Rio Tinto Limited (RIO) off market share buyback announced on 22nd September 2017. These instructions will only apply to you if you successfully participated in the off-market share buyback. In this buyback, you received $63.67 per share, of which $9.44 was deemed a capital component and $54.23 a fully franked dividend component. The market value deemed by the ATO was $71.02.

The example uses the following data and assumptions, please amend accordingly for individual holdings.

500 RIO shares purchased on 30 Jun 2017:

Purchase price on 30 Jun 2017 $45.50

Cost: $22,750.00

Brokerage: $29.95

Total cost: $22,779.95

Assume 100 shares were bought back by RIO through the buy-back programme:

Instructions for Stock Doctor Portfolio Manager

- Click on the 'Portfolio’ tab and then click on the appropriate under ‘My Portfolio(s)’, which includes the RIO shares.

- Under the ‘Securities Held’ section, find the row Rio Tinto Limited (RIO). Click the drop- down button next to ‘Transaction’ on the same line, and select ‘New Buyback’.

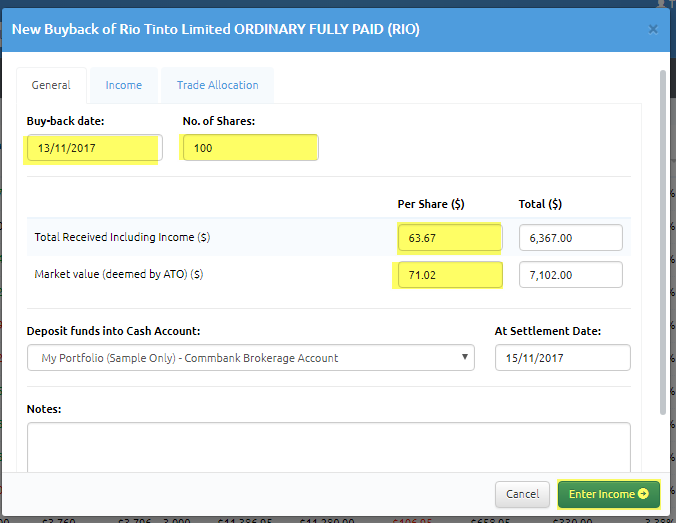

- In the new dialogue box:

3a. Enter the Buy-back date as 13 November 2017.

3b. The No. of shares to rollover is 100 (this should be the number of shares you elected for the buyback).

3c. Enter $63.67 as the Per Share amount for Total Received Including Income ($). The Total ($) should auto-calculate.

3d. Enter $71.02 as the Per Share amount for Market Value (deemed by ATO) ($). The Total ($) should auto-calculate.

3e. Click Enter Income. This should take you to the next ‘Income’ dialogue box.

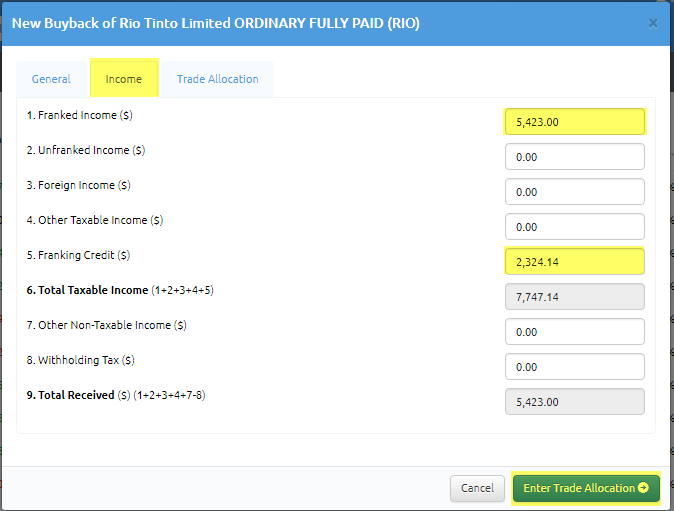

- A new ‘Income’ dialogue box tab should appear:

4a. Franked Income ($) is $5,423.00. i.e. $54.23 per share for 100 shares.

4b. The Franking Credit ($) is $2,324.14, i.e. $23.2414 per share for 100 shares. ($54.23 x 30% / 70%)

4c. The totals should auto-calculate.

4d. Click the Enter Trade Allocation button to go through to the Trade Allocation tab of the dialogue box.

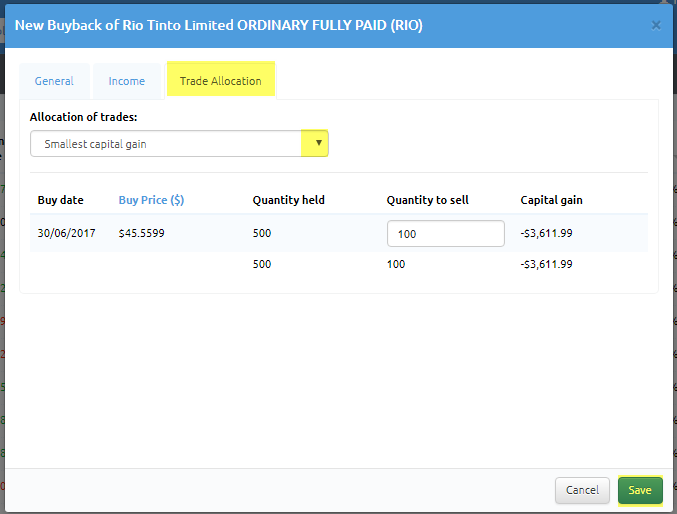

- You should be in the Trade Allocation tab of the Dialogue Box.

5a. Allocate the trade from the drop-down box: Oldest First, Newest First, Smallest Capital Gain or Largest Capital Gain.

5b. The quantity to sell should match the amount you nominated for buyback (or scale back amount).

5c. Click Save

You have now accounted for the RIO buyback.