Wesfarmers Limited (WES) completed the demerger of Coles Group Limited (COL) on 28 November 2018. Eligible shareholders received 1 COL share for each WES share owned. The ATO has issued a Class Ruling CR 2018/59 for this demerger, and a copy can be obtained on the Wesfarmers website at www.wesfarmers.com.au

Instructions for Wesfarmers shareholders who acquired their Wesfarmers shares on or after 20 September 1985 (post-CGT shares).

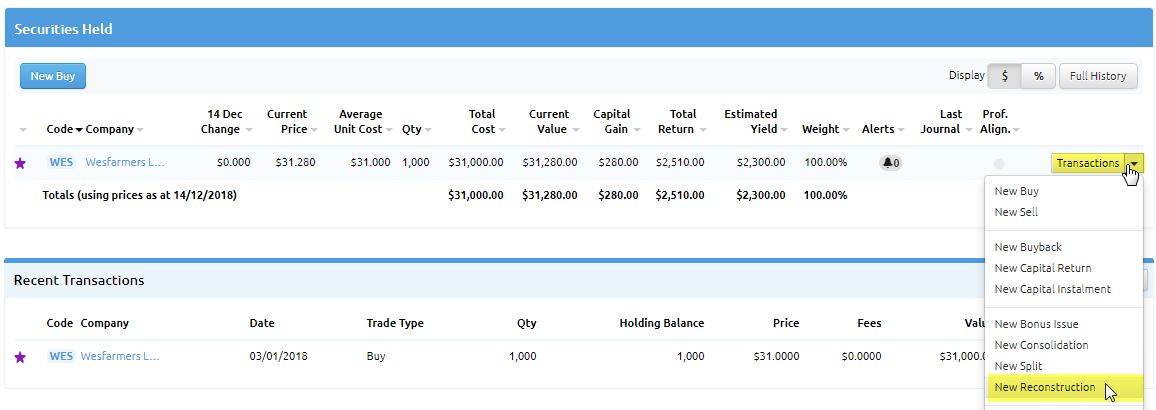

- Click on the 'Portfolio’ tab and then click on the appropriate under ‘My Portfolio(s)’, which includes the WES shares.

- Under the ‘Securities Held’ section, find the row Wesfarmers Limited (WES).

- Click the drop-down button next to ‘Transactions’ on the same line, and select ‘New Reconstruction’.

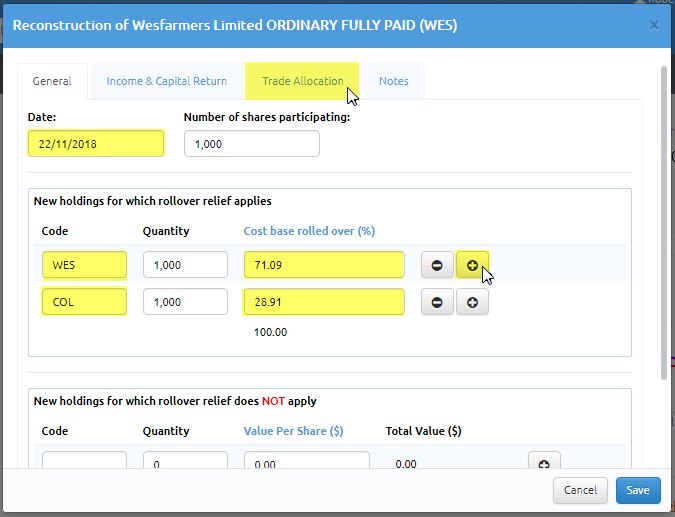

- In the Reconstruction window, enter the following:

- Date as 22/11/2018.

The number of shares participating, should be the same as the number of WES shares owned on this date. - Under “New holdings for which rollover relief applies” Enter the following:

- Code: WES

- Quantity: same amount as “number of shares participating” and

- Cost base rolled over (%): 71.09%

- Click on the plus symbol (+) to add another line.

- On the new line, Code: COL

- Quantity: same amount as “number of shares participating” and

- Cost base rolled over (%): 28.91%

- Date as 22/11/2018.

- Click the ‘Trade Allocation’ tab.

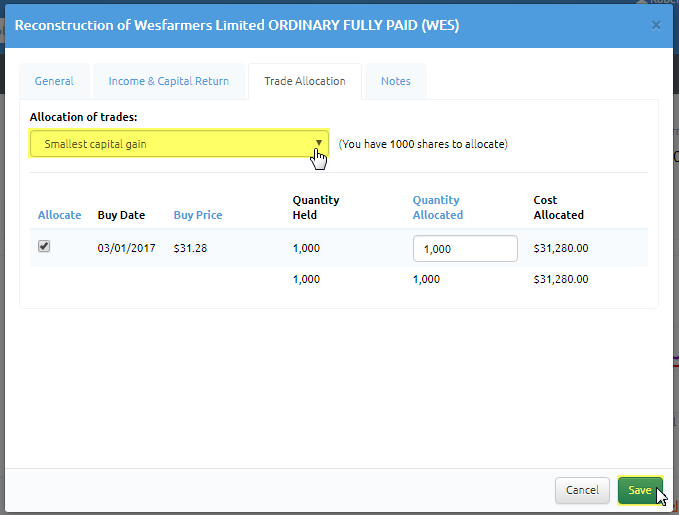

- Confirm that a trade allocation method has been selected.

- If not, from the drop-down menu select one of the following options:

Oldest First, Newest First, Smallest Capital Gain, Largest Capital Gain, or Same Proportion of Each.

- If not, from the drop-down menu select one of the following options:

- Confirm that a trade allocation method has been selected.

- Click “Save” and you have accounted for the WES/COL demerger in Portfolio Director.