Instructions to account for the McMillan Shakespeare Limited (MMS) off market share buyback of 14 October 2019 follow. These instructions will only apply to you if you successfully participated in the off market share buyback. In this buyback, the market price was $15.9742 per share, the price you received was $13.74 with $11.96 deemed a fully franked dividend component, and $1.78 deemed a capital component. The market value deemed by the ATO was $14.88.

The example uses the following data and assumptions, please amend accordingly for your individual circumstances.

1,000 MMS shares purchased on 16 Nov 2018

Share price at 16 Nov 2018 $15.00

Cost: $10,000.00

Brokerage: $29.95

Total cost: $15,029.95

You nominate 100 shares (from your parcel of 1,000) for the buyback.

Instructions for Stock Doctor

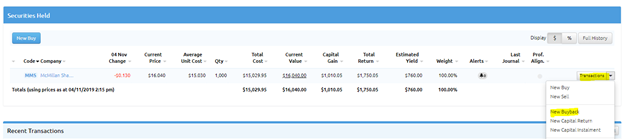

- Click on the 'Portfolio’ tab and then click on the appropriate under ‘My Portfolio(s)’, which includes the MMS shares.

- Under the ‘Securities Held’ section, find the row McMillan Shakespeare Limited (MMS). Click the drop down button next to ‘Transactions’ on the same line, and select ‘New Buyback’.

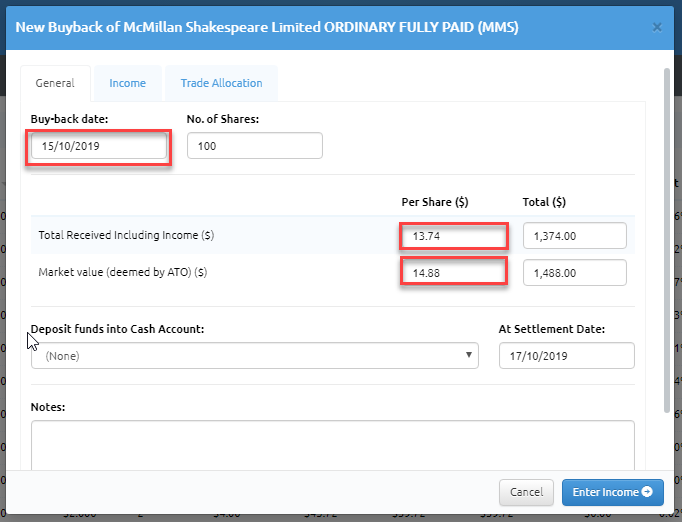

- In the New Buyback dialogue box:

3a. Enter the Buy-back date as 15 October 2019.

3b. Enter the No. of shares is 100 (this should be the number of shares you elected for the buyback).

3c. Enter $13.74 as the Per Share amount for Total Received Including Income ($). The Total ($) should auto-calculate.

3d. Enter $14.88 as the Per Share amount for Market Value (deemed by ATO) ($). The Total ($) should auto-calculate.

3e. Click Enter Income. This should take you to the next ‘Income’ dialogue box.

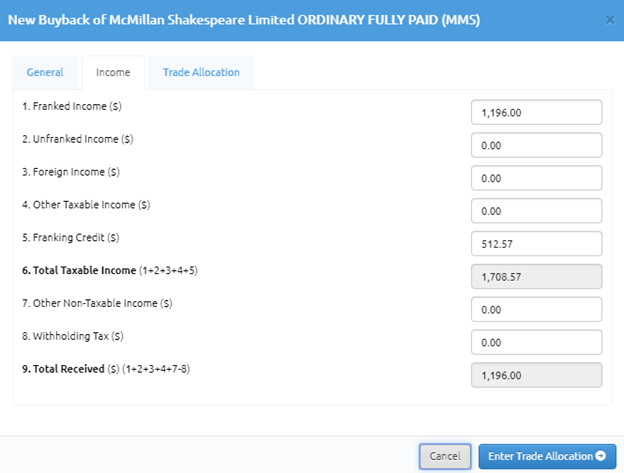

- A new ‘Income’ dialogue box tab should appear:

4a. Franked Income ($) is $1,196. i.e. $11.96 per share for 100 shares.

4b. The Franking Credit ($) is $512.57 i.e. $5.12571 per share for 100 shares. ($11.96 x 30%/ 70%)

4c. The totals should auto-calculate.

4d. Click the Enter Trade Allocation button to go through to the Trade Allocation tab of the dialogue box.

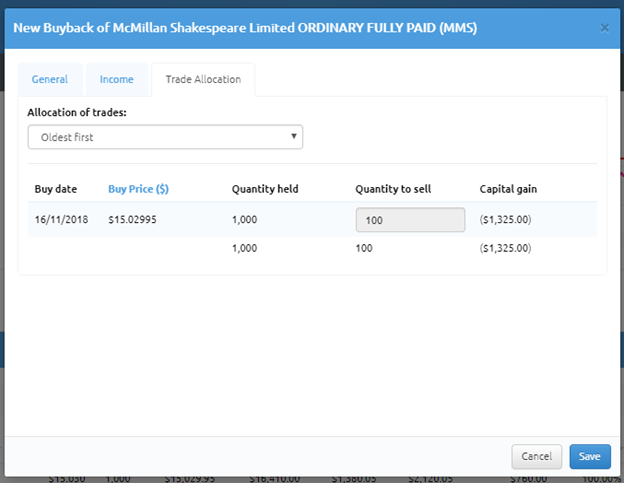

- You should be in the Trade Allocation tab of the Dialogue Box.

5a. Allocate the trade from the drop down box: Oldest First, Newest First, Smallest Capital Gain, Largest Capital Gain, or Same Proportion of Each.

5b. The quantity to sell should match the amount you nominated for buyback (or scale back amount).

5c. Click Save

You have now accounted for the MMS buyback of October 2019.

Important note regarding reporting at Tax time

The steps identified above are correct from a performance and what money you received perspective.

However, from a tax perspective it is not that simple.

Deemed Capital Proceeds is $2.92

This is the amount which is important when assessing CGT, as it is the amount the ATO have deemed to be the capital proceeds from the sale. The good news is that Stock Doctor is sophisticated enough to do this elegantly for you.

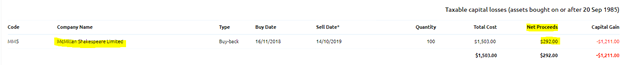

If you have followed the instructions above, then the Capital Component will be $1.78 per share for the buy back. It will be displayed in your transactions as follows:

The difference of $3.59 per share is captured within your capital gains report correctly without you having to do anything. You will notice in the screenshot below that the Net Proceeds is calculated using a $5.60 per share price. This correct for tax purposes.

As always, our team in the office are ready and willing to assist you with any questions you have about any of the content above. Please give us a call on 1300 676 333 or email us at support@lincolnindicators.com.au with any questions you may have.

However, we are not licensed to provide tax advice and therefore anything which relates to tax or your personal circumstances we will not be able to answer. In order to have personal tax or finance questions answered, you will need to seek the services of a licensed practitioner who will be qualified to answer your queries.