BHP Billiton (BHP) May 2015 demerger of South32 (S32).

BHP Billiton (BHP) demerged a number of the company’s non-core assets as a new company South32 (S32) on 25th May 2015. Eligible shareholders will receive 1 S32 share for each BHP share they own. Instructions below are for BHP investors who have acquired and held BHP shares on or after 20 September 1985 (implementation of CGT). The ATO has just issued the tax ruling for this demerger Class Ruling CR 2015/40.

- Click on the 'Portfolio’ tab and then click on the appropriate under ‘My Portfolio(s)’, which includes the BHP shares.

- Under the ‘Securities Held’ section, find the row BHP Billiton Limited (BHP).

- Click the drop down button next to ‘Transactions’ on the same line, and select ‘New Reconstruction’.

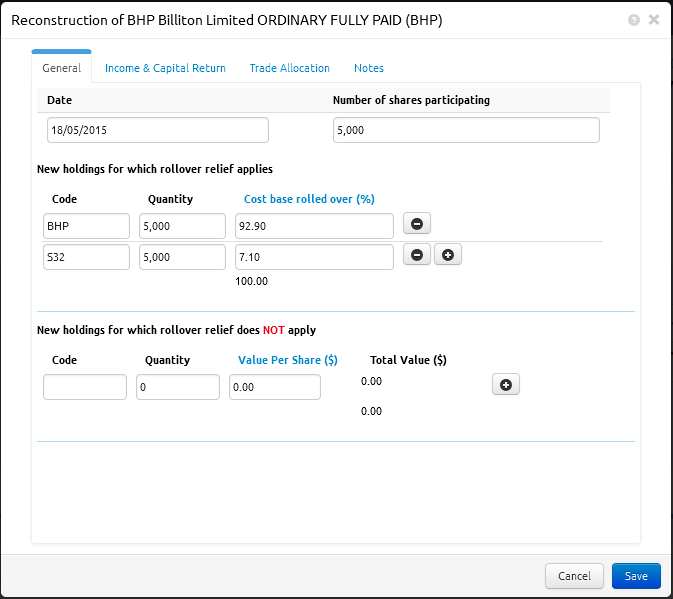

- In the Reconstruction window, enter the following:

- Date as 18th May 2015. The number of shares participating should be the same as the number of BHP shares owned on this date.

- Under “New holdings for which rollover relief applies” Do the following:

- Code: BHP, Quantity: same amount as “number of shares participating” and Cost base rolled over (%): 92.9%

- Click on the plus symbol to add another line.

- On the new line, Code: S32, Quantity: same amount as “number of shares participating” and Cost base rolled over (%): 7.1%

5. Click “Save” and you have accounted for the BHP/S32 demerger in Portfolio Director.

Optional – If you have participated in BHP’s share sale facility.

Select your S32 shares and enter a sale as normal. On the share sale screen, enter the appropriate S32 shares sold and the price received from the share sale facility according to the documentation you have received. Ensure that the “fees” is set to $0.00.