WDC into WFD

On 30 June 2014, the Westfield Group (WDC) transformed into Westfield Corporation (WFD) by transferring its Australian and New Zealand assets to Westfield Retail Trust (renamed as Scentre Group) and by retaining its overseas assets. Under the transformation plan, eligible WDC security holders will receive one thousand two hundred forty six (1,246) securities of the newly formed Scentre Group (SCG) and one thousand (1,000) securities of newly formed Westfield Corporation (WFD) for every one thousand (1,000) WDC securities held. Per ATO ruling, the approved cost base split was computed to be 36.38% for SCG and 63.62% for WFD.

Please see below a set of instructions outlining how to account for the demerger in Stock Doctor Portfolio Manager. These instructions are relevant to WDC shares acquired after 02 November 2010. WDC shares acquired prior to this date will follow a different set of instructions link as it will have to include the establishment of WRT in 2010.

For illustrative purposes only, the following assumptions regarding the WDC security holdings have been made:

Shares: 1000

Trade date: 30/07/2008

Price: $10

Broker: $100.00

Total Cost: $ 10,100

1. Under portfolio director, click on the portfolio containing WDC. It will take you to another screen.

2. Under securities held, click on WDC. It will take you to the WDC screen.

3. Under 'Trades and Adjustments', click on ‘Other Transactions’ and choose ’New Reconstruction’.

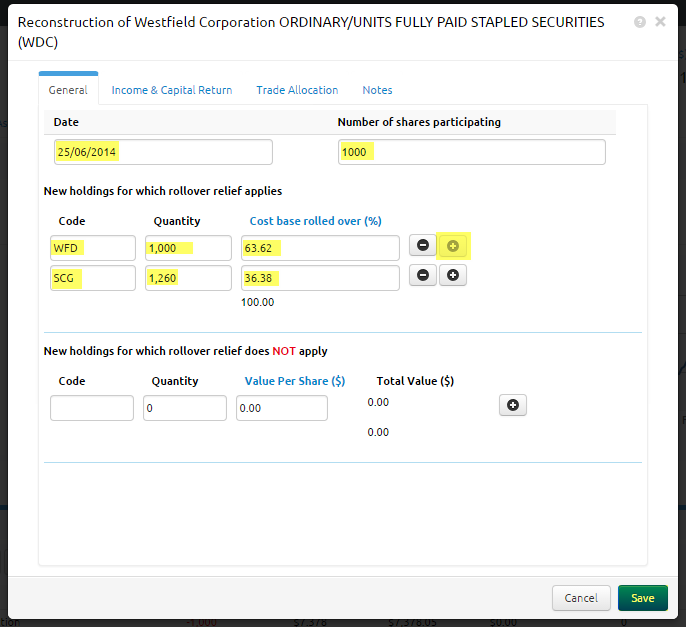

4. In the window that will open, enter the following information in the General tab.

Date : 25/06/2014

No. shares to participating: 1000

New holding for which rollover relief applies

Code : WFD

Quantity: 1000

Cost base rolled over (%): 63.62

Click the (+) button.

Code : SCG

Quantity: 1260 (1000 x 1.246)

Cost base rolled over (%): 36.38

5. Click on Save.