shown as a percentage of Total Proceeds. |

| Weighting | Current Liability / Sum of current liability of all open shorts. |

| Alerts | Triggered / total alerts for this security. |

Portfolio Manager - Securities (Short Trades) Screen

Underneath the ASX code and company name, investors will be shown the Current Quantity Shorted, the Price and the Current Liability. In addition, users can see the Expenses, Total Return (in dollar terms) and Total Return per annum in percentage terms generated from these securities. To the right of this, investors will be able to see in the pie chart the percentage weighting of the specific security compared to the rest of the portfolio.

Trades and Adjustments

In the Trades and Adjustments section, investors will be able to see recent trades and adjustments for this security. These will be ordered by the Date column with the most recent at the top. The second column Trade Type highlights the type of transactions such as Short Sell, Covering Buy etc., while the Quantity, Price, Value, Fees and Current Holding are also displayed. If investors have included any relevant Notes for a transaction, then these are shown in the last column. Above the list of recent transactions, investors can also easily enter new transactions for this security by clicking on the buttons 'New Short', 'New Covering Buy' and 'Other Transactions'. Trades and adjustments can also be deleted by selecting the relevant row with the check box at the very left and then clicking the 'Delete' button at the top left of the section. The 'Move to Long Trades Page' button will move the selected trades from the short account to the long account.

| Field | Calculation |

| Quantity | Quantity Amount |

| Price | Current price (intraday where available) |

| Current Liability | Current Qty Held * Price |

| Expenses | Current Qty Shorted * Price |

| Total return |

Proceeds of short sells |

| Total Return PA (%) | - |

Income

The Income and Expenses section highlights recent relevant Income/Expenses for this security. At the very top right of the section there are two buttons 'New Income' and New Expense button, which can be used to manually add details of Income and Expenses. Below this, the relevant Income/Expense will be ordered in the Date column with the most recent at the top. The other columns provided information of the Holding, DPS (cents), Franked amount, Unfranked amount, Total received, Franking Credit and Total Taxable. Income or Expenses can also be deleted by selecting the relevant row with the check box at the very left and then clicking the Delete button at the top left of the section.

Reports

There are no capital gains on short selling so they will not appear in the capital gains report. Proceeds of short sales are counted as income and the cost of covering buys are considered expenses in the financial year they occur. These income and expense transactions will appear in the income report.

How do you enable Short Sell functionality?

How do you enter a short sell?