The acquisition of Westfield Corporation by Unibail-Rodmaco can be accounted on your Portfolio manager using the steps below.

There are multiple ways of recording the tax information on the acquisition, it is highly recommended that you sought tax advice regarding the demerger/acquisition from your tax accountant in order to achieve the optimal outcome for allocation of your cost bases in your new Unibail-Rodamco & OneMarket holdings.

The instructions set out below is based on a general approach which may not be the most optimal outcome for Stock Doctor members due to the complexity behind the transactions.

Setting the scene

We bought 1 parcel of 5,000 WFD shares at the price of $10 (no brokerage included for simplicity).

Our total cost base for our WFD parcel is 5,000 x $10 = $50,000

Step 1 – OneMarket Demerger

For every 20 WFD shares you own, you get 1 OMN share.

The OMN purchase is funded by a distribution of $0.0677 paid by WFD. $0.0677 x 20 WFD share = $1.354 (which is the cost base of your new OMN shares).

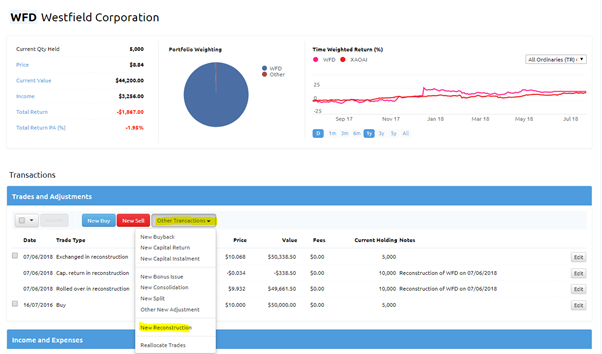

1) Go to your Portfolio which contains the WFD shares

2) Go into the WFD security page

3) Under “Trades & Adjustments”, Click on “Other Transactions” and then “New Reconstruction”.

a. Date = 07/06/2018

b. Number of Shares participating = 5,000 (as per my original position)

c. Under New holdings for which rollover relief applies:

i. Code = WFD

ii. Quantity = 5,000

iii. Cost base rolled over (%) = 100

d. Under New holdings for which rollover relief does NOT apply:

i. Code = OMN

ii. Quantity = 250 (Based on 5,000 / 20)

iii. Value per Share = $1.354

4) Go to the “Income & Capital Return” tab (top row)

5) For item 10. Capital Return ($) = $338.50 [$0.0677 X 5000 WFD shares]

6) Click Save

*The capital return is calculated by your total WFD shares X $0.0677, in the example provided, this would be $0.0677 x 5000 = $338.50*

You have now accounted for your new OneMarket (ASX:OMN) shares within your portfolio manager.

Keep in mind that the ‘capital return’ of $338.50 is NOT a dividend received from the company. We have marked it as a ‘capital return’ solely for record keeping, understanding that the OMN shares we received were paid for by the ‘capital return’.

The $338.50 is not marked as a capital return in documentations provided by the company or the ATO because the underlying transaction of the OMN demerger is of a value below $150M. The idea behind the transaction however, is very similar.

Step 2 – Exchange of WFD shares for Unibail-Rodamco SE Stapled Securities & Cash

Before we begin this step, open the ATO Calculator by clicking the link below and selecting “Westfield Group 2018 Calculator”. (You will need Microsoft excel for this step)

https://www.ato.gov.au/Calculators-and-tools/Westfield-Group---2018-Calculator-Instructions/

Input the data required by the Excel spreadsheet (as per example below). The example that we have provided is based on one parcel purchase of WFD shares. If you have bought multiple WFD share parcels over the years, you will need to input each parcel from Row 1 through to 10.

Bear in mind that this is a CGT event due to a change of ownership

Investors would receive:

- a cash amount of $3.5153*

*This is the Australian dollar equivalent of the USD$2.67 you were entitled to.

- 0.01844 of a Unibail-Rodamco SE stapled security, worth $5.4088 on 7 June 2018

SHARES COMPONENT

Following the example from above, 5000 WFD shares would be exchanged for 0.01844 Unibail-Rodamco SE Stapled security.

The Chess-Depository Interest (CDI) that were issued to investors represents 1/20 of a stapled security.

- 5000 WFD shares X 0.01844 Unibail Stapled = 92.2 (which will get rounded down to 92)

- 92 Unibail Stapled Securities X 20 = 1840 Unibail CDI’s

There are two options that investors can elect for in the determination of the cost base of their new Unibail-Rodmaco CDIs:

- Rollover Relief

- No Rollover Relief

The rollover relief can be applied ONLY if you have made a capital gain on your WCL portion of the WFD shares.

As per the ATO calculator based on the example used, we have made a $815.64 loss (see highlighted) on WCL and therefore, cannot elect for the rollover relief.

An example will be provided on if you have elected for the CGT rollover relief for your WCL holdings BEFORE the transaction on the 07/06/2018.

Based on the ATO calculator, you will be receiving 1840 Unibail-Rodmaco CDIs with a cost base of $14.6659.

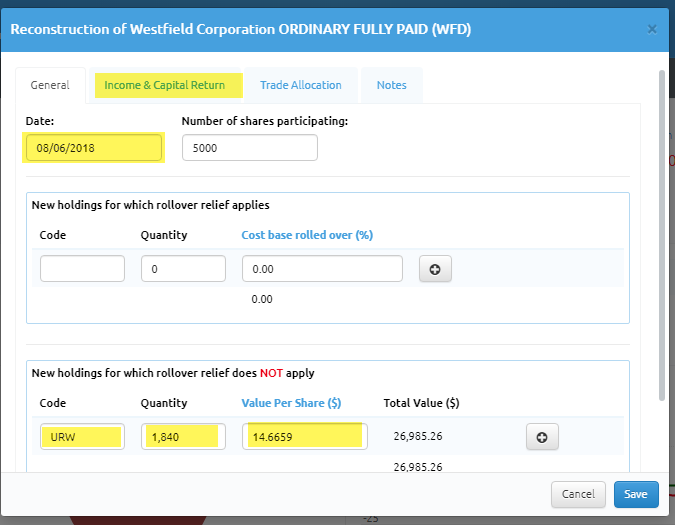

Recognising the acquisition on Stock Doctor

- Go to the WFD securities page

- Click on “Other Transactions” and select “New Reconstruction”

- Date = 08/06/2018

- Under New holdings for which rollover relief does NOT apply:

a. Code = URW

b. Quantity = 1840 (as per the ATO calculator)

c. Value per share = $14.6659

**Please check this against any statements that you may have received from WFD or your broker’s account to ensure that the quantity is correct, if it is different to the one produced on the ATO calculator, use the one on the statement but keep the cost base the same. **

5. Move to the “Income & Capital Return” Tab (see highlighted in above example) to add in the cash consideration received.

CASH COMPONENT

Following the example above, investors would receive $3.5153 per share in cash.

- 5000 WFD shares X $3.5153 = $17,576.5 [Total Cash Consideration]

6. For item 10. Capital Return ($) = $17.576.5 (as per the calculation above)

7. Click Save.

You have now accounted for the Unibail acquisition within your Portfolio Manager on Stock Doctor.

Electing for CGT rollover relief for your WCL portion

If you made a gain on your WCL portion of your WFD holdings, you may elect to rollover your CGT to your Unibail shares. In the example below, we are using a buy price of $5 rather than $10. Keep in mind that this would have been completed BEFORE the demerger was finalised. If you haven’t elect to roll your CGT relief over before the acquisition was completed on the 07/06/2018, then you do not have the option of rolling over your CGT.

Example:

Bought 5,000 WFD shares on the 16/07/2016 at $5 per share (no brokerage included for simplicity)

Total cost base = 5,000 x $10 = $50,000

Input this into the ATO Calculator:

You have made a gain of $4071.86 on your WCL portion and have the option to roll this into your new URW holdings.

You can do so by going to Row 7 – Elect CGT Roll-over for your WCL shares? and drop down ‘Yes’.

Because you have elected for the CGT rollover, your number of shares in URW decreases from 1840 to 1202 units because of a decreased cost base.

From here, you start off at Step 1 of “Recognising the acquisition on Stock Doctor”.