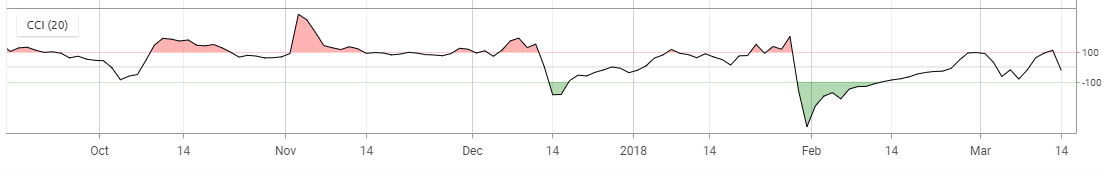

The Commodity Channel Index (CCI) is used to time buys and sells based on overbought and oversold conditions.

Indicator Type

Momentum indicator

Works Best

Developed for commodities, it works in all markets that have cyclical patterns and are currently trending.

Formula

The CCI starts with the average of the high, low and close for the period and subtracts the “n” period moving average. The goal is to measure the current price level relative to an average price level over a given period of time, normalized for the average price over time.

Parameters

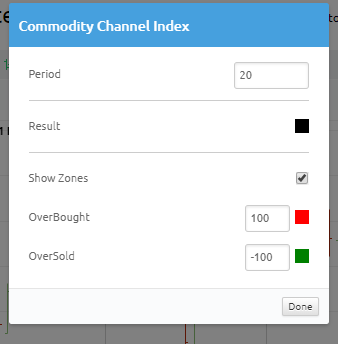

The typical period used is 20 although some traders use a number of periods less than one-third of the cycle length. Larger numbers of periods are less prone to whipsaws.

Defaults 20-periods.

The “Show Zones” box allows the user to draw overbought and oversold lines on the plot. They default to +100 for overbought and -100 for oversold but can be changed by the user.

You can also select colors for the CCI and show zone line by selecting the appropriate box to bring up a color palette. The color for the average (median) determines the color for filled bands.

Theory

The CCI creates an index that measures the difference between current price change and an average price change. Deviations from the average should present trading opportunities and is essentially an indexed momentum study. CCI is relatively high when prices are far above their average. CCI is relatively low when prices are far below their average. In this manner, CCI can be used to identify overbought and oversold levels.

Interpretation

Most of the random fluctuations of the CCI should fall within a channel between negative 100% and positive 100%. The rules of trading are to buy long when CCI rises above +100%, and sell that position when CCI falls below +100%. Conversely, sell short when CCI falls below -100% then cover shorts when CCI rises above -100%. The idea is to buy strength and sell when that strength wanes.