You can choose the default tax treatment for each of your portfolios. This will ensure accurate tax reporting is conducted on your portfolio.

For a "New portfolio" that you are creating simply click on the tax tab and the follow the steps below "Entering the appropriate tax treatment."

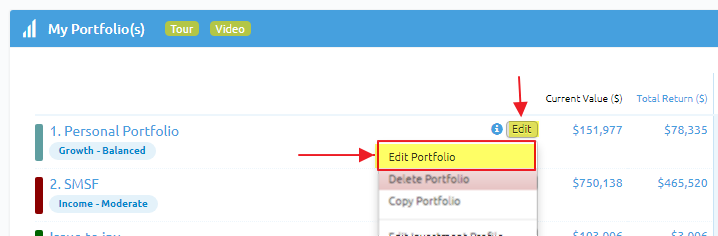

For an "Existing portfolio" that you have established:

- Navigate to the Portfolio Director

- Click the 'Edit' button (next to the portfolio name you wish to change the tax treatment for)

- Select 'Edit Portfolio'

Now the follow the steps below for "Entering the appropriate tax treatment."

Entering the appropriate tax treatment

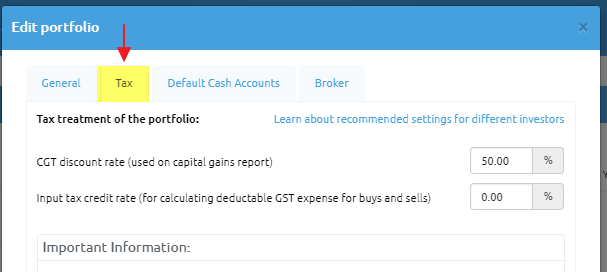

- Click the 'Edit' button (next to the portfolio name)

- Click on the Tax tab

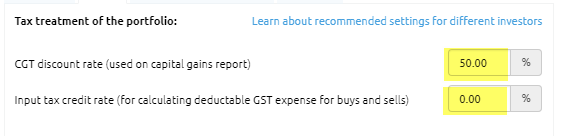

- Under the heading 'Tax treatment of your portfolio'

- Edit the CGT discount rate and Input tax credit rate percentages that apply to your portfolio.

CGT discount rate is the discount on capital gains where the asset was held for more than 12 months.

Input tax credit rate is used to calculate the default values for deductable and non-deductable GST expense. E.g. for a trust this rate is 55%, meaning 55% of the GST expense on a trade can be claimed as an expense against income and the remaining 45% is added to the cost base.

Typically these are set as follows:

|

Investor type |

CGT discount rate |

Input tax credit rate |

|

Individual investor |

50% |

0% |

|

SMSF registered for GST |

33.3333% |

75% |

|

SMSF not registered for GST |

33.3333% |

0% |

|

Company registered for GST |

0% |

100% |

|

Non Australian resident |

0% |

100% |

|

Trusts |

50% |

55% |

- Click Save to apply settings

References

- www.ato.gov.au - 'Working out your capital gain'

- www.macquarie.com.au - 'Self Managed Super Funds'

- www.ato.gov.au - 'Capital gains tax (CGT) discount for foreign resident individuals'

- www.gpt.com.au - 'General Summary of Australian Income Tax Implications for Security holders'

Important information

Lincoln Indicators is not licensed to provide tax advice. The above table of tax rates is to be used as a guide only and may change at any time. It is your responsibility at all times to ensure that the correct tax rates are used. In order to determine what the exact rates are that should be applied to your portfolio please seek independent financial tax advice from a licensed professional. Lincoln Indicators takes no responsibility for the tax rate you apply.