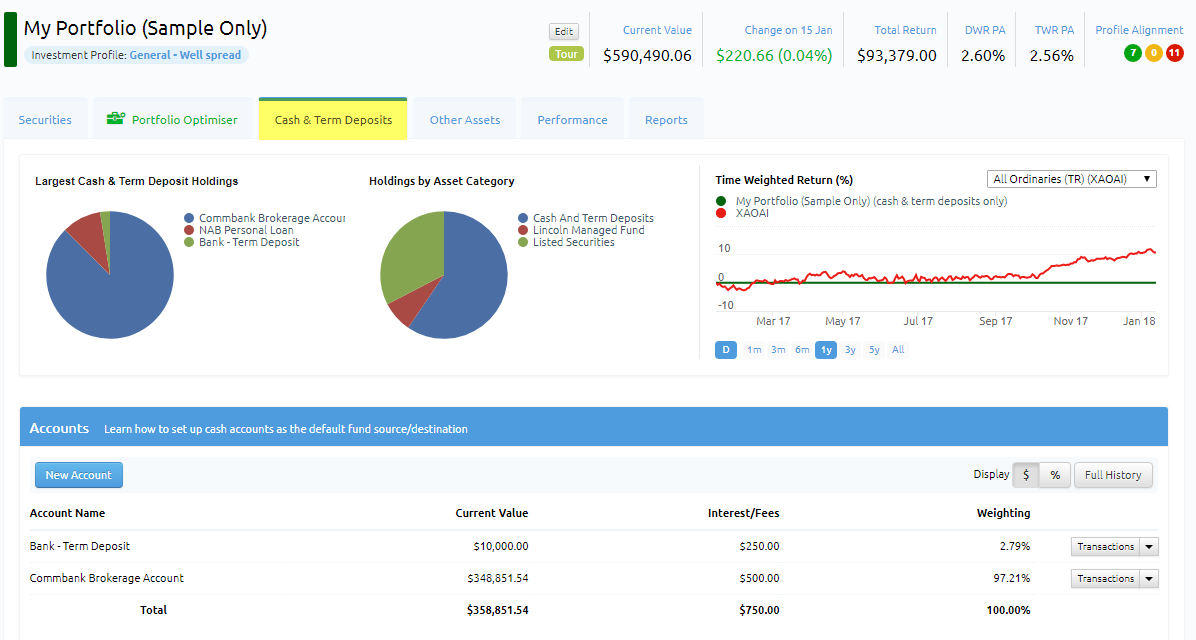

Clients may find the statements from their banking institution sufficient for reporting transactions and therefore may not feel the need to maintain a separate cash account within the Portfolio Manager.

Cash as an asset class is not subject to capital gains and therefore technically not required. All deposits and withdrawals are not considered as capital gains or loss events.

From a performance perspective bank interest / fees often make up a minor part of the assets total value therefore return is often negligible. You will need to decide whether the interest / fees incurred on your cash account are significant enough to report on.

Cash style assets like term deposits we recommend you include in the portfolio manager under the "Cash and Term Deposits" section.

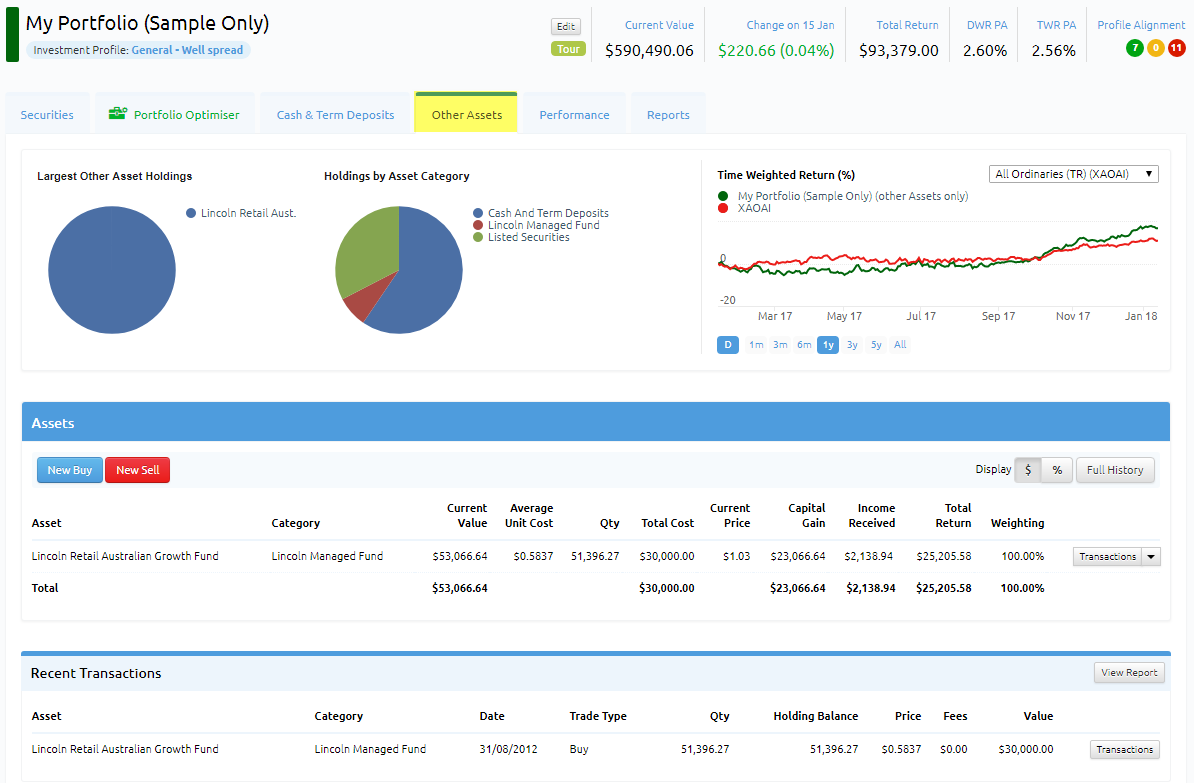

For Bonds and other floating face value assets then enter them into the "Other Assets" section.