ROIC stands for Return on Invested Capital.

Indicator Type

Financial Indicator

Formula

ROIC = Earnings before interest and tax (EBIT) divided by average invested capital.

Parameters

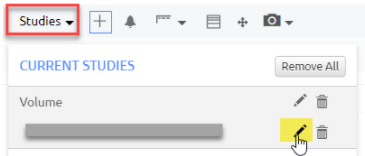

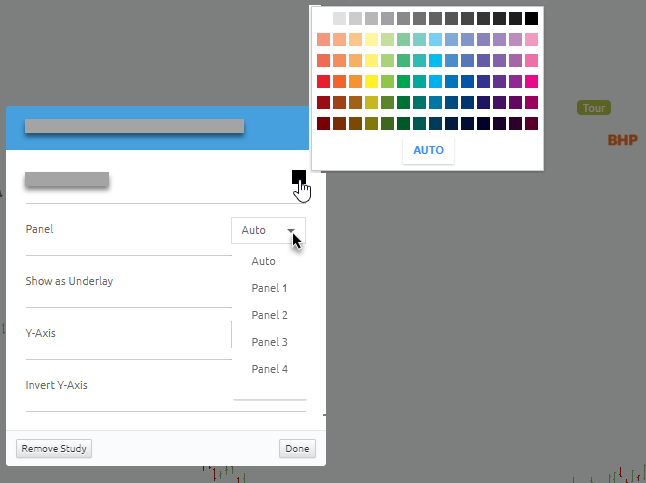

ROIC: You can choose a colour for the plot, by selecting the box next to it to bring up a colour palette.

Panel: You can also choose where the study is placed, by default it is set to Auto applying it to it own panel at the bottom of the chart but if you would like to overlay the study onto another panel, click the drop-down arrow next to Auto and select a panel e.g. Panel 1.

Once you have finished adjusting parameters, click Done

Theory

ROIC is approximated as earnings before interest and tax (EBIT) divided by average invested capital. By definition, invested capital are assets that are expected to contribute to earnings such as inventory, land, and goodwill. Ideally, investors should look for a company that generates a ROIC that is greater than its cost of capital because it suggests efficient use of capital. Unlike ROE, ROIC is unaffected by financial leverage, and is useful for capital intensive businesses such as resource stocks.