Tabcorp Holdings Limited (TAH) completed the demerger of The Lottery Corporation Limited (TLC) on the 1 June 2022. The demerger has created two standalone businesses being The Lottery Corporation Limited (for Lotteries & Keno), and Tabcorp Holdings Limited (wagering & gaming).

Eligible shareholders received one The Lottery Corporation Limited (TLC) share for each Tabcorp Holdings Limited (TAH) share owned, on the record date of 25 May 2022.

The ATO has issued a Class Ruling CR 2021/50 for this demerger, and a copy can be obtained from the ATO website at: https://www.ato.gov.au/law/view/document?docid=CLR/CR202258/NAT/ATO/00001

- Click on 'Portfolio’ and then click on the portfolio, that has your TAH shares.

- Under the ‘Securities Held’ section, find the row TAH Tabcorp Holdings Limited (TAH)

- Click the drop-down button next to ‘Transactions’ on the same line and select ‘New Reconstruction’.

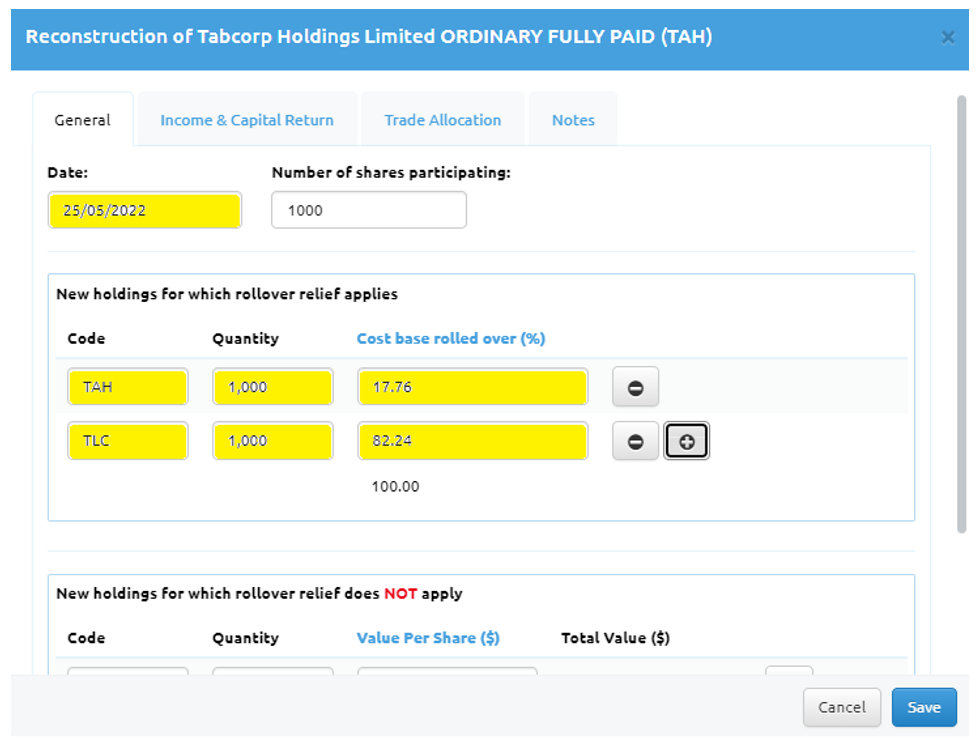

- In the Reconstruction window, enter the following:

- Date: 25th May 2022. The “number of shares participating” should be the same as the number of TAH shares owned on the record date. In this example 1000.

- Under “New holdings for which rollover relief applies” Complete the following:

- Code: TAH, Quantity: same amount as “number of shares participating” (1000), and Cost base rolled over (%): 17.76 %

- Click on the “plus symbol” to add another line.

- On the new line, Code: TLC, Quantity: same amount as “number of shares participating” (1000), and Cost base rolled over (%): 82.24%

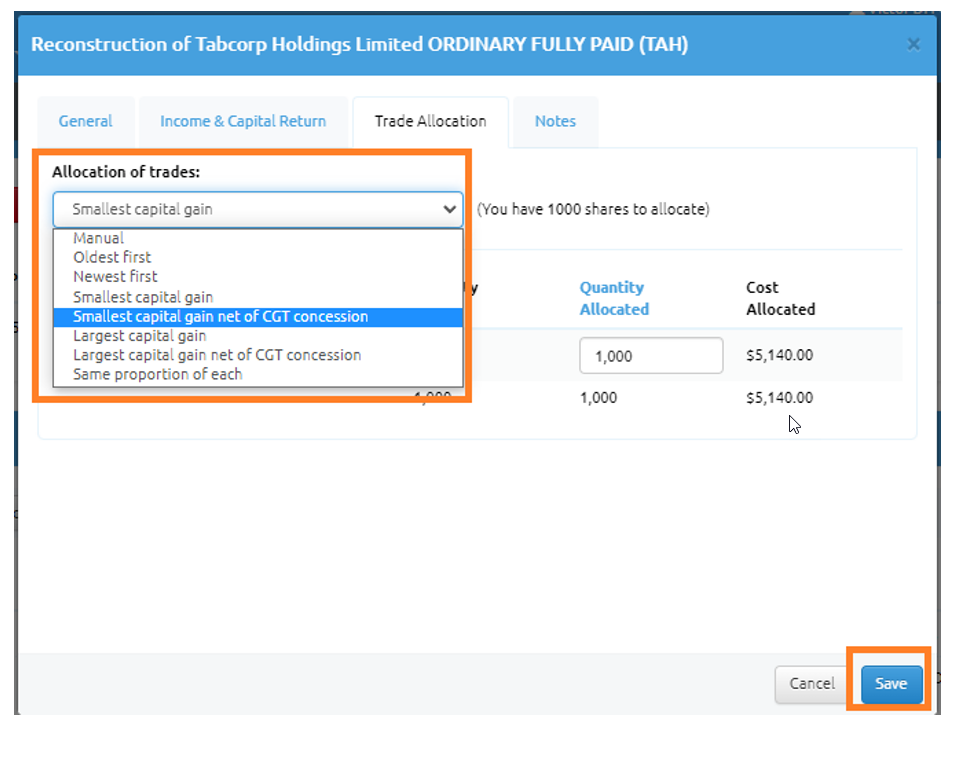

- Then click on the “Trade Allocation Tab” and check your “Allocation of Trades” method.

6. Click “Save” and you have accounted for the TAH/TLC demerger in Portfolio Director.

Our team in the office are ready and willing to assist you with any questions you have about any of the content above. Please give us a call on 1300 676 333 or email us at support@lincolnindicators.com.au with any questions you may have.

However, we are not licensed to provide tax advice and therefore anything which relates to tax or your personal circumstances we will not be able to answer. In order to have personal tax or finance questions answered, you will need to seek the services of a licensed practitioner who will be qualified to answer your queries.