Brokers and research houses typically have analysts who cover listed companies and make recommendations to clients on whether to buy, sell or hold these stocks. Analysts are generally responsible for a limited number of stocks, enabling them to follow developments closely and to produce their own estimates of future earnings per share (EPS). The consensus earnings estimate is the average or median forecast estimate provided by most research analysts covering the stock.

Analysts may revise earnings estimates to reflect the changes in the expectations of the company’s performance in the future. This tends to occur following a better or worse than expected profit announcement or changes in the economic conditions. Their recommendations can significantly affect share prices, with upgrades to EPS forecasts capable of pushing share prices higher. The change to earnings forecasts is known as earnings revision.

Earnings revisions are a momentum factor that measures the forecast earnings per share (EPS) change over a rolling timeframe. In fact, back-tested data and empirical research have demonstrated a strategy based on earnings revisions can generate attractive risk-adjusted returns over time.

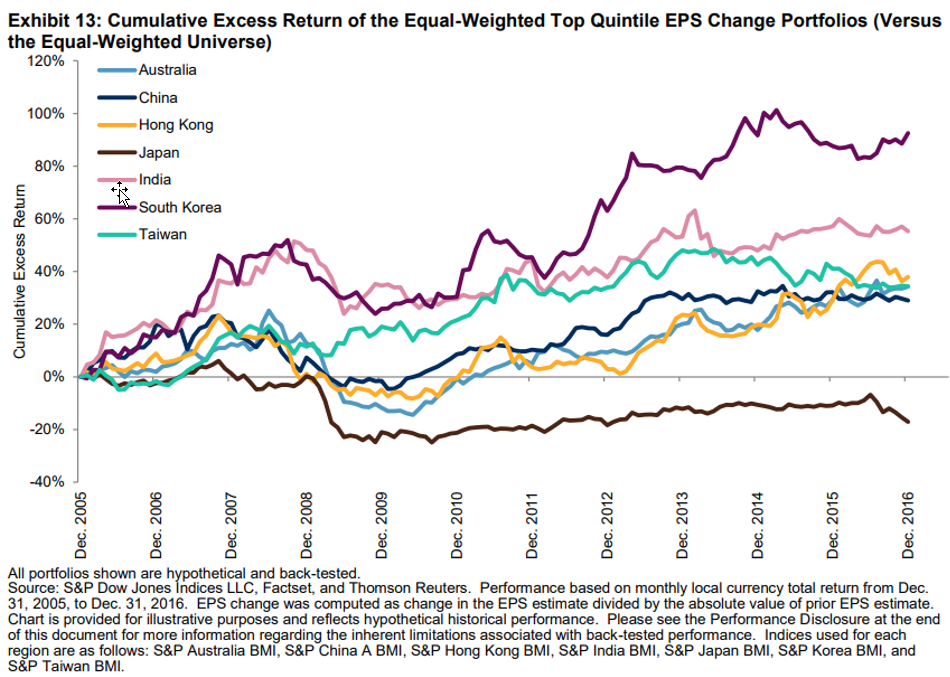

A research paper entitled “Do Earnings Revisions Matter in Asia” by S&P Global in December 2017 revealed that stock prices tend to move in the same direction as their earnings revisions in the majority of the Pan Asian markets, including Australia. Companies with poor earnings revisions tended to have more volatile returns, as market participants reacted negatively to companies with downward revisions in estimates. The research also noticed that market participants tended to penalize stocks with poor earnings revisions more when the market was in a downward trend.

Interestingly they also found that earnings revision strategies tend to work better in the smaller cap universe. The chart below shows how applying a portfolio of the top quintile on EPS revisions resulted in the market's outperformance in most Asian countries except for Japan.

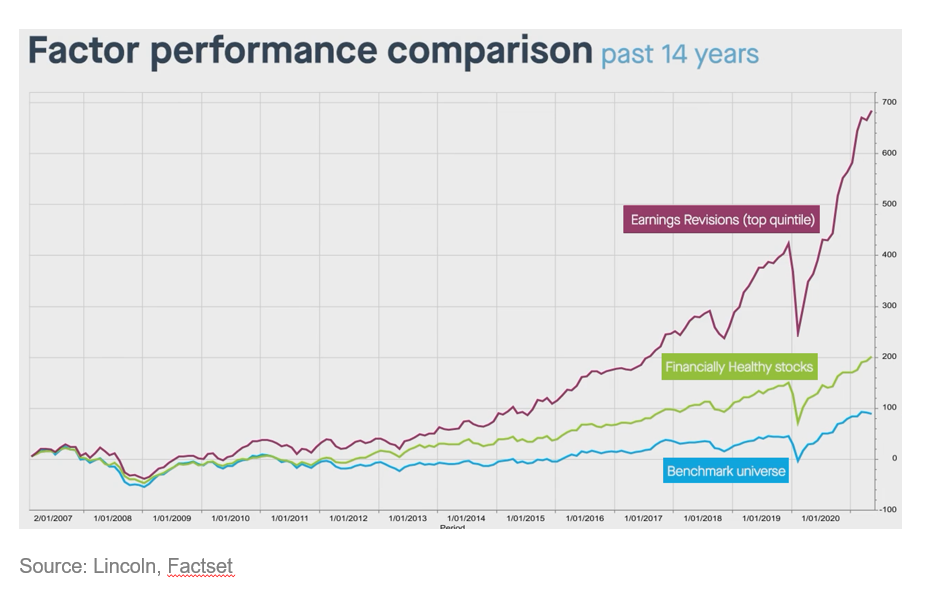

Our own analysis of the earnings revision factor within Factset also produced similar outcomes. As you can see from the chart below, the portfolio with the top quintile in earnings revisions (maroon colour) outperformed all other factor strategies, including the benchmark market return (in blue) over the last 14 years.

Source: Factset. Benchmark is an equal weighted entire universe of ASX stocks.

In essence, changes to forecast revision provides a good gauge of changes to investor sentiment. Upgrades to forecast imply positive sentiment, whereas downgrades are more likely to disappoint.

In Stock Doctor, earnings revision lies under Golden Rule 3 – Outlook. We use the earnings revision over three months because this period represents a good balance in capturing more recent earnings changes without the short-term gyrations, which can create unnecessary portfolio churn.

The 3 Month EPS revisions use consensus data and are calculated as follows:

Current 1 year forecast EPS / 1 year forecast EPS 3 months ago.

One thing to note is that earnings revision strategies can lead to high portfolio turnover. Hence, it's important investors implement this factor in combination with our Primary and Secondary Golden Rules to tailor these stocks to an investors own personal preference, tolerance to risk, style, and investment goals.