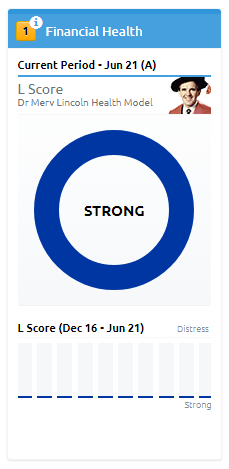

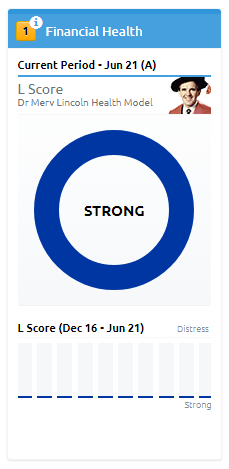

Financial Health is our first and most important Golden Rule.

Understanding the true financial health of a company means that you understand the level of risk your companies are exposed to, allowing investment with confidence, control and peace of mind.

Financial Health measures a companies ability to absorb a shock to its operations should something go wrong at an operational or financial level.

However, there are some common mistakes that can be made by investors when analysing Financial Health. We have listed them in order to help you avoid similar mistakes.

1. Being Strong or Satisfactory does not mean “buy”

Just because a company is exposed to manageable levels of financial risk does not constitute a buy recommendation.

Though a very important step in the investment process, it is not the be all and end all of your purchase decision. Factors such as earnings growth for capital appreciation seeking investors or dividend yield for income seeking investors, as well as an assessment of a company's other key performance metrics and its appropriateness relative to your investment objectives are important steps in determining whether a stock is write for your portfolio.

2. Financial Health can not immunise against you against everything

Despite our best efforts to allow for transparent investing, there will be times when the financial health score may not protect an investor from a disastrous event. These include:

Natural disaster

A major natural disaster may have a crippling effect on a business and its operations to the point where it cannot continue as a going concern. Such events are not predictable and therefore should they occur may result in a once quality company coming under strain

Fraudulent behaviour

As we assess listed companies we are reliant on the moral standings of management and the quality of their auditors to ensure that the numbers produced by a company are factual and a true reflection on the business. Any attempts to act in a deliberate way to compromise the authenticity of published reports is illegal and obviously plays havoc on our ability to paint an accurate picture as to the levels of financial risk a company is exposed to.

Management incompetence

Not all misstatements of accounts or decisions are fraudulent in nature. Some are simply results of incredibly poor governance and flat out incompetence. Should events such as unknown problems be disclosed to market out side of reporting periods where they are unable to be assessed within the confines of disclosed financials then there may be times risks were not identified. Commonly this can occur if a company discloses debt levels significantly above what had previously been reported or certain operations with a business are performing to a level far worse than had previously been disclosed. Though regrettable events, such events not previously disclosed at not possible to pick up.

3. A poor company may continue as a going concern

Some companies with an Early Warning, Marginal or Distress health can continue as going concerns despite the fact they are exposed to above acceptable levels of financial risk.

This is due mainly to

Investors continue to keep providing capital to the company through 'capital raisings' in order to cover off any cash short falls in the short term. Though normally seen by many as a negative, inevitably the company will send out positive updates to support the need to raise capital.

Companies can and do get lucky. This occurs when a company has stretched its finances thin and taken risks in running the business to achieve a desired outcome. Provided they still have access to capital, such risks can provide for the potential of large gains however investors need to understand these risks and therefore determine whether they are appropriate for the style of portfolio they are building.

At Stock Doctor we would prefer that no companies ever fail, including those with poor financial health, however it is important to note that there will be times that due to the company specific behaviour highlighted above that the Health Score may miss a failure.

Our commercial history and significant back testing has ensured a 95% classification accuracy of identify companies as poor financial health before failure. Therefore with Stock Doctor and Golden Rule #1 - Financial Health, you go a long way to ensuring that your portfolio is filled with the fundamentally most sound stocks on the exchange able to whether any change in business conditions.