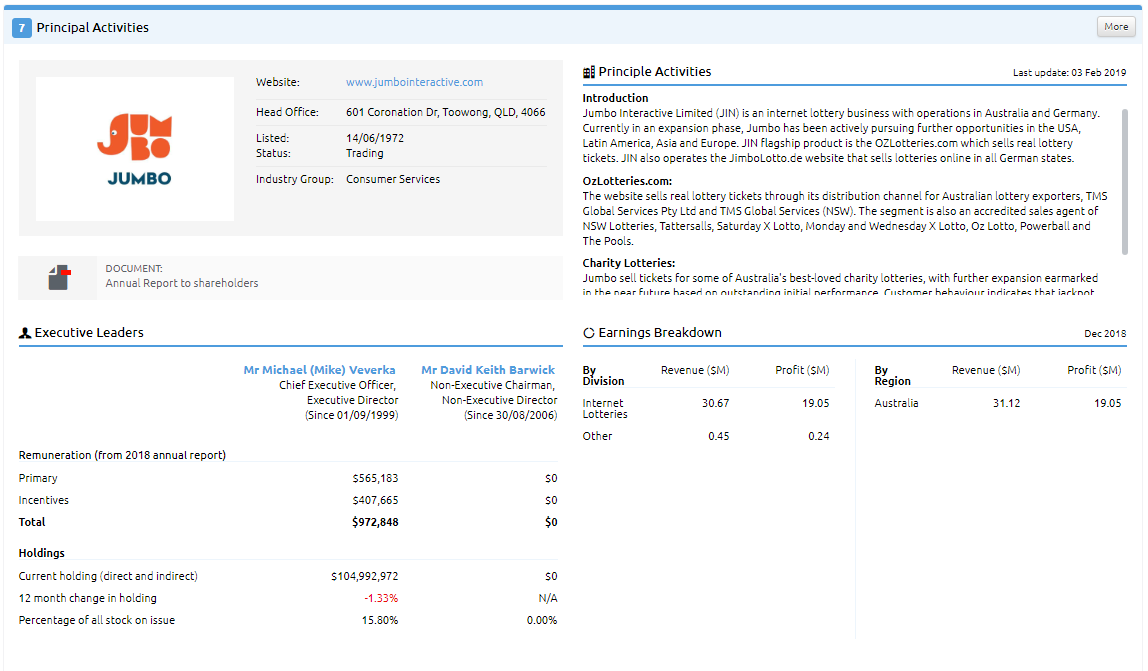

Before investing in a company, an investor should at least have a basic understanding of a company's principal activities, as well as the potential opportunities and threats that may impact future earnings.

- Understand what business does to generate revenue

- Visit the company’s website to learn more

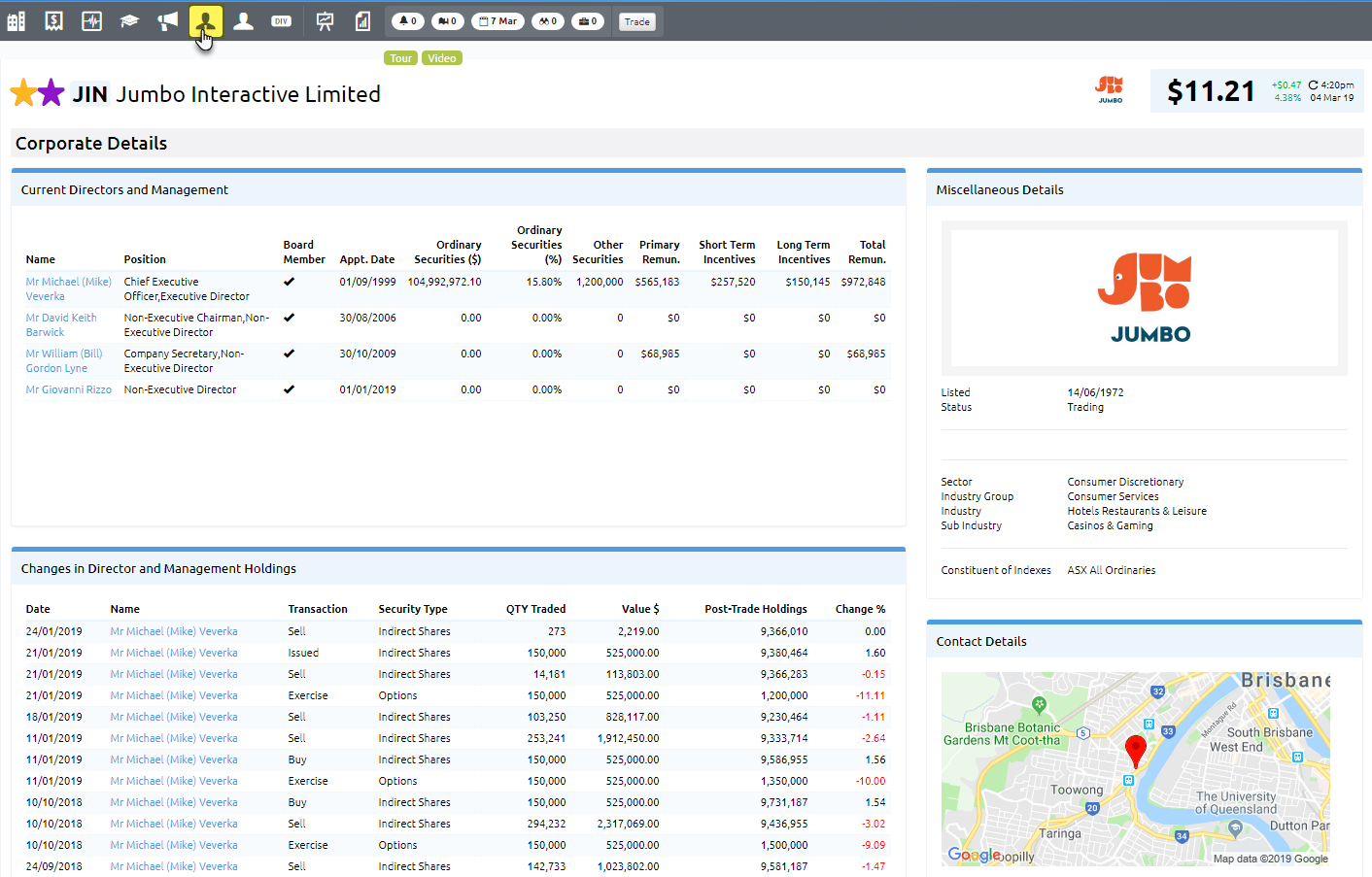

- Research the directors and management team

- Earnings breakdown

As you are a part owner of the business you need to believe in what the company does.

Stock Doctor provides you with a summary of the business operations, earnings breakdown including the sector group, executives and tenure and various business segments.

A direct link to the company's latest Annual Report is available from this section, to give you a complete picture of their activities and financial performance at a glance.

Our Research team also spend a significant amount of time analysing the operations of companies within our coverage universe. Therefore, reading the analyst comment will give you a solid insight into what the company does.

It is also important to understand the company management, especially with regards to their track record and other companies they have been associated with. When looking at Board members you should also look at the other Boards they currently sit on and assess their performance with regards to the management of these companies.

You also want your key Executives and Directors aligning their interests with shareholders by maintain material interests in the business. While some selling is acceptable in circumstances where management have looked after investors for a long time, a significant transaction may be a warning signal and be sign that the Director’s commitment to the business is starting to come undone.

A ready breakdown of earnings is available so that an assessment of the drivers for growth can be made, including an understanding of the concentration or geopolitical risks that may be present.

Finally, what are key executives being paid relative to the performance they have delivered to shareholders? Ideally you want to ensure that their remuneration reflects the level of success investors have attained.