Below is information relevant to Fairfax Shareholders participating in the scheme of arrangement in relation to the merger of Nine Entertainment Co. Holdings Limited (NEC) and Fairfax Media Limited (FXJ).

- On 7 December 2018 (Implementation Date), the scheme of arrangement in relation to the merger of Nine and Fairfax was implemented.

- The Scheme Consideration received by a Fairfax Shareholder for each Fairfax share on the Implementation Date was the aggregate of:

- $0.025 in cash (the Cash Consideration); and

- 0.3627 of a New Nine Share (the Scrip Consideration).

- The market value of New Nine Shares determined as at the Implementation Date was $1.658 per New Nine Share. This equates to the one day cumulative volume weighted average price (VWAP) of one New Nine Share on 7 December 2018.

- The above market value has been determined in accordance with ATO guidelines regarding the determination of market value for scrip consideration in the event of a merger via a scheme of arrangement – click here for further information.

- Therefore, the total capital proceeds received by a Fairfax Shareholder for the disposal of a Fairfax share under the Scheme was $0.6264 per Fairfax share held. This is the aggregate of:

- the Cash Consideration of $0.025; and

- the market value of the Scrip Consideration as at the Implementation Date, being $0.6014 (calculated as 0.3627 multiplied by $1.658).

The example uses the following data and assumptions, please amend accordingly for individual holdings.

1000 FXJ shares purchased on 1 Dec 2014

Purchase price on 1 Dec 2017: $1.00

Total Cost: $1,000.00

Instructions for Stock Doctor

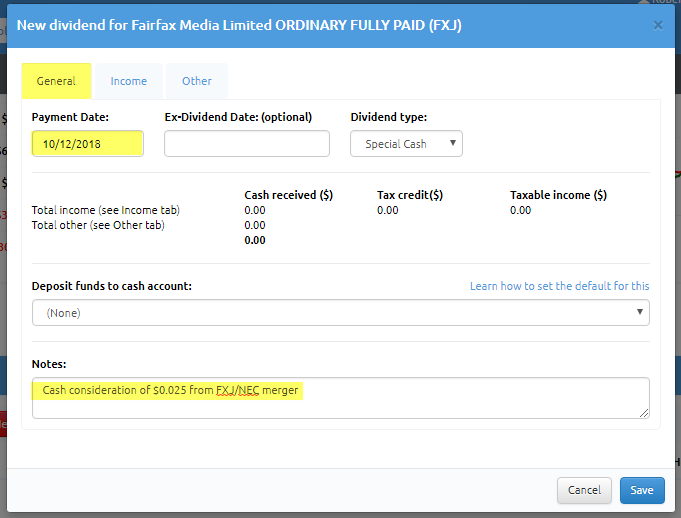

Step 1: Account for the cash consider of $0.025 per FXJ share

- Navigate to the Portfolio Manager

https://www.stockdoctor.com.au/Portfolio - Select the portfolio containing FXJ

Under Securities Held - Click on FXJ

Under Income and Expenses

- Click New Dividend.

- Enter Payment Date: 10/12/2018

- Note: Cash consideration of $0.025 from FXJ/NEC merger

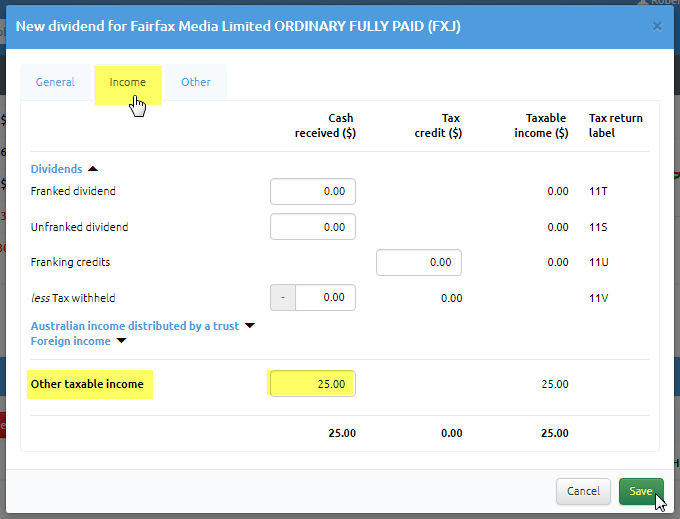

- Click on the Income tab, under “Other Taxable Income” input $25 (1000 shares x $0.025)

- Click Save.

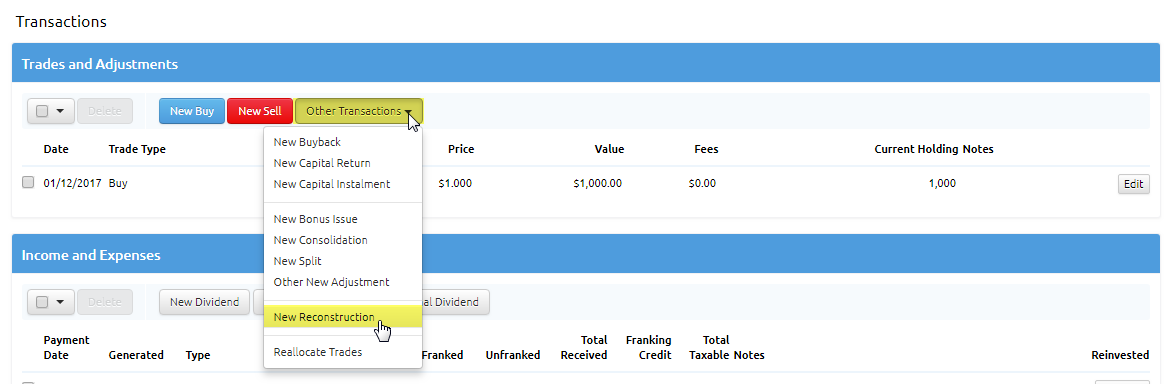

Step 2: Account for new NEC shares

Under Trades and Adjustments

- Click on 'Other Transactions'

- Select 'New Reconstruction'

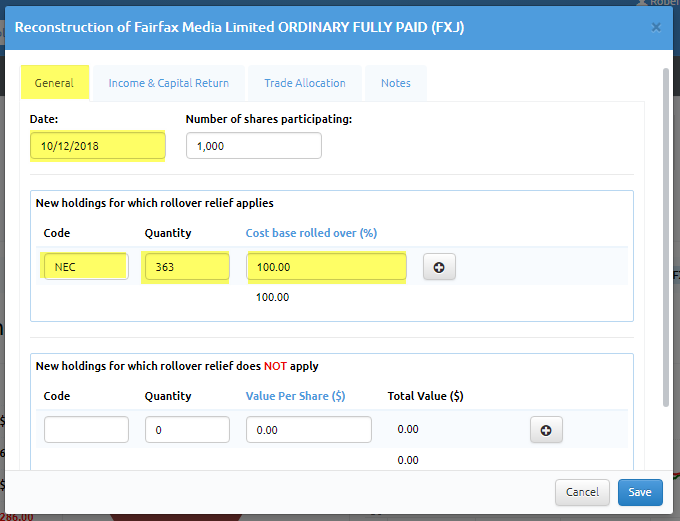

- Date: 10/12/2018

- Under New holdings for which rollover relief applies:

- Enter Code: NEC

- Enter Quantity: 363 (0.3627 x 1000 FXJ shares – rounded up)

**Please check with your statements as to how many shares you have been allocated and input that number here if it is different to the calculation. - Enter Cost base rolled over (%) = 100%

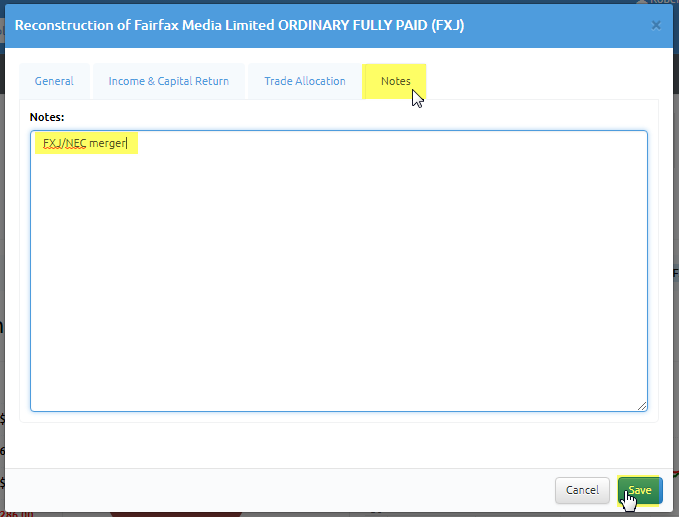

- Click on the Notes tab

- Record the reason for this transaction: 'FXJ/NEC merger'

- Click Save

You have now accounted for the merger.