Liontown Resources Limited (LTR) demerger of the company’s non-lithium exploration assets to Minerals 260 Ltd (MI6). Eligible shareholders will receive 1 Minerals 260 Limited (MI6) for every 11.94486 Liontown Resources LTD (LTR) shares held at record date 28 September 2021. Each Liontown Resources (LTR) share held underwent a capital reduction of $0.21 per share.

Instructions below are for the LTR investors who have acquired the MI6 shares in the demerger.

Click on the portfolio that has Liontown Resources LTD (LTR) shares.

- Under the ‘Securities Held’ section, click on the share code LTR - Liontown Resources LTD.

- Under the Trades and Adjustments area, please click on the ‘Other Transactions’ button, and in the drop down menu, click on ‘ New Capital Return’

- Date received is 4 October 2021, and the amount is $0.21 per share. The Total Received should update automatically and then click Save.

Please follow these steps to affect the demerger:

- Please click on the ‘Other Transactions’ button, and in the drop down menu, click on ‘New Reconstruction’.

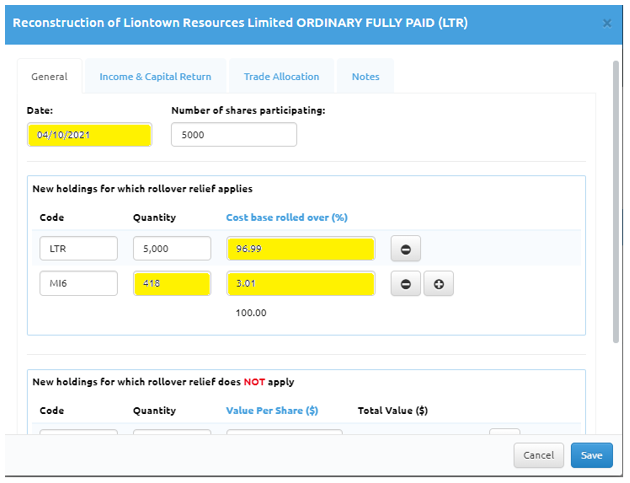

- In the Reconstruction window, enter the following:

- Date as 4 October 2021. The number of shares participating should be the same as the number of LTR shares owned on this date.

- Under “New holdings for which rollover relief applies”, do the following:

- Code: LTR, Quantity: same amount as “number of shares participating” and Cost base rolled over (%): 96.99%

- Click on the “plus” symbol to add another line.

- Calculate how many MI6 shares you will receive by dividing the number of LTR shares 5000 (in this example) and by11.94486 = 418 shares.

- On the new line, Code: MI6, Quantity: 418 and Cost base rolled over (%): 3.01%

3. Then clock on the “Trade Allocation tab, to allocate the trade from the drop-down box: Oldest First, Newest First, Smallest Capital Gain, Largest Capital Gain, or Same Proportion of Each.

4b. The quantity to sell should match the amount you nominated for buyback (or scale back amount).

4c. Click Save