The enhancements in this release are part of our commitment to constant improvement through rigorous research and ongoing development, all designed to support your long-term investment success:

Changes to Golden Rules 1, 2 and 3:

- Improvements to our Star Growth Stock and Borderline Star Growth Stock selection process.

Borderline Star Growth Stocks now need to meet the existing Star Growth Stock selection criteria:

Satisfy our primary and most important Golden Rules 1, 2 and 3.Previously Borderline Star Growth Stocks were selected based on a larger qualitative overlay and a subjective analyst call on the likelihood of meeting Star Growth status in the near future.

Now the entire universe of Growth Stocks will be ranked against key factors, to distinguish between the elite Star Growth Stocks from Borderline Star Growth Stocks.

-

- To learn more about our optimised stock selection process, view our 'Empowering members through constant innovation' webinar recording.

- To learn more about our optimised stock selection process, view our 'Empowering members through constant innovation' webinar recording.

-

- New criterion added under Golden Rule 3 - ‘EPS Forecast 3m Revision (%)’

Our extensive research and back-testing processes have demonstrated that including earnings revisions in our application of Golden Rule 3 can generate attractive risk-adjusted returns over time.

Forecast upgrades imply positive sentiment, whereas downgrades indicate negative expectations and are more likely to disappoint.

We apply the earnings revision over a period of three months because we believe this represents a good balance in capturing more recent earnings changes without the short-term gyrations that can create unnecessary portfolio churn.

- As Borderline Star Growth Stocks now meet Golden Rules 1, 2 and 3, we have removed tick and cross symbols from the Primary Golden Rules headers.

-

- Star Stock Stars will now denote whether a company meets or fails growth and/or income criteria.

- Star Stock Stars will now denote whether a company meets or fails growth and/or income criteria.

-

Changes to Analyst Comments

- ‘Key Events’ tab name changed to ‘Key Updates’

- The last 3 key events are now displayed (clicking on a subject line will direct you to full comment).

Lincoln Valuations removed

As part of Golden Rule 5 Share Price Value for our three categories of Star Stocks, we’ll now no longer be displaying Lincoln valuations. But, as always, we will continue to display Consensus Price Targets (where data is available).

While our valuations have always tracked closely to consensus valuations, we’ve decided that by focusing on Consensus Price Targets, we can leverage the expertise of leading global research houses and enable our Lincoln analysts to focus on what they do best – optimising and applying our quantitative methodology and assessing the active risks facing companies.

- ‘Consensus Valuation’ name changed to ‘Consensus Price Target’

- Lincoln valuations removed from Golden Rule 4 Chart, Financial Metrics tab, Corporate details page > Important Events list, and Recent Updates.

- Under Golden Rule 4, 'Valuation' button name change to 'Price Target'

- In the Peer Comparison table, ‘Price to Consensus Target (%)’ now replaces ‘Price to Lincoln Valuation (%)’

- Lincoln Valuation related fields removed from Watchlist, Alerts and Stock filter tools.

NOTE: Any 'Lincoln Valuation' fields in existing watchlist views, alert criteria and stock filters have been automatically converted to Consensus Price Target equivalent.

Financial Statements / Financial metrics tab:

- Added Forecast EPS 3M Revision (%) and Intangibles to Total Assets (%)

Analyst comments page

- Added Strategic comments and Active Risks tabs on the right-hand side.

Portfolio Optimiser and Portfolio Constructor

- Lincoln's SDMAX and SD30TSR technical indicators, can now be applied to portfolio investment profiles to assist trend sensitive investors.

As part of our enhanced quantitative process and how it's reflected in Stock Doctor, we're also enabling trend sensitive members to apply our proprietary SDMAX and SD30TSR technical indicators to a portfolio profile to assist with the management of portfolios. If 'Sensitivity to price falls' is applied to a portfolio investment profile, it will exclude stock selections that are in a SDMAX or SD30TSR bearish trend.

Borderline Star Growth Stock (BSGS) performance removed

Following rigorous back-testing of the new Star Growth Stock and Borderline Star Growth Stock selection process, we no longer provide performance tracking of Borderline Star Growth Stocks.

As over time, the number of Borderline Star Growth Stocks fluctuated between 0 and 40 as companies move in and out of Borderline Star Growth Stock classification during economic downturns, for example, the number of BSGS drops significantly, causing a concentration that is not reflective of the longer-term makeup or performance of our Star Growth Stock list.

Borderline Star Growth Stocks are Growth Stocks that rank outside the top 30 Growth Stocks based on our propriety Z Score ranking. Still, they represent high-quality businesses that pass our Golden Rule 1 Financial health, Golden Rule 2 Past Financial Performance and Golden Rule 3 outlook and active risks.

- BSGS Return chart removed from Research home page

- BSGS fields removed from stock filter and watchlist

- BSGS overlays removed from the portfolio manager.

- BSGS return portfolio removed from Advanced charting.

- BSGS performance removed from Daily Digest.

Changes to Mobile site

- Added ‘Resource Centre’ section.

Enabling members to now view Lincoln news and educational video content on their mobile and tablet devices.

Changes to Alerts

- Added change to ‘EPS Forecast 3m Revision (%)’ option under ‘Consensus EPS estimate change’ alerts section.

- Removed Lincoln Valuation Alerts (any existing Lincoln Valuation alerts will be converted to Consensus Price Target equivalent)

Recent Updates

- Stopped displaying events for changes of strategic and key risk comments.

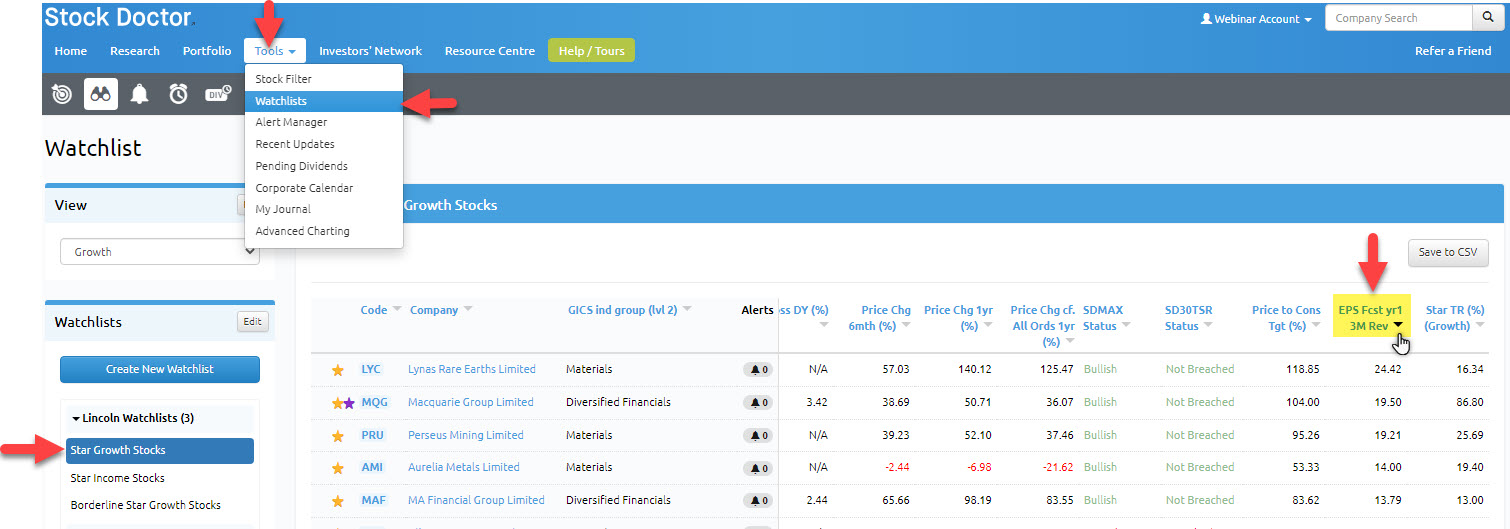

Changes to Watchlist

- Added ‘EPS Forecast 3m Revision (%)’ criterion.

Changes to Stock Filter

- Added ‘EPS Forecast 3m Revision (%)’ criterion.

- Changes to Tim’s Growth Stock with Potential filter

-

- Added an EPS Forecast Year 1 3M Revision column.

- Added an EPS Forecast Year 1 3M Revision column.

-

Changes to Daily Digest

- Improved descriptions for Star Stock updates.

Stock Doctor PC Charting Tool

- The download scheduler has been updated and now also runs on Saturday nights to pick up international index and commodities values that change on Saturday.

- Fundamentals tab: Removed Lincoln valuation ($) and added Intangibles to Total Assets (%)