Reconstructions are used when new shares are issued to a shareholder, or existing holders are altered on account of a corporate restructure.

If you receive a combination of money and shares in the takeover or merged company, your capital proceeds are the total of the money and the market value of the shares you received. The capital gain is the capital proceeds less the cost base. The cost base of the new shares is their market value.

In some circumstances you may be entitled to rollover relief. This allows you to disregard the capital gain made from the original shares, units or other interest. You are taken to have acquired the replacement shares, units or other interest for the cost base of the original shares at the time you acquired the original shares.

Rollovers, Bonus Issues, New Splits and Consolidations can be entered using the Reconstruction tool.

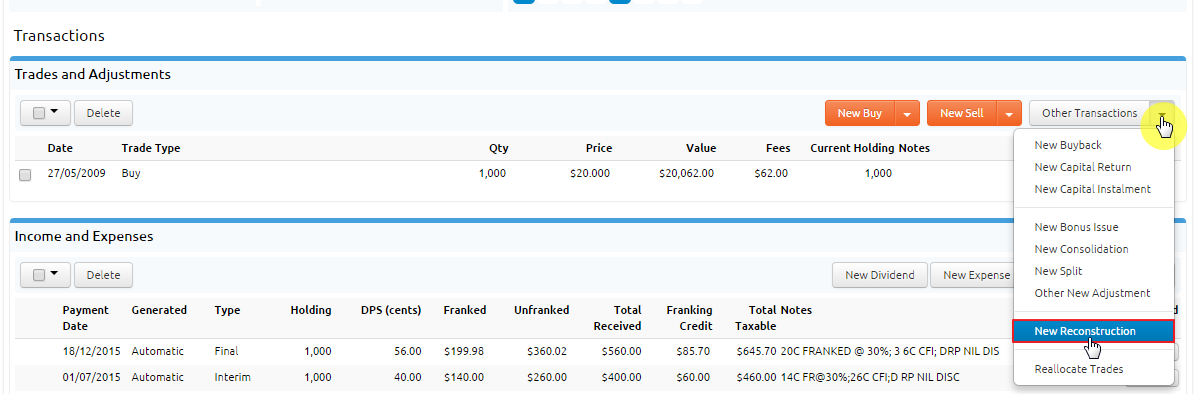

You can access the Reconstruction Tool by navigating to the Portfolio Director:

https://www.stockdoctor.com.au/Portfolio

- Select your portfolio

- Under 'Securities Held' section

- Click on the 'company code/name' that needs the reconstruction

- Under 'Trades and Adjustments' section

- Click on the Other Transactions drop down arrow

- Select New Reconstruction

As restructure events occur and the tax details of new Rollovers, Bonus Issues, New Splits and Consolidations are finalised, we will publish specific instructions on how to deal with them in the Stock Doctor Portfolio Manager. These will be placed in our Help Centre under FAQ's > Advanced Reconstructions

Example 1.

The example below shows how you would enter the DuluxGroup demerger that occurred on 12/07/2010, where shareholders apportioned the cost base of Orica shares 90.4% Orica and 9.6% DuluxGroup.

Please note these assumptions have been made for my hypothetical transactions.

- 1,000 original Orica shares were bought at $20 per share (25/07/2009)

- Original brokerage was $62 (GST inclusive)

General Tab

Date - will default to today's date

Number of shares participating - will default to the current holding

Cost base rolled over (%) - The percentage of the original cost base that is being rolled over as the cost of this stock. The new trades will be backdated to the buy date of the original stock. Note that it is a percentage of the total cost base (i.e. prior to the deduction of any capital returns on the Income & Capital Returns tab).

(+) Button - Adds a new row

Value per Share ($) - The initial value attributed of the share received.

Income & Capital Return Tab

Trade Allocation Tab

- Confirm that a trade allocation method has been selected.

- If not, from the drop-down menu select one of the following options:

Oldest First, Newest First, Smallest Capital Gain, Largest Capital Gain, or Same Proportion of Each.

- If not, from the drop-down menu select one of the following options:

Allocate - Include in automatic allocation of trades.

Buy Price - Buy price including fees.

Quantity Allocated - Include in automatic allocation of trades.

Notes Tab

Click Save to apply reconstruction

Example 2.

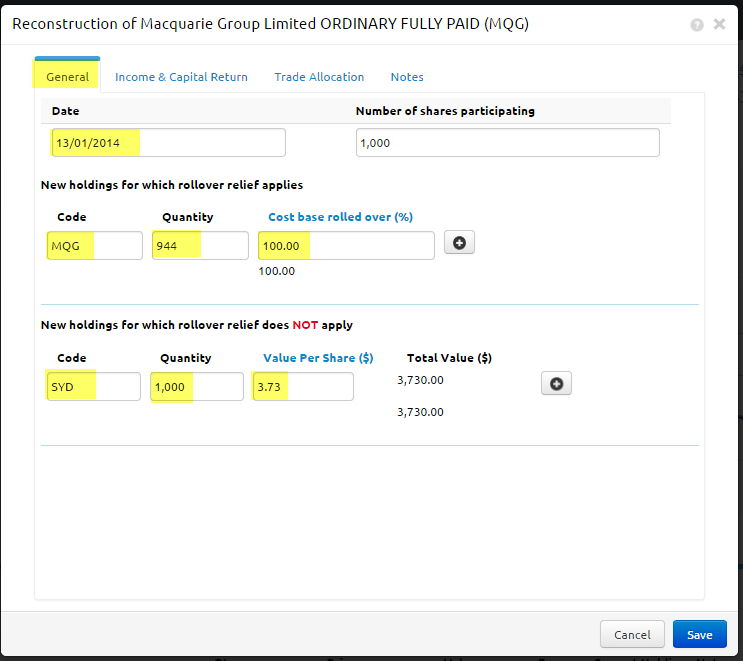

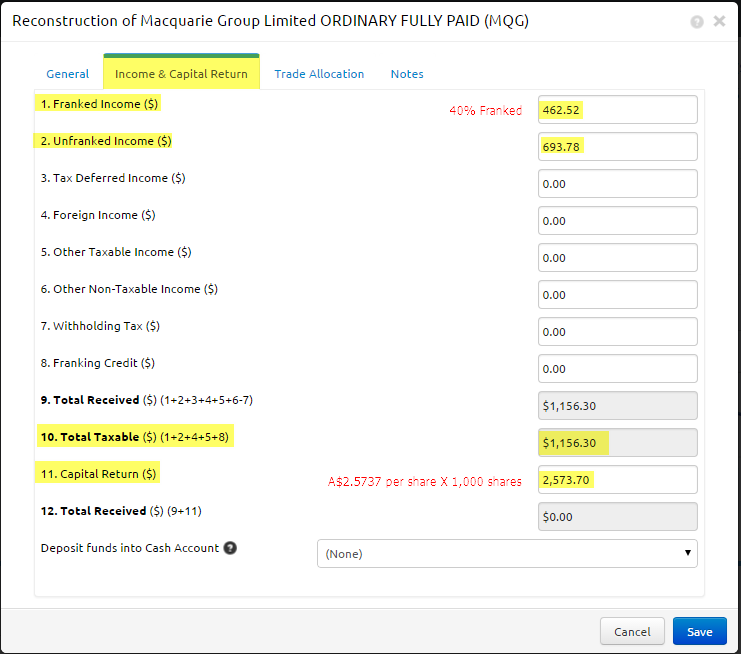

The example below shows how you would enter the Macquarie (MQG) Distribution of Sydney Airport (SYD) securities that occurred on 13/01/2014. Where for every 1 MQG share held you will be issued 1 new Sydney Airports ( SYD ) share with a cost base of A$3.73 per share (made up from a MQG distribution being a Special Dividend of A$1.1563 per share 40% franked and a return of capital of A$2.5737 per share. The result of the capital return on MQG effectively means a share consolidation of 0.9438 for 1 )

Please note these assumptions have been made for my hypothetical transactions.

- 1,000 original MQG shares were bought at $20 per share (28/05/2009)

- Original brokerage was $19.95 (GST inclusive)

General Tab

Income & Capital Return Tab

Trade Allocation Tab

Click the ‘Trade Allocation’ tab.

- Confirm that a trade allocation method has been selected.

- If not, from the drop-down menu select one of the following options:

Oldest First, Newest First, Smallest Capital Gain, Largest Capital Gain, or Same Proportion of Each.

- If not, from the drop-down menu select one of the following options:

Notes Tab

Click Save to apply reconstruction