Used to identify overbought and oversold conditions.

Indicator Type

Momentum Oscillator

Works Best

All market types and time frames although intraday is the most popular.

Formula

The difference between two simple moving averages using the median price instead of the close price. The result does not have high or low limits.

Parameters

Theory

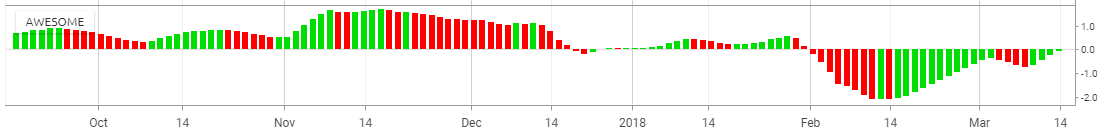

The awesome oscillator will fluctuate between positive and negative territory. A positive reading means the faster moving average is greater than the slower moving average. A negative reading means faster average is less than the slower average.

The color of the bars depends on its value compared to the bar before. If the oscillator value is greater than the previous it is typically painted green. If it is lower then it is typically painted red, although the user can changed these colors. It is possible to have green bars with negative values and red bars with positive values.

As with MACD, when the market is rising, the faster average will move quicker and the oscillator values will rise. When the market slows down as it tops, the faster average will turn sooner and eventually cross down below the slower average.

Interpretation

Interpretation is similar to MACD including buying when the oscillator crosses through the zero line to the upside and selling when it crosses back below. Of course, this will result is many false signals in flat or choppy markets.

Another use would be the “saucer signal” which finds pullbacks in existing trends, similar to a small three-bar reversal. For the long side, when the oscillator is above zero, the setup is two consecutive red bars followed by a green bar. Buy the next period’s open.

Conversely, for a sell the oscillator should be below zero. After two green consecutive bars and a red bar, sell the next period’s open.

Divergence analysis works well here but not as it does in other indicators. If the oscillator makes two consecutive highs, even if the second is not lower than the first, it creates a bearish setup at the first red bar. And on the bullish side, two consecutive lows in the oscillator, even if the second is not higher than the first, creates the setup on the first green bar.