Average True Range (ATR) is usually used to set trailing stops to close positions based on average true range. Not commonly used to open positions.

Indicator Type

Trade trigger

Works Best

All market types in daily and weekly time frames, although it can be used intraday, as well. However, trending markets are best.

Formula

Calculate the Average True Range and then multiply by the multiplier. For an up trend, subtract from previous close. For a down trend, add to previous close.

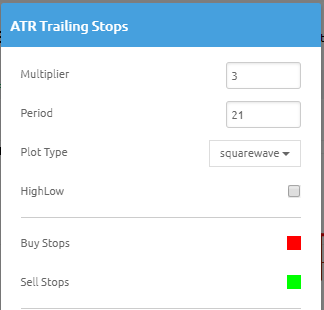

Parameters

ATR typically uses between a 5- and 21-period span. Originator Welles Wilder suggested using 7. Multiples vary between 2.5 and 3.5 ATR and Wilder suggested 3. Defaults to a 21-period average of the True Range and 3-period multiple for the stop.

You can also select the color for Average True Range line by selecting the box to bring up a color palette.

The format for the stop can be set by setting the plot type to points or square wave.

The High/Low option bases the stop on the previous period’s high for up trends and previous period’s low for down trends.

Theory

All stops attempt to limit risk by placing orders to exit a trade if price moves in the wrong way. Some traders simply use a percentage; others use technical levels such as support, resistance and trendlines. Still others use complicated formulas using indicators and price action together (if indicator crosses X then exit).

ATR Trailing Stops are based on average true range, which itself attempts to consider period to period changes as well as the range for the current period. By doing so, it incorporates volatility into the mix so that stops for more volatile stocks are wider and stops for more sedate stocks are narrower.

Interpretation

The Average True Range Trailing Stop is similar to other trailing stop methods. As long as price action remains above the stop in up trends and below it for down trends, the position is held. As soon as price crosses the stop, the position is exited.