Vocus Communications (VOC) merged with M2 Group (MTU), and issued shareholders of MTU with shares in VOC. Eligible shareholders received 1.625 shares for each MTU share they own. These instructions depend on the provision of capital gains tax rollover relief, pending a Class Ruling from the Australian Taxation Office.

Each MTU security was exchanged for 1.625 VOC security for security holders on the record date of 8 February 2016. MTU has ceased trading and the new VOC securities commenced trading on 9 February 2016.

To account for the merger in Stock doctor, please do the following:

- Under 'Portfolio Director', click on the portfolio containing MTU.

- Under 'Securities Held', click on MTU. This will take you to the MTU securities screen.

- Under 'Trades and Adjustments', click on the down arrow next to ‘Other Transactions’ and choose ‘New Reconstruction’.

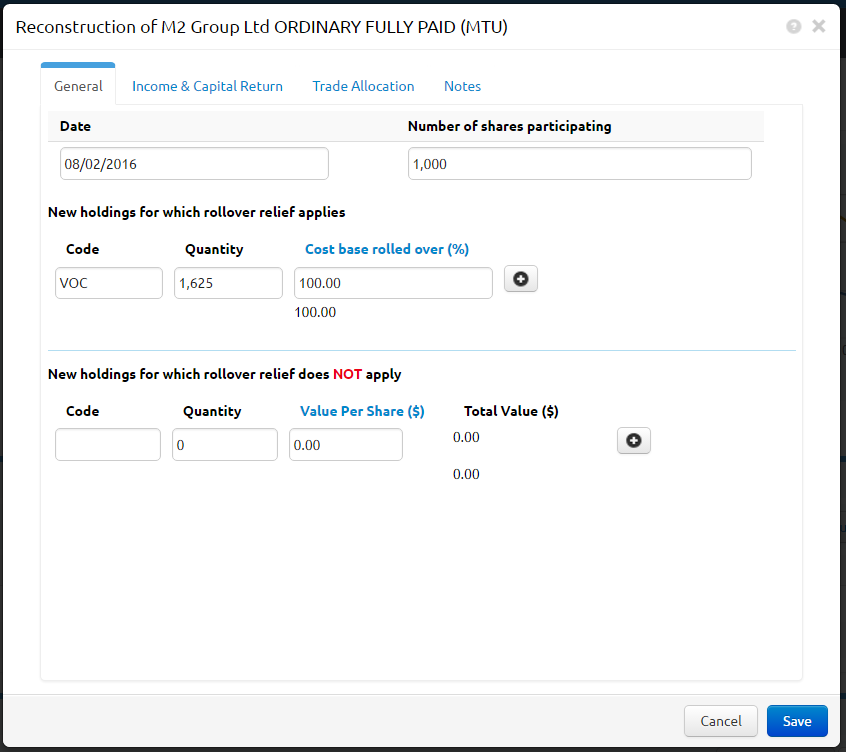

- In the new dialogue window that opens, enter the following information in the ‘New Holding for which rollover relief applies area’:

- Make the following adjustments:

- Date: 08/02/2016

- Code: VOC

- Quantity: Enter the quantity per your statement (which will be the Number of shares in MTU x 1.625).

** In this example, we have considered 1,000 shares of MTU for which the quantity of VOC shares is 1,625, but this should be modified to reflect your own holding. - Cost base rolled over (%): 100.

- Now click ‘Save’.

You have now accounted for the merger between MTU and VOC.