Instructions to account for the JB Hi-FI (JBH) off market share buyback announced on 14 February 2022. These instructions will only apply to you if you successfully participated in the off-market share buyback. In this buyback, the market price was $52.3854 per share, the price you received was $45.05, (being the market price less 14 % discount), with $41.87 deemed a fully franked dividend component, and $3.18 deemed a capital component. The market value deemed by the ATO was $49.07.

https://www.ato.gov.au/law/view/document?docid=CLR/CR202241/NAT/ATO/00001

The example uses the following data and assumptions, please amend accordingly for your individual circumstances.

432 JBH shares purchased on 6 Jan 2022

Share price at 6 Jan 2022 $ 46.25

Cost: $ 19,980.00

Brokerage: $29.95

Total cost: $ 20,009.95

You nominate 100 shares (from your parcel of 432) for the buyback. Be mindful to double-check the number of shares accepted in the buyback (refer to your statements), given that a scale back was introduced due to overwhelming investor demand.

Instructions for Stock Doctor

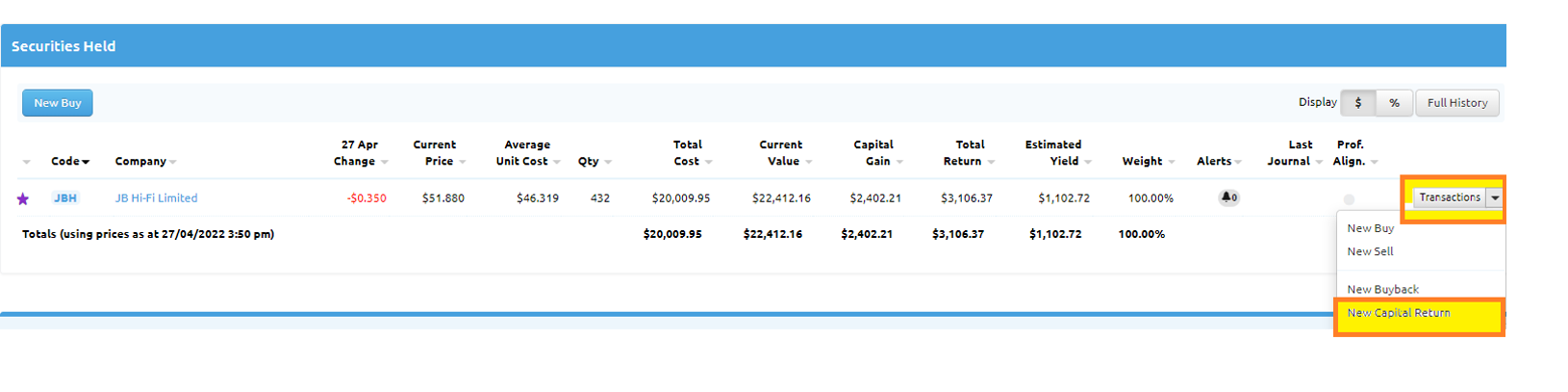

- Click on the 'Portfolio’ tab and then click on the appropriate under ‘My Portfolio(s)’, which includes the JBH shares.

- Under the ‘Securities Held’ section, find the row JB HI-FI (JBH). Click the drop-down button next to ‘Transactions’ on the same line, and select ‘New Buyback’.

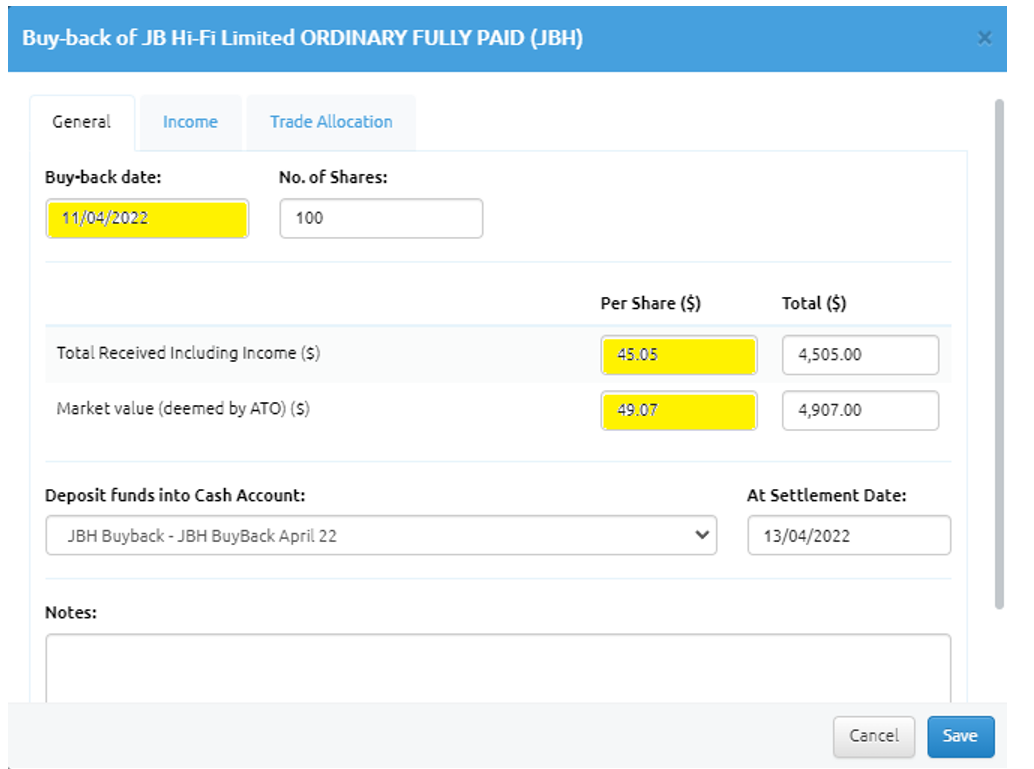

3.In the New Buyback dialogue box:

3a. Enter the Buy-back date as 11 April 2022.

3b. Enter the No. of shares is 100 (this should be the number of shares accepted through the buyback – please refer to your statements for the number of confirmed shares bought back).

3c. Enter $45.05 as the Per Share amount for Total Received Including Income ($). The Total ($) should auto-calculate.

3d. Enter $49.07 as the Per Share amount for Market Value (deemed by ATO) ($). The Total ($) should auto-calculate.

3e. Click Enter Income, found in the bottom right-hand corner if this window. This should take you to the next ‘Income’ dialogue box.

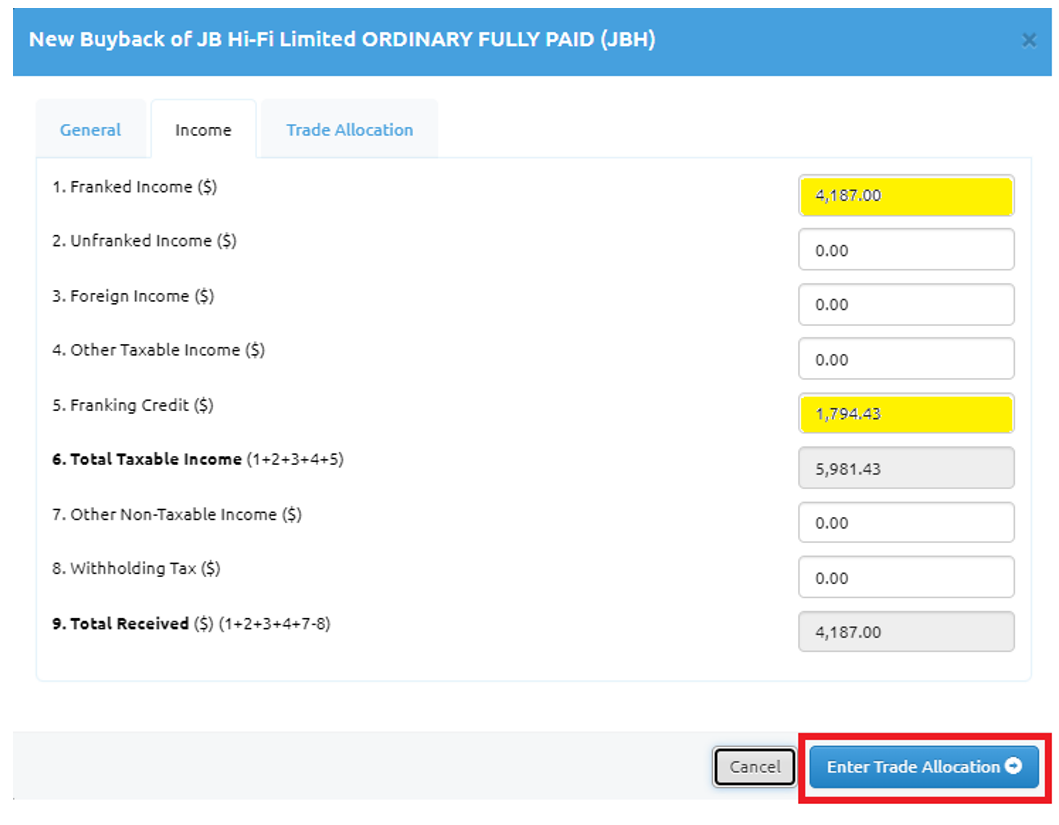

- A new ‘Income’ dialogue box tab should appear:

Franked Income ($) is $ 4,187.00 i.e. $41.87 per share for 100 shares ($41.87 x 100).

4b. The Franking Credit ($) is $1,794.43 i.e. $41.87 per share for 100 shares. ($41.87 x 30% / 70%) – or best to use your statement

4c. The totals should auto-calculate.

4d. Click the Enter Trade Allocation button to go through to the Trade Allocation tab of the dialogue box

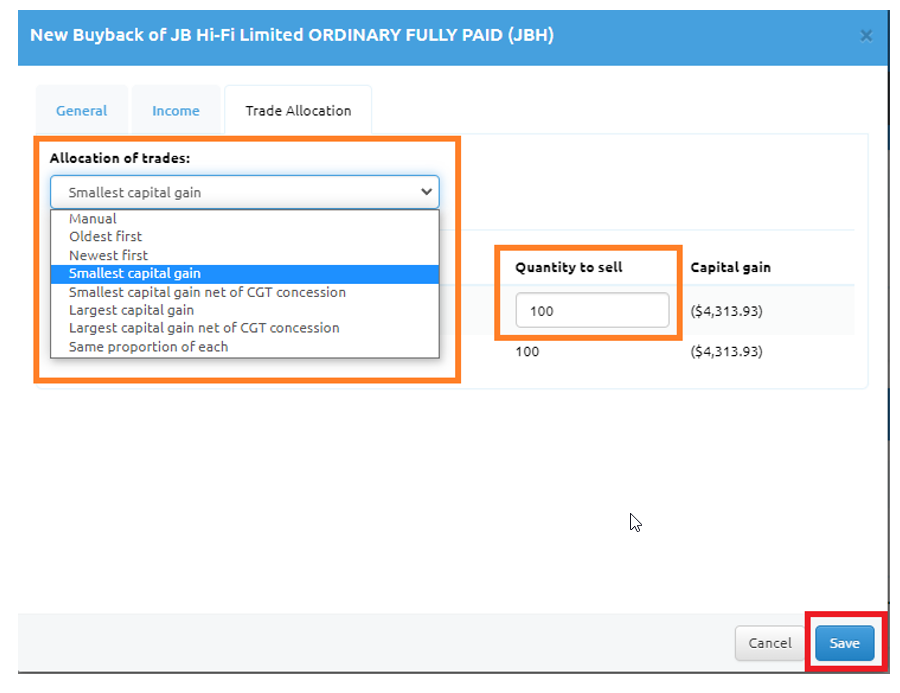

- You should be in the Trade Allocation tab of the Dialogue Box.

5a. Allocate the trade from the drop-down box: Oldest First, Newest First, Smallest Capital Gain, Largest Capital Gain, or Same Proportion of Each.

5b. The quantity to sell should match the amount you nominated for buyback (or scale back amount).

5c. Click Save

You have now accounted for the JBH buyback of April 2022.

However, we are not licensed to provide tax advice and therefore anything which relates to tax or your personal circumstances we will not be able to answer. In order to have personal tax or finance questions answered, you will need to seek the services of a licensed practitioner who will be qualified to answer your queries.

Our team in the office are ready and willing to assist you with any questions you have about any of the content above. Please give us a call on 1300 676 333 or email us at support@lincolnindicators.com.au with any questions you have.