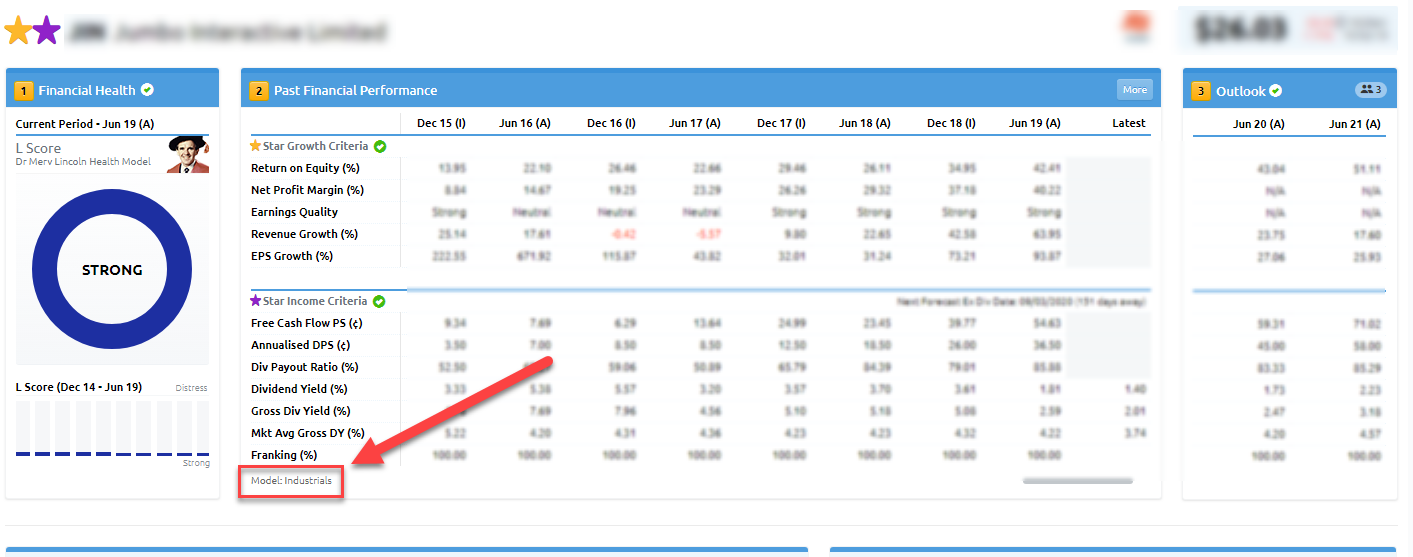

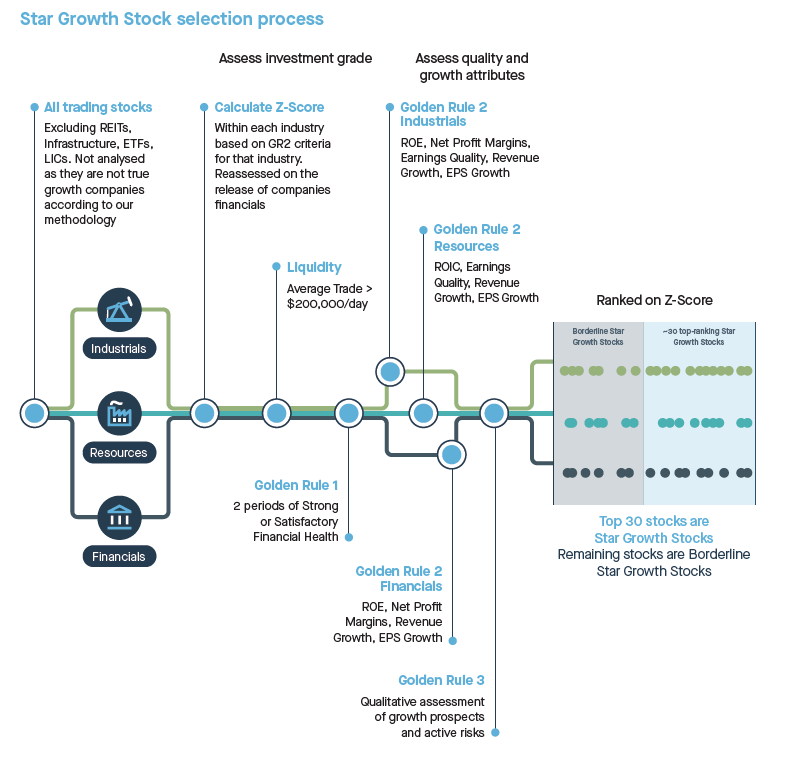

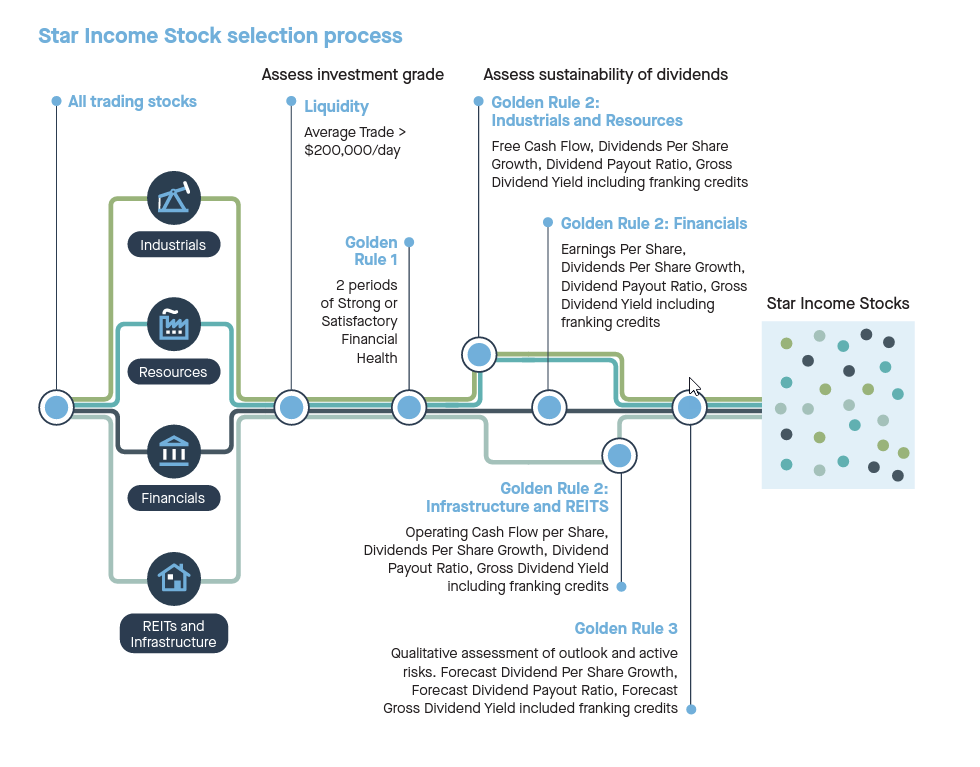

We have 4 different models (Industrials, Financials, Resources and Infrastructure):

- Industrials model- applied to the Materials, Consumers discretionary, consumer staples, Health Care, IT, Telecommunications sectors

- Financials model– applied to Banks and Insurance sectors

- Resources model - applied to Energy, Metals and Mining sectors

-

Infrastructure model - applied to the Transport, Utilities and Real Estate sectors.

** According to our approach, companies in the infrastructure model are not considered to be true growth opportunities and therefore will never hold Star Growth Stock or Borderline Star Growth Stock status. This is because they tend to be larger more mature businesses often with trust structures and a focus on profit distribution in the form of dividends as opposed to Growth companies that invest profits back into the business to fund further growth opportunities.

The diagrams below illustrate the flow of our Star Growth Stock and Star Income selection process:

Description of ratio's used in each model:

Industrials

Growth Model:

Return on Equity: ROE, calculated as the net income divided by average total equity, measures the percentage return earned by each dollar invested by shareholders. This profitability measure is useful for comparing companies with similar capital structures (especially in the industrial and financial sectors) but can be artificially inflated by debt, asset write-downs, and buybacks.

Net Profit Margins: Net Profit Margin, calculated as net income divided by total revenue, is a measure of the economic moat and competitiveness of the industry in which the company operates. It is useful to assess the trend in margins over time as this suggests that a company is increasing/decreasing its dominance in the industry. Companies may need to reduce prices to maintain market share but at the expense of lower margins.

Earnings Quality: Earnings Quality is defined as the reliability in the earnings figure and how well it represents the underlying cashflow of the business. Companies with low earnings quality tend to have high disparities between cash generation and net income because reported earnings can be manipulated through the capitalisation of expenses, depreciation and accruals.

Revenue Growth: Revenue Growth is important in understanding whether a business has reached maturity. However, in assessing revenue growth, investors need to be mindful of artificial growth which can be generated through acquisitions, store rollouts, and cyclical timeframes.

EPS Growth: Earnings Growth is helpful for investors in evaluating the expanding nature of the business. Investors should look for a trend of consistent and sustainable earnings growth over a longer time frame because in the short term: Growth can be artificially driven by acquisitions, divestments, and cost cuts. Year on year growth can be influenced by cyclical fluctuations.

Income Model:

Free Cash Flow per Share: Free cash flow is calculated as the operating cashflow minus capital expenditure and is a reliable measure of the financial strength of a company. Spare cash generation allows businesses to pursue opportunities that can enhance shareholder value. It is also useful in determining whether a company is likely to have enough funds to meet dividend obligations.

Annualised Dividends per Share: Dividend per share is the portion of a firm’s distributions attributed to each share outstanding. This measure is used to estimate the amount of dividends that an income investor might expect to receive in one year if he or she were to buy a company's common stock.

Dividend Payout Ratio: Dividend payout ratio, calculated as the dividend per share divided by earnings per share, measures the proportion of earnings paid out as dividends. This ratio is not useful for infrastructure and utility type companies because earnings are impacted by large and variable depreciation and amortisation expenses. Instead, for these industries, it is more appropriate to use distributions as a portion of operating cashflow.

Dividend Yield: Dividend Yield is calculated as the dividend per share divided by the share price. It reflects the percentage income an investor would receive if they bought the stock at the current price. In general stocks that pay high dividend yields tend to be mature businesses with relatively high payout ratios. Investors should be wary of “yield traps” where price has dropped and dividends are likely to follow but the yield is still high because the dividend used to calculate it is from the previous year.

Gross Dividend Yield: Gross Dividend Yield is the dividend yield inclusive of franking credits. Dividends represent the after-tax earnings distributed to shareholders notionally taxed at the company rate of around 30%. Under the dividend imputation system, shareholders get a credit in their tax return for tax already paid by the company. This credit is included in the gross yield calculation.

Market Average Gross Dividend Yield: Market Average Gross Yield is the average gross dividend yield of all companies in the ASX300 Index weighted by market capitalisation.

Franking: Franking is the percentage rebate a shareholder receives for the tax paid by the company on profits distributed as dividends. Franking credits are also referred to as imputation credits.

Financials

Growth Model:

Return on Equity: ROE, calculated as the net income divided by average total equity, measures the percentage return earned by each dollar invested by shareholders. This profitability measure is useful for comparing companies with similar capital structures (especially in the industrial and financial sectors) but can be artificially inflated by debt, asset write-downs, and buybacks.

Net profit margins: Net Profit Margin, calculated as net income divided by total revenue, is a measure of the economic moat and competitiveness of the industry in which the company operates. It is useful to assess the trend in margins over time as this suggests that a company is increasing/decreasing its dominance in the industry. Companies may need to reduce prices to maintain market share but at the expense of lower margins.

Revenue Growth: Revenue Growth is important in understanding whether a business has reached maturity. However, in assessing revenue growth, investors need to be mindful of artificial growth which can be generated through acquisitions, store rollouts, and cyclical timeframes.

Earnings per Share Growth: Earnings Growth is helpful for investors in evaluating the expanding nature of the business. Investors should look for a trend of consistent and sustainable earnings growth over a longer time frame because in the short term: Growth can be artificially driven by acquisitions, divestments, and cost cuts. Year on year growth can be influenced by cyclical fluctuations.

Income Model:

Annualised Earnings per Share: Earnings per share is a portion of the company’s profit allocated to each outstanding share and is a useful metric for valuations, assessing growth trends and the impact of share issues and acquisitions.

Annualised Dividends per Share: Dividend per share is the portion of a firm’s distributions attributed to each share outstanding. This measure is used to estimate the amount of dividends that an income investor might expect to receive in one year if he or she were to buy a company's common stock.

Dividend Payout Ratio: Dividend payout ratio, calculated as the dividend per share divided by earnings per share, measures the proportion of earnings paid out as dividends. This ratio is not useful for infrastructure and utility type companies because earnings are impacted by large and variable depreciation and amortisation expenses. Instead, for these industries, it is more appropriate to use distributions as a portion of operating cashflow.

Dividend Yield: Dividend Yield is calculated as the dividend per share divided by the share price. It reflects the percentage income an investor would receive if they bought the stock at the current price. In general stocks that pay high dividend yields tend to be mature businesses with relatively high payout ratios. Investors should be wary of “yield traps” where price has dropped and dividends are likely to follow but the yield is still high because the dividend used to calculate it is from the previous year.

Gross Dividend Yield: Gross Dividend Yield is the dividend yield inclusive of franking credits. Dividends represent the after-tax earnings distributed to shareholders notionally taxed at the company rate of around 30%. Under the dividend imputation system, shareholders get a credit in their tax return for tax already paid by the company. This credit is included in the gross yield calculation.

Market Average Gross Dividend Yield: Market Average Gross Yield is the average gross dividend yield of all companies in the ASX300 Index weighted by market capitalisation.

Franking: Franking is the percentage rebate a shareholder receives for the tax paid by the company on profits distributed as dividends. Franking credits are also referred to as imputation credits.

Resources

Growth Model:

Return on Invested Capital: ROIC is approximated as earnings before interest and tax (EBIT) divided by average invested capital. By definition, invested capital are assets that are expected to contribute to earnings such as inventory, land, and goodwill. Ideally, investors should look for a company that generates a ROIC that is greater than its cost of capital because it suggests efficient use of capital. Unlike ROE, ROIC is unaffected by financial leverage, and is useful for capital intensive businesses such as resource stocks.

Earnings Quality: Earnings Quality is defined as the reliability in the earnings figure and how well it represents the underlying cashflow of the business. Companies with low earnings quality tend to have high disparities between cash generation and net income because reported earnings can be manipulated through the capitalisation of expenses, depreciation and accruals.

Revenue Growth: Revenue Growth is important in understanding whether a business has reached maturity. However, in assessing revenue growth, investors need to be mindful of artificial growth which can be generated through acquisitions, store rollouts, and cyclical timeframes.

EPS Growth: Earnings Growth is helpful for investors in evaluating the expanding nature of the business. Investors should look for a trend of consistent and sustainable earnings growth over a longer time frame because in the short term: Growth can be artificially driven by acquisitions, divestments, and cost cuts. Year on year growth can be influenced by cyclical fluctuations.

Income Model:

Free Cash Flow per Share: Free cash flow is calculated as the operating cashflow minus capital expenditure and is a reliable measure of the financial strength of a company. Spare cash generation allows businesses to pursue opportunities that can enhance shareholder value. It is also useful in determining whether a company is likely to have enough funds to meet dividend obligations.

Annualised Dividends per Share: Dividend per share is the portion of a firm’s distributions attributed to each share outstanding. This measure is used to estimate the amount of dividends that an income investor might expect to receive in one year if he or she were to buy a company's common stock.

Dividend Payout Ratio: Dividend payout ratio, calculated as the dividend per share divided by earnings per share, measures the proportion of earnings paid out as dividends. This ratio is not useful for infrastructure and utility type companies because earnings are impacted by large and variable depreciation and amortisation expenses. Instead, for these industries, it is more appropriate to use distributions as a portion of operating cashflow.

Dividend Yield: Dividend Yield is calculated as the dividend per share divided by the share price. It reflects the percentage income an investor would receive if they bought the stock at the current price. In general stocks that pay high dividend yields tend to be mature businesses with relatively high payout ratios. Investors should be wary of “yield traps” where price has dropped and dividends are likely to follow but the yield is still high because the dividend used to calculate it is from the previous year.

Gross Dividend Yield: Gross Dividend Yield is the dividend yield inclusive of franking credits. Dividends represent the after-tax earnings distributed to shareholders notionally taxed at the company rate of around 30%. Under the dividend imputation system, shareholders get a credit in their tax return for tax already paid by the company. This credit is included in the gross yield calculation.

Market Average Gross Dividend Yield: Market Average Gross Yield is the average gross dividend yield of all companies in the ASX300 Index weighted by market capitalisation.

Franking: Franking is the percentage rebate a shareholder receives for the tax paid by the company on profits distributed as dividends. Franking credits are also referred to as imputation credits.

Infrastructure / Utilities / REITS

Growth Model:

Infrastructure/Utilities and REIT stocks are generally not classified as growth opportunities because:

• These stocks tend to be mature businesses with a defensive income stream.

• They are asset intensive businesses and have high debt underlying the ownership of those assets. The borrowed debt is not used for growth opportunities but rather to generate income.

• The assets they hold are generally income producing assets not growth assets.

• Growth tends to come from the acquisition of assets which is not considered a sustainable growth strategy.

• These stocks usually pay most of their operating income out to shareholders in the form of dividends instead of reinvesting those proceeds back into the business to drive growth. Hence, they have very high dividend pay-out ratios.

Income Model:

Operating Cash Flow: Operating cash flow equates to the amount of cash a company generates through its normal business operations. This figure is preferred by many analysts because it strips away accounting accruals which are included in net income.

Annualised Dividends per Share: Dividend per share is the portion of a firm’s distributions attributed to each share outstanding. This measure is used to estimate the amount of dividends that an income investor might expect to receive in one year if he or she were to buy a company's common stock.

Dividend Payout Ratio: Dividend payout ratio, calculated as the dividend per share divided by earnings per share, measures the proportion of earnings paid out as dividends. This ratio is not useful for infrastructure and utility type companies because earnings are impacted by large and variable depreciation and amortisation expenses. Instead, for these industries, it is more appropriate to use distributions as a portion of operating cashflow.

Dividend Yield: Dividend Yield is calculated as the dividend per share divided by the share price. It reflects the percentage income an investor would receive if they bought the stock at the current price. In general stocks that pay high dividend yields tend to be mature businesses with relatively high payout ratios. Investors should be wary of “yield traps” where price has dropped and dividends are likely to follow but the yield is still high because the dividend used to calculate it is from the previous year.

Gross Dividend Yield: Gross Dividend Yield is the dividend yield inclusive of franking credits. Dividends represent the after-tax earnings distributed to shareholders notionally taxed at the company rate of around 30%. Under the dividend imputation system, shareholders get a credit in their tax return for tax already paid by the company. This credit is included in the gross yield calculation.

Market Average Gross Dividend Yield: Market Average Gross Yield is the average gross dividend yield of all companies in the ASX300 Index weighted by market capitalisation.

Franking: Franking is the percentage rebate a shareholder receives for the tax paid by the company on profits distributed as dividends. Franking credits are also referred to as imputation credits.