The development of the Portfolio Optimiser and Portfolio Constructor represents a new paradigm of investing for investors. Once only available to high end quantitative research teams, we have broken the mould and for the first time in Australia and the world allowed investors to apply complex theories in an easy to use tool.

Traditionally research has been very analyst centric, in that an analyst covers a stock (sometimes hundreds) and you as an investor have to try to make head or tails as to which stocks to select. What's even more difficult is then managing your portfolio making buy and sell decisions based on the objective you are trying to achieve.

User centric research

Starting first with an investors preferences and desired outcomes, an appropriate investor profile can be identified, once this is done then scan the investable universe to identify the stocks which as a collective most closely align to the stated objectives and preferences.

To do this there are three main risks we try to manage:

- How the portfolio in total will behave

- The risk (volatility) of the individual stocks

- The propensity for income to be paid

We calculate all these risks within our Star Growth, Income and Borderline stocks to then calculate who as a collective will create a portfolio of companies that align to the stated objective.

So rather than simply look at a full list of recommendations for possible inclusion, now you can focus your attention on building a portfolio just looking at the 10 to 20 stocks that as a collective will help you achieve your goal.

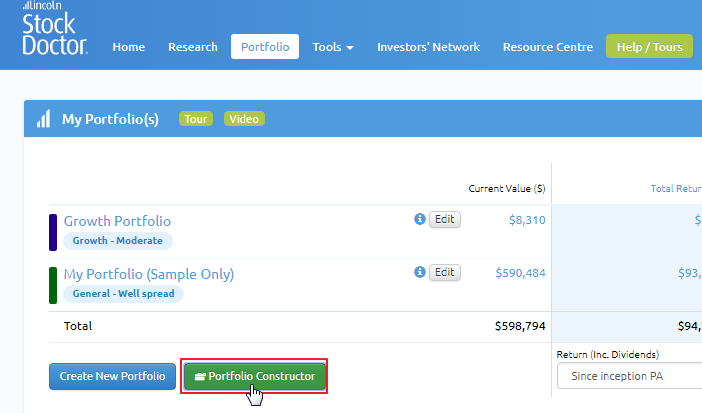

Monitoring that the portfolio remains in alignment

Once you are managing an existing portfolio the Optimiser looks to see which stocks are currently in alignment with the objective and those that are not.

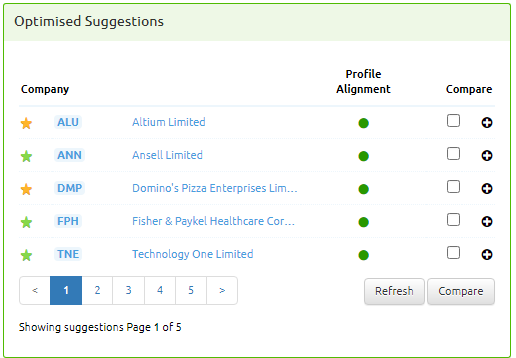

When looking to replace those that are not, the Optimiser throws up some 'Optimised suggestions' which are made taking into account the risk properties of the existing portfolio and the objective the investor has selected for the portfolio.

The first five suggestions are the top 5 selected based on their ability to more quickly align the portfolio to desired objective. Though they are the five most highly ranked suggestions they are NOT in order of ranking. Rather, they are sorted in alphabetical order. You will still be required to see which of the companies you prefer to be investing in.

But what we have done is taken from the 2000+ stocks on the exchange brought to your attention 5 that will help the portfolio better align to the stated objective.