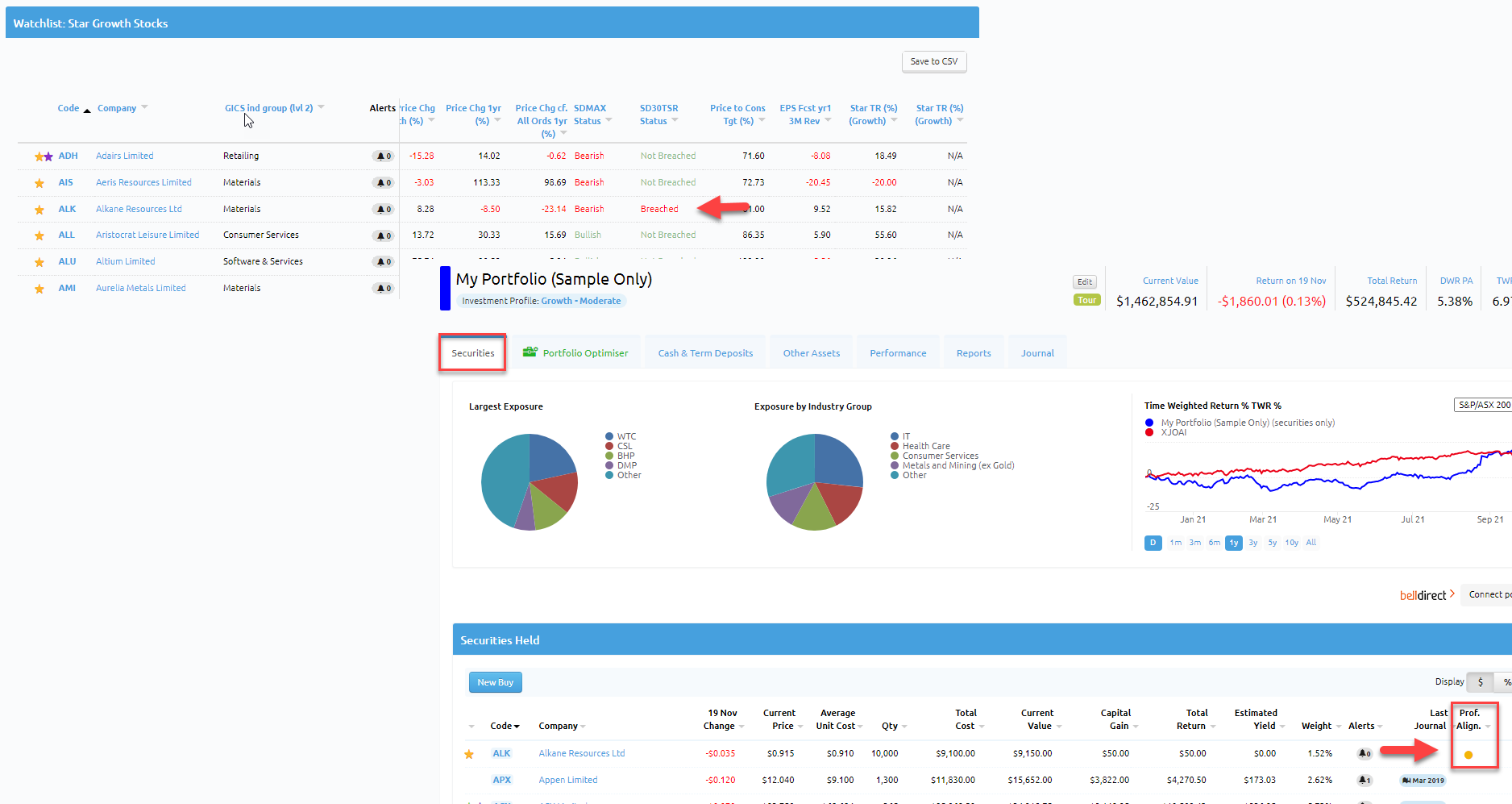

As part of our enhanced quantitative process and how it's reflected in Stock Doctor, we're also enabling trend sensitive members to apply our proprietary SDMAX and SD30TSR technical indicators to a portfolio profile to assist with the management of portfolios.

- SD30TSR is a 30% trailing stop loss and re-entry indicator that is suitable for proactive investors that are comfortable with some volatility and are moderately trend-sensitive but wish to avoid major share price declines.

- SDMAX is a four and 13-week high/low simple moving average crossover technical overlay. It is appropriate for investors who are highly trend-sensitive and have more time to actively manage their portfolio.

Members who identify as trend sensitive when entering their Stock Doctor portfolio investment profile will not receive any stock suggestions that do not meet the criteria of the indicator they've applied. In other words, the only recommendations they will see are those that are trading in a bullish trend.

Below are instructions on how to apply our SDMAX or SD30TSR filter into your investment profile:

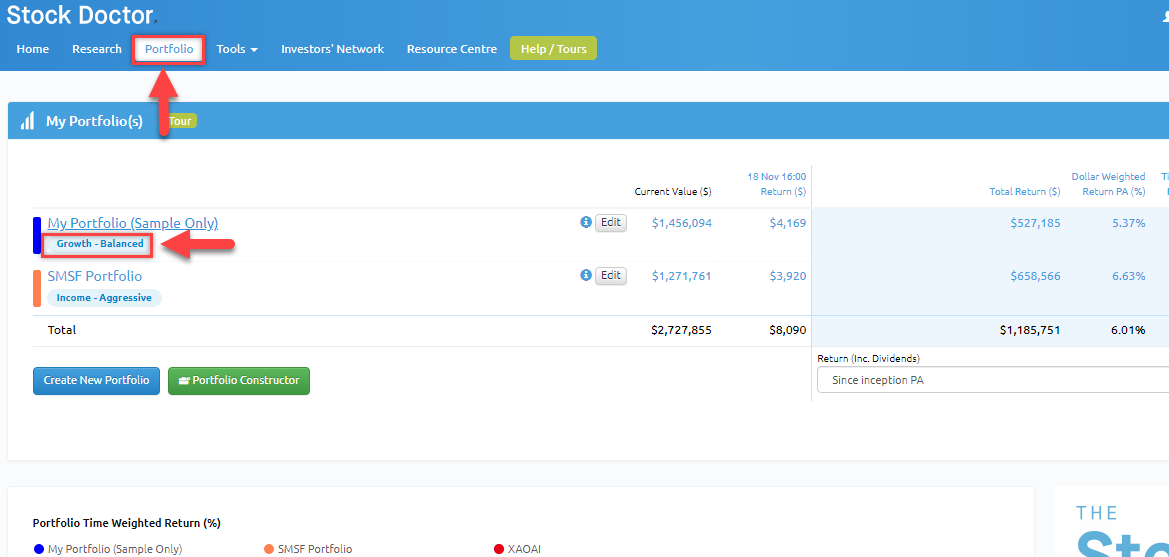

- Navigate to the Portfolio Director - https://www.stockdoctor.com.au/Portfolio/

If you have a portfolio that has an existing investment profile assigned:

- Under the portfolio you would like to update

- Click on the Investment Profile (e.g. Growth - Balanced)

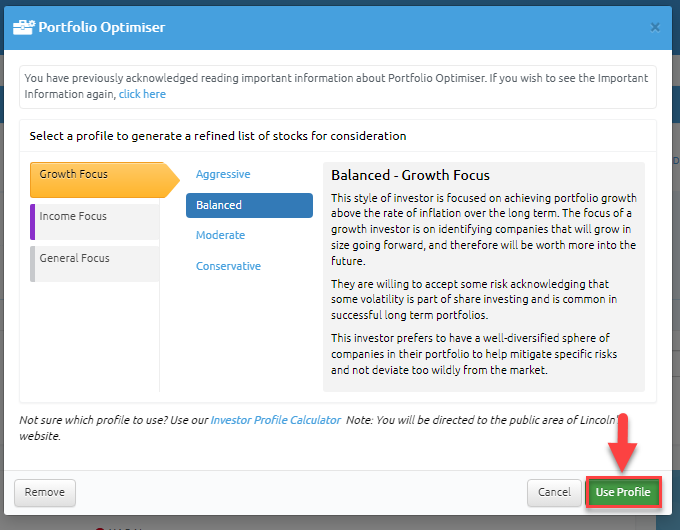

If you do not have an investment profile assigned.

- Under the portfolio you would like to add an investment profile

-

Click Add Profile > Select the Investment Profile you would like to apply to the selected portfolio

** If you are unsure on which profile to select, please click here to learn more about the portfolio optimiser

- Click on the Use Profile button

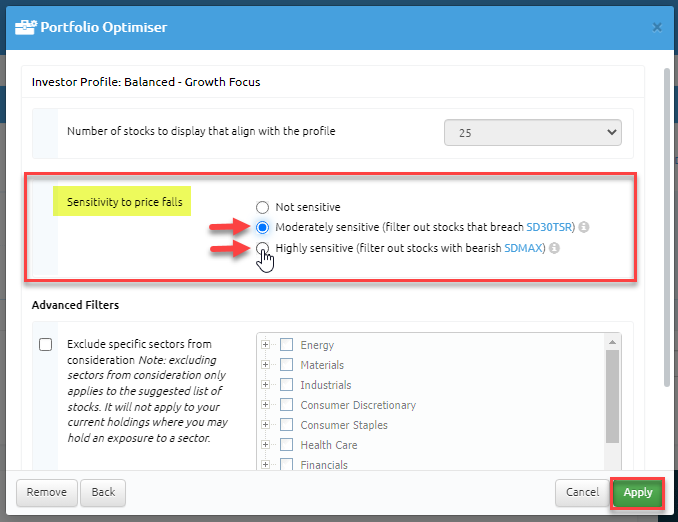

- Select your Sensitivity to price falls:

- Not sensitive (no technical filter will be applied to your profile)

- Moderately sensitive (filters out stocks that breach SD30TSR)

- Highly sensitive (filters out stocks with a bearish SDMAX)

- Click Apply to save settings.

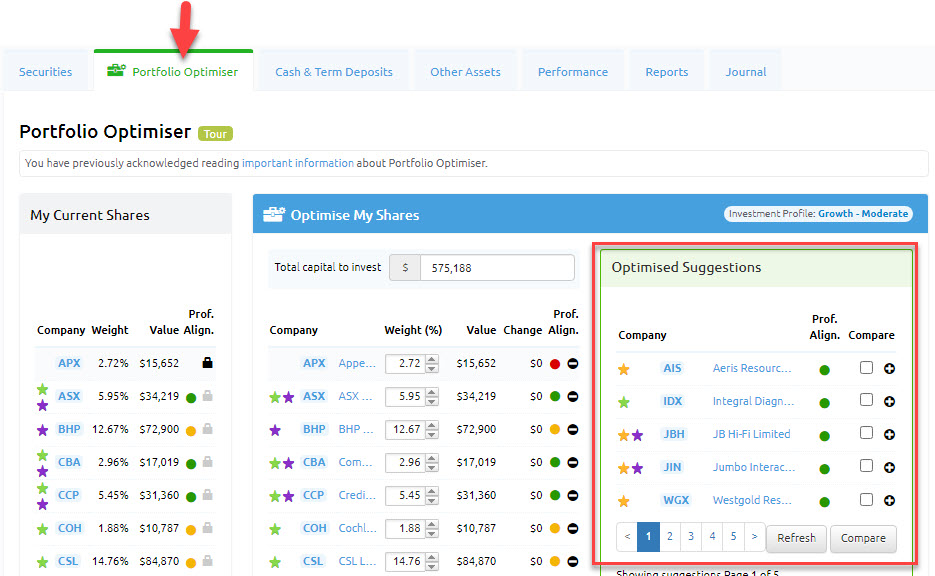

Selecting Sensitivity to price falls will result in the Portfolio Optimiser > Optimised Suggestion list filtering by the selected indicator: Moderately sensitive (SDMAX) / Highly sensitive (SDMAX).

e.g. If Moderately sensitive (SD30TSR) was selected, stocks that are in a bearish SD30TSR condition will be excluded from results.

Also. if you select you are sensitivity to price falls, the optimiser will continually monitor you profile alignment for bearish trend changes based on your selected sensitivity: Moderately sensitive (SDMAX) / Highly sensitive (SDMAX).

e.g. If Moderately sensitive (SD30TSR) is selected within the portfolio investment profile, and at the end of a trading day a stock meets a bearish condition for SD30TSR, the coloured profile alignment (status) dot next to the company will change from green to amber reflecting it does not meet the properties within the selected profile. To learn more about the different investment profile status's view our portfolio optimiser help article.