ADX/DMS stands for Average Directional Index and Directional Movement System. It can be used to identify the direction and strength of a trend.

Indicator Type

Trend finder / indentifier

Works Best

All markets and time frames although this study can excel in determining if a visually flat market is starting to develop a trend.

Formula

Directional Movement (DM) is defined as the largest part of the current period’s price range that lies outside the previous period’s price range. Each period will either be positive (larger range above previous range), negative (larger range below previous range) or zero if moves above and below the previous period’s range are the same or price stay within the previous day’s range.

The value of the Plus Directional Indicator (+DI) is the DM, if above the previous range) divided by the average true range. The value of the Minus Directional Indicator (-DI) is the DM (if below the previous range) divided by the average true range. Each period with have only one result, either plus, minus or zero.

Calculate the Average Directional Index by taking a simple moving average of the past +DI and -DI values. Period defaults to 14 periods.

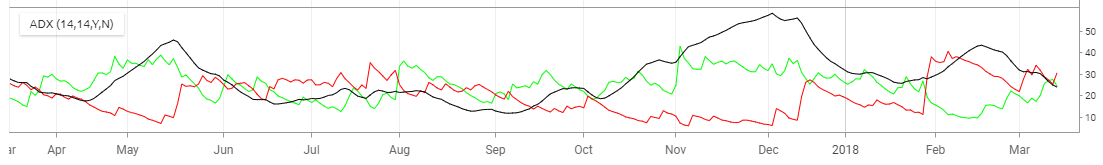

You can also select colors for the ADX, +DI and –DI lines by selecting the appropriate box to bring up a colour palette. Green and red are often used for +DI and –DI, respectively.

Parameters

The period value in the DM calculation corresponds to trader preference in RSI, Stochastics and other Welles Wilder studies. Daily charts use values of 9 to 14 with 10 being Wilder’s original.

Interpretation

This system can be used as a filter for more traditional studies. If ADX is above 25-30, a trend following system can be used. If it is below 25-30 then an alternate should be used. Enter when +DM crosses above -DM and Exit when the reverse occurs. When PDM is greater than MDM it means days when the trend was up outweigh the days when the trend was down (over the past “n” days). The greater the difference, the stronger the trend

High and rising ADX indicates a strong trend but not direction. +DM and –DM, not to mention visual inspection, tells the trader market direction. Low and falling ADX suggests whatever trend was in place has or will soon fail.