The acquisition of Class limited (CL1) by HUB24 Limited (HUB), scheme has been implemented and Class Limited has been suspended from trading from 7 February 2022. The scheme record date is expected to be 9 February 2022. Shareholders will receive 1 HUB24 share for every 11 Class limited shares and a cash amount of $0.125 for every Class Limited share.

To account for the cash amount and acquisition in the Stock Doctor Portfolio Manager, please see instructions below:

- Navigate to the Portfolio Manager: https://www.stockdoctor.com.au/Portfolio

- Select your portfolio

- Under Securities Held,

Click on CL1. - Scroll down page, Under Income and Expenses section

Click on the New Dividend button.

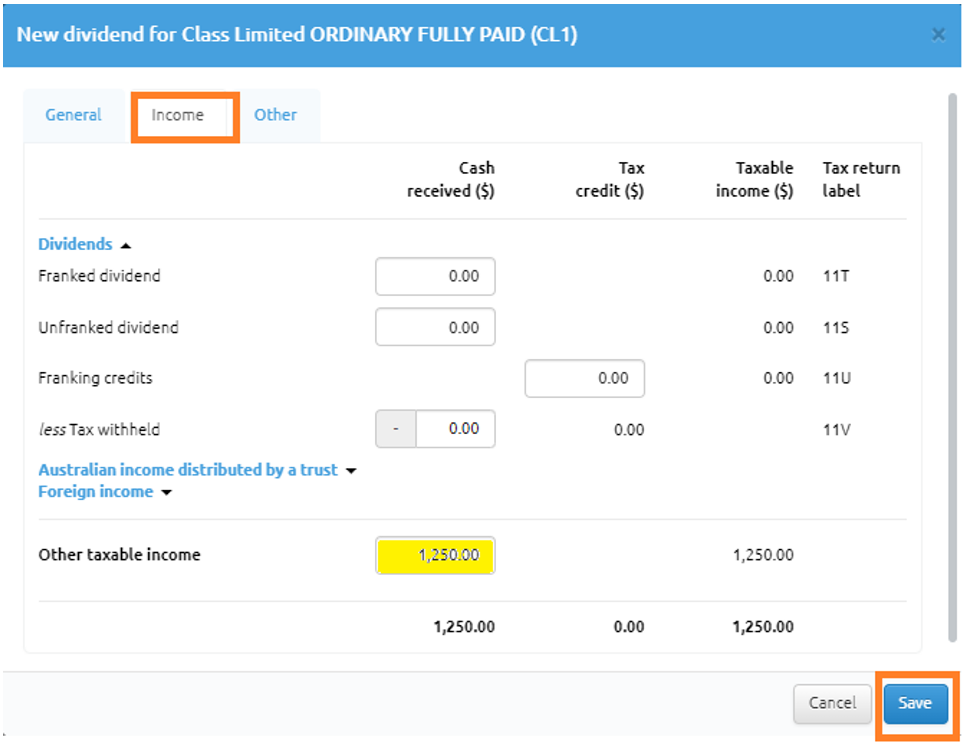

In the new window,

- Enter payment date is 16/2/2022

- then click on the “Income Tab”

- in the “Other Taxable Income” field

Enter the cash amount received for your $0.125 per share. IE.

If you have 10,000 shares in CL1, then 10,000 x $0.125 = 1,250.00. - Then click on Save

As seen below:

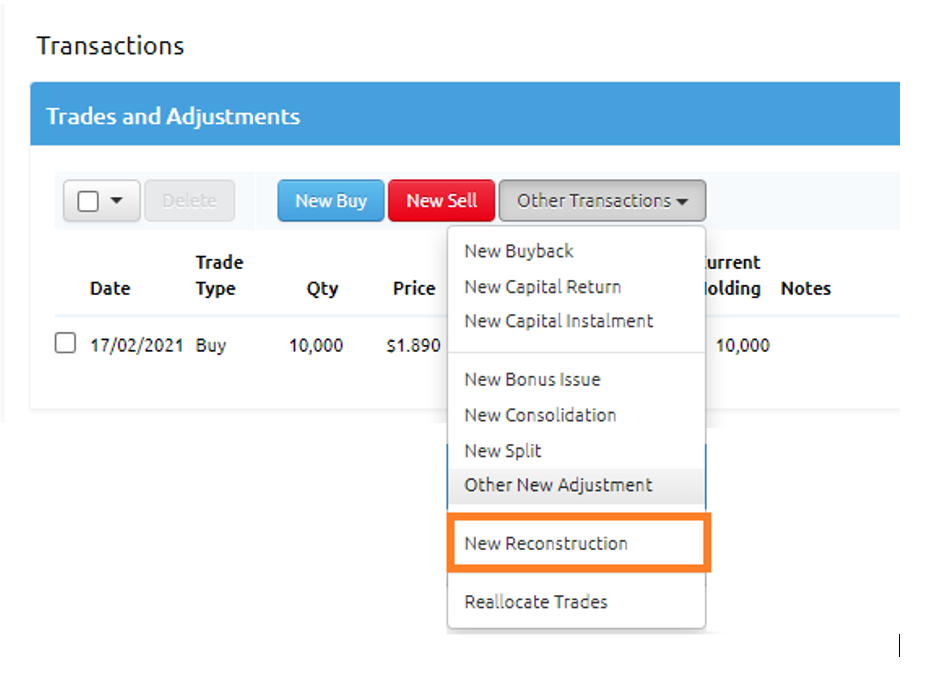

- Scroll up to the Trades and Adjustments section

- Click on the button called “Other transactions”

From the drop-down menu, click on “New Reconstruction”

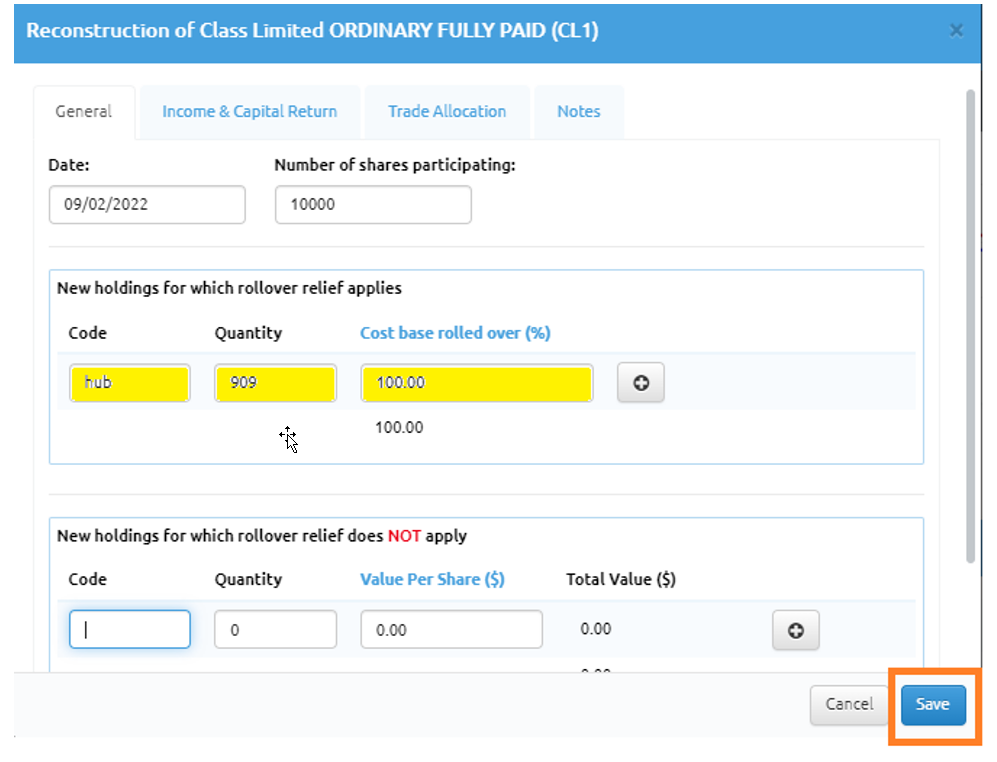

In the new window,

- Enter the Date: 9/2/2022

- Enter number of shares participating is your current holding of CL1

- In the box titled New Holdings for which rollover relief applies:

- Code: HUB

- Quantity: Your CL1 holding divided by 11

IE: 10,000 CL! Shares divided by 11 = 909 HUB Shares - Cost base rolled over (%):100.

- Then click on the blue Save button.

Below is the dialogue box:

You have now accounted for the Scheme of arrangement for CL1 .

Our team in the office are ready and willing to assist you with any questions you have about any of the content above. Please give us a call on 1300 676 333 or email us at support@lincolnindicators.com.au with any questions you may have.

However, we are not licensed to provide tax advice and therefore anything which relates to tax or your personal circumstances we will not be able to answer. In order to have personal tax or finance questions answered, you will need to seek the services of a licensed practitioner who will be qualified to answer your queries.