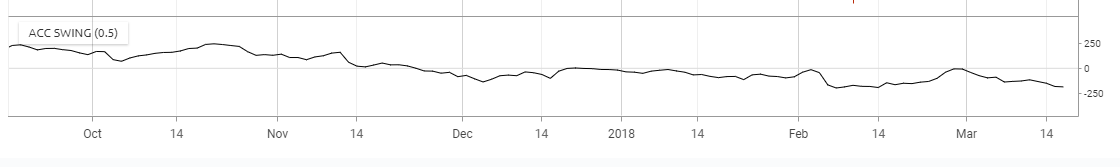

The Accumulation Swing Index (ASI) is the cumulative sum of the Welles Wilder’s Swing Index indicator. The Accumulation Swing Index compares the current and previous price to calculate a 'real' price of a share.

Price swings are qualified with a numerical value, while also identifying swing points for the short-term. ASI can also be used to confirm trend line breakouts on price charts. These signals are identified by breakouts from past previous highs or lows in the index.

An upside breakout occurs when the Accumulation Swing Index exceeds its value on the day when a previous significant high swing point was made. A downside breakout is indicated when the value of the Accumulation Swing Index drops below its value on a day when a previous significant low swing point was made.

Comparing the ASI to trendlines drawn on the price chart will confirm a breakout. A false breakout occurs when the trendline drawn on a price chart is penetrated, but the similar trendline drawn on the ASI is not broken.