PE stands for Price Earnings.

PEG stands for Price Earnings Growth.

Indicator Type

Valuation Indicators

Formula

PE = Market Value per share / Earnings per share.

PEG = PE / EPS Growth

where:

EPS = Earnings per share

Parameters

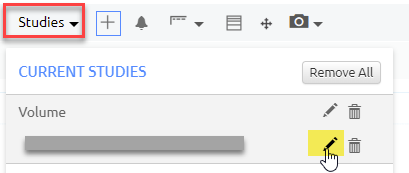

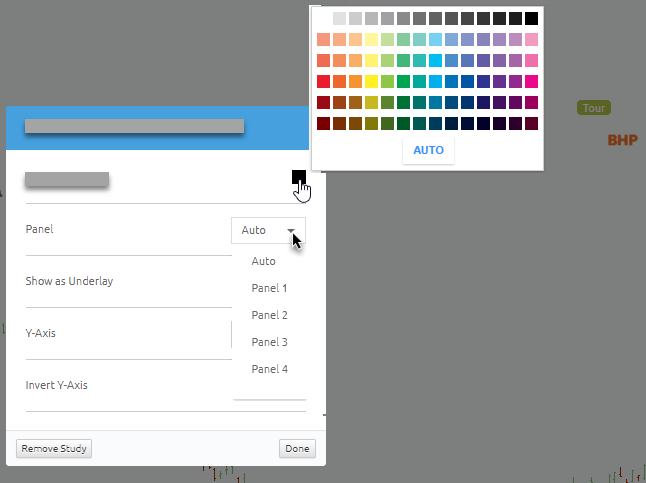

PE and PEG: You can choose a colour for the plot, by selecting the box next to it to bring up a colour palette.

Panel: You can also choose where the study is placed, by default it is set to Auto applying it to it own panel at the bottom of the chart but if you would like to overlay the study onto another panel, click the drop-down arrow next to Auto and select a panel e.g. Panel 1.

Once you have finished adjusting parameters, click Done

Theory

- If the EPS growth rate is less than the company’s PE, the PEG will be greater than 1.0, indicating that the company’s share price is potentially overvalued at the current price.

Please note: PEG is not plotted on a chart, where:

- EPS growth cannot be calculated because a company’s previous year’s EPS is negative, or

- EPS growth is negative (i.e. previous years EPS is greater than the current years EPS).