BHP Group (BHP) and Woodside Energy Group Ltd Ltd (WDS) (formerly known as Woodside Petroleum Ltd (WPL)), entered into a share sale agreement for the merger of BHP’s oil and gas portfolio with Woodside by an all-stock merger on 22 November 2021. Eligible BHP shareholders, will receive 1 WDS share for each 5.5340 BHP shares they held at the close of business on 26 May 2022.

The ATO has issued a Class Ruling CR 2022/60 for this merger, and a copy can be obtained on the ATO website at https://www.ato.gov.au/law/view/document?docid=CLR/CR202260/NAT/ATO/00001

Below are instructions on how to account for the BHP/Woodside merger and BHP in-specie dividend in your portfolio:

- Click on the 'Portfolio’ tab and then click on the appropriate portfolio, under ‘My Portfolio(s)’, which includes the BHP shares.

- Under the ‘Securities Held’ section, please click on the New Buy button

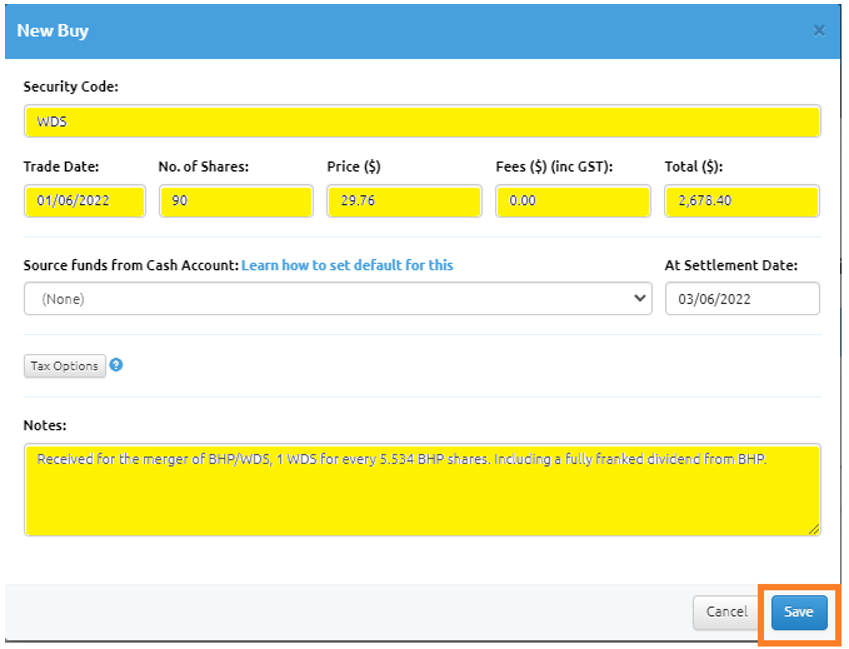

- In the new window, please type in the following:

- Security Code: WDS

- Trade Date: 01/06/2022

- No of shares: Your BHP shareholding divided by 5.5340. (E.g. 500 divided by 5.534 = 90) Please verify this number to your BHP share registry notice.

- Price: $29.76

- Fees: Zero

- Source funds from cash account drop down menu, please select (None), if you have a bank account attached to this portfolio

- Notes box, we suggest entering a note, referencing the shares were received as part of the BHP/WDS merger.

- Click on the Save button, found in the bottom right-hand corner.

You will need to manually add in the in-specie dividend of approximately $5.38 and franking credit of $2.30 per BHP share.

Below are the instructions:

1. Click on the “portfolio tab”, then click on the “portfolio name” that contains your BHP shares.

- Under the ‘Securities Held’ section, click on the row BHP Group (BHP)

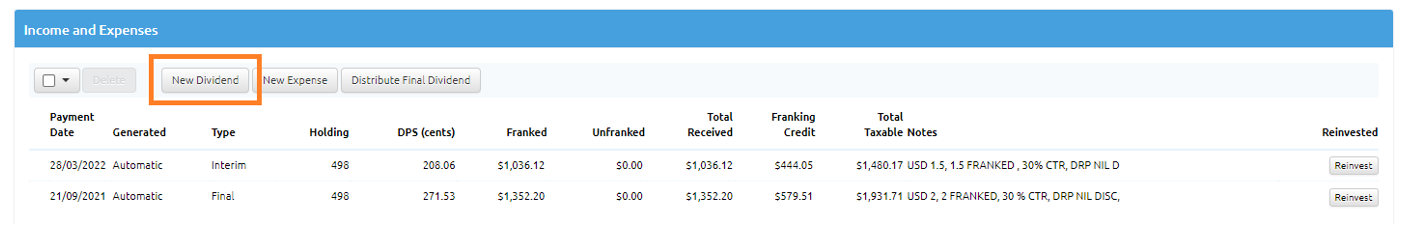

2. Scroll down to the "Income and Expenses" area

3. Click on the button called "New Dividend"

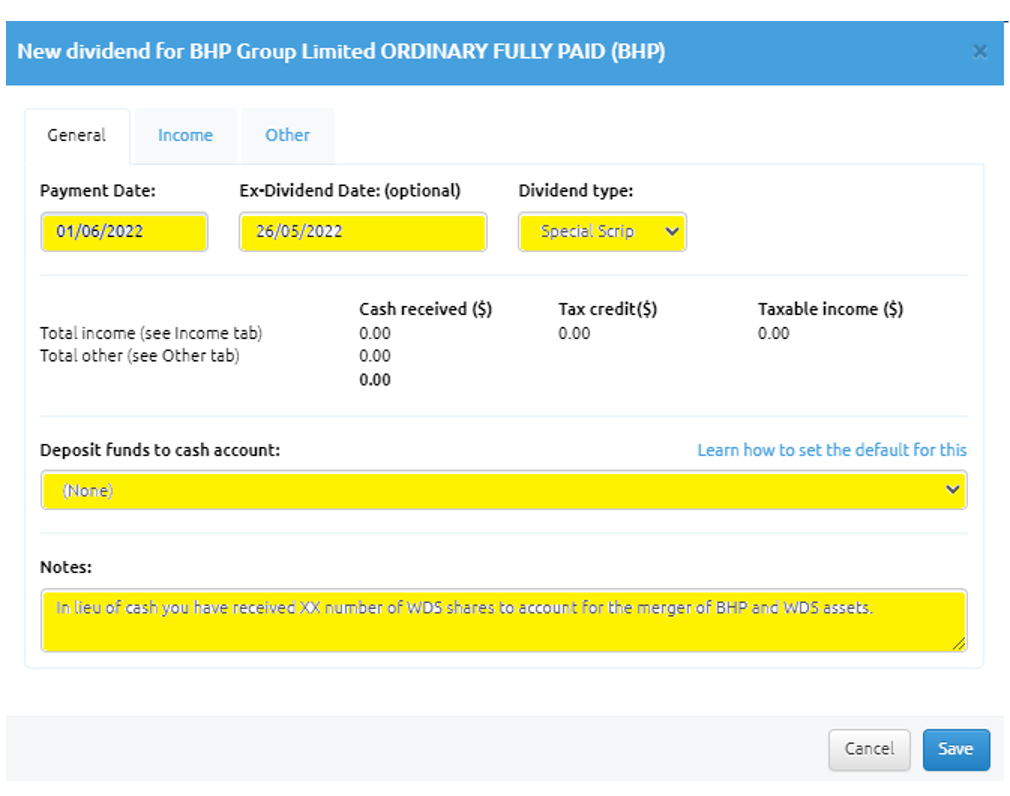

- In the new window, Under the 'General' Tab please record the following:

- Date: 1 June 2022

- Ex-Dividend Date: (This is optional): 26 May 2022

- Dividend Type: Special Script

- If you have a bank account attached to this portfolio, in the “Deposit funds to cash account” drop down menu, please alter to “None”.

- In the “Notes” box, you may record that in lieu of cash you have received XX number of WDS shares to account for the merger of BHP and WDS assets.

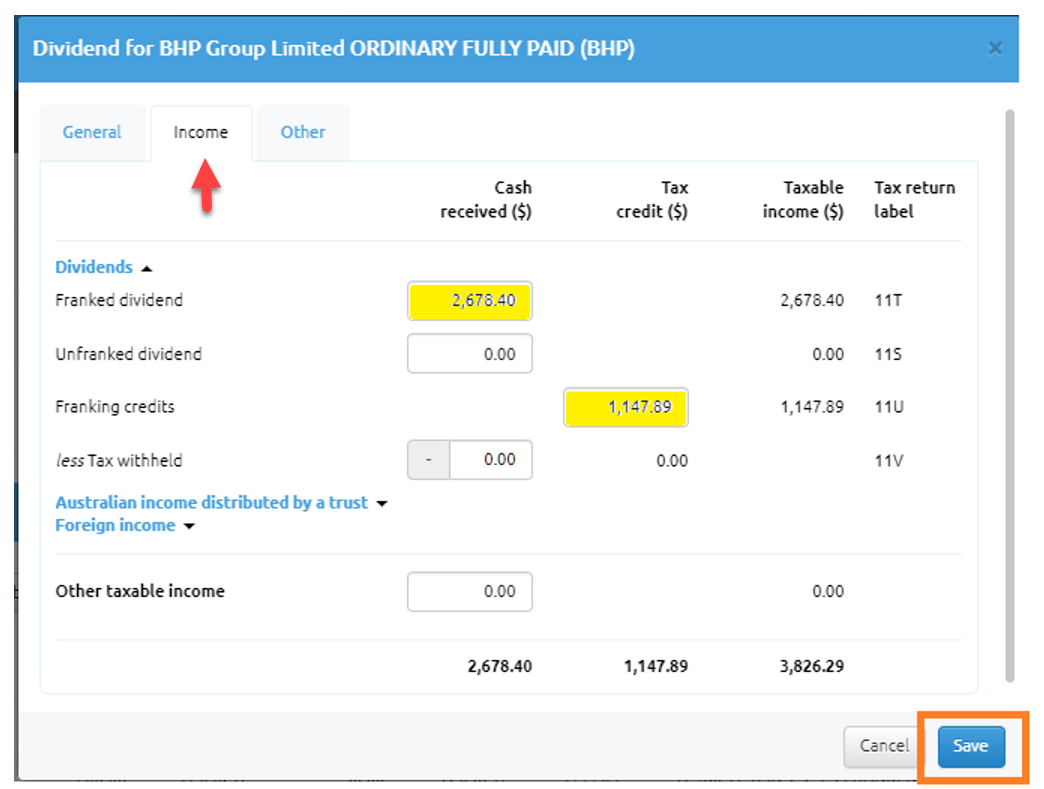

- Click on the "Income” tab and add in your franked dividend and franking credits into the correct boxes, labelled 11T and 11U, as per you’re In Specie Dividend Statement from BHP.

- Click “Save” in the bottom right-hand corner and you have accounted for the BHP/WDS merger of May 2022 in your portfolio.

Our team in the office are ready and willing to assist you with any questions you have about any of the content above. Please give us a call on 1300 676 333 or email us at support@lincolnindicators.com.au with any questions you may have.

However, we are not licensed to provide tax advice and therefore anything which relates to tax or your personal circumstances we will not be able to answer. In order to have personal tax or finance questions answered, you will need to seek the services of a licensed practitioner who will be qualified to answer your queries.