Lincoln’s Financial Health Model assesses a company’s underlying quality, investment worthiness and insolvency risk. It calculates and combines 14 key accounting ratios extracted from a company’s public financial statements - including debt ratios, cash flow ratios, and profit ratios

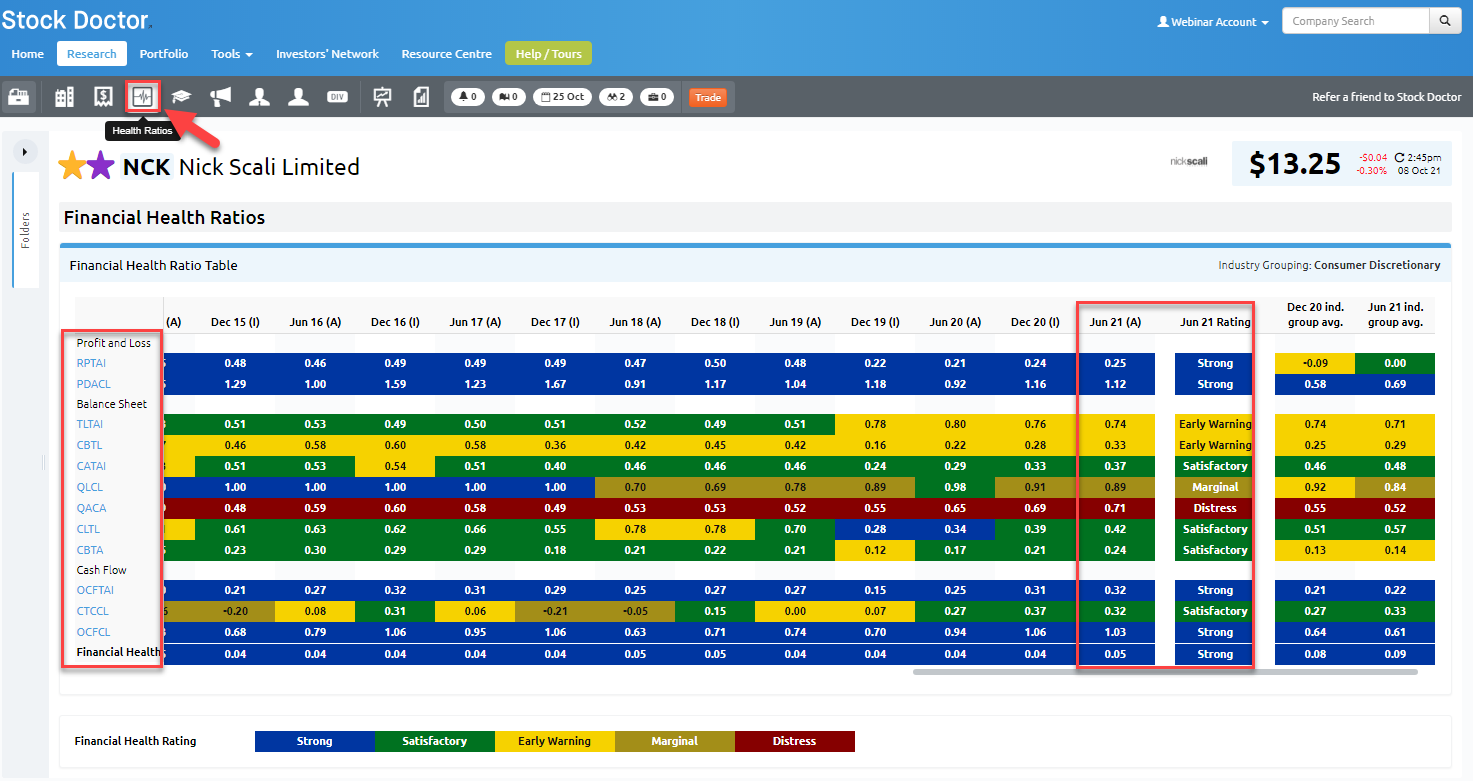

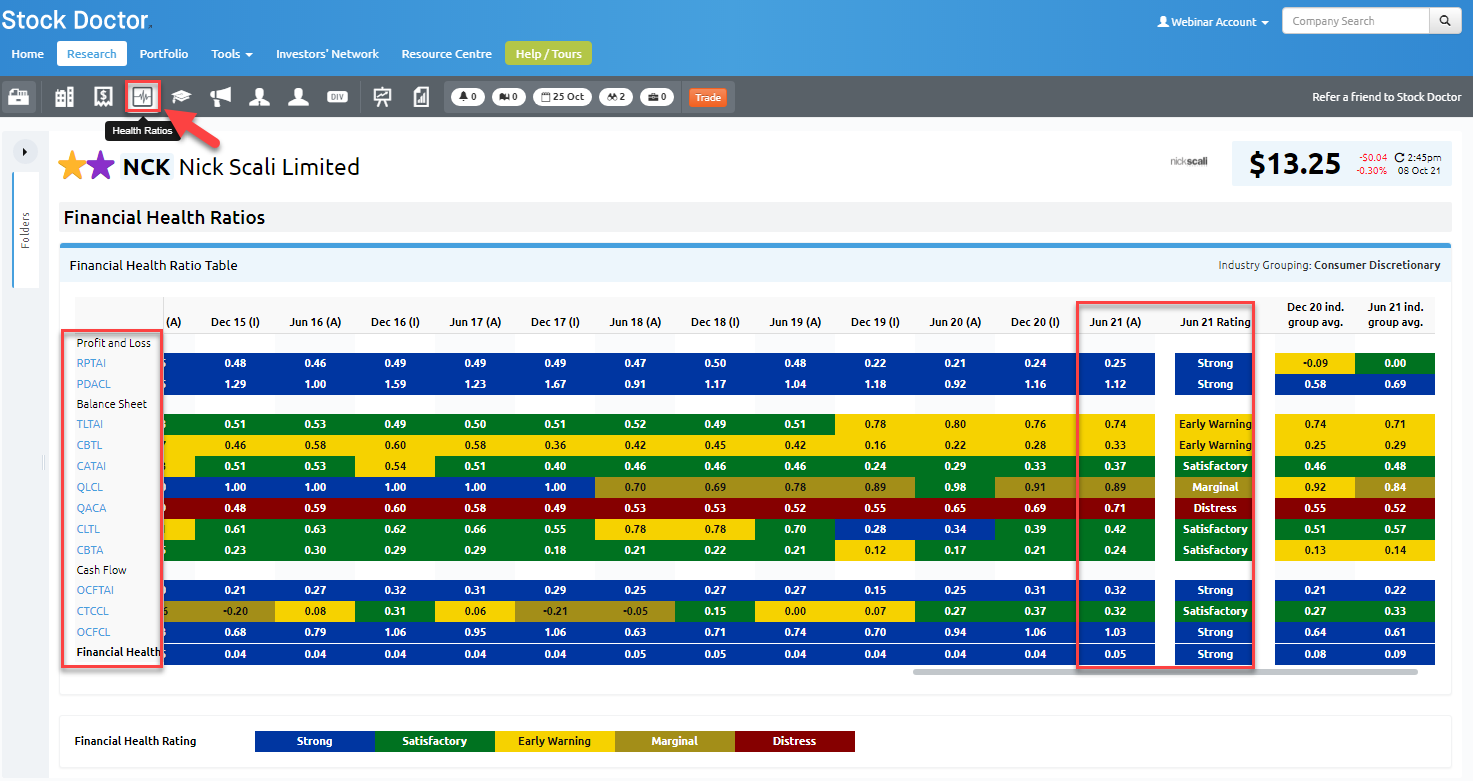

The 'Heath Ratios' page can be accessed via the '9 Golden Rules screen' of a company, by clicking the 'Heart Rate' icon.

Lincoln Indicators Stock Doctor Platform provides an overview of these ratios for each company in an easy-to-read screen.

The 14 key accounting ratios are combined to compute a Financial Health Score based on Lincoln’s pioneering quantitative methodology algorithm. It enables investors to focus on quality companies with:

- A history of profitability

- Manageable debt levels

- Strong cash flows

It also enables investors to screen out the hundreds of companies that are financially unhealthy, high risk, and therefore highly speculative because of:

- Weak or negative profits

- High debt and/or intangibles

- Poor cash flows

Financial Health Ratios

CATAI: Current Assets to Total Tangible Assets

This ratio measures the efficiency in the management of stock and/or debtors, and the backstop of fixed assets that may be available as a source of funds, either by way of sale or mortgage. Lower risk firms have a lower value for CATAI because they turn their stock over faster and/or collect their debtors quicker, and/or have a backstop of long-term assets that may be available as a source of funds, either by way of sale or mortgage. Higher risk companies have a higher value for CATAI.

CBTA: Cash Balance to Total Assets

Cash balance is defined as a company’s total cash in the bank as it appears on the cash flow statement. Lower risk firms have a higher value for CBTA because they have more cash that can be used to pay for commitments that it has with suppliers, a bank or any other party that has rendered a product or service. Higher risk companies have a lower value for CBTA which means its ability to meet its commitments is significantly hampered.

CBTL: Cash Balance to Total Liabilities

This ratio shows a company’s cash balance in relation to its total liabilities. Lower risk firms have a higher value for CBTL because they have more cash that can be used to pay for commitments that it has with suppliers, a bank or any other party that has rendered a product or service. Higher risk companies have a lower value for CBTL which means its ability to meet its commitments is significantly hampered.

CLTL: Current Liabilities to Total Liabilities

A factor determining a company's financial standing is the extent of more pressing debt commitments. Higher risk companies have more of their borrowing's short term than is normal for the industry. The higher the value of this ratio, the greater the risk because the more that borrowing's are short term, the more susceptible a company is to financial difficulties in the event of a downturn in trading.

CTCCL: Change in Total Cash Flow to Current Liabilities

Total cash flow refers to the net cash flow from a company’s operating, investing and financing activities. If a company produces a negative change in cash flow over the year, then this development puts a significant strain on the business to meet its short-term commitments. A reduction in the amount of cash in the bank is an increased risk, particularly if a third party needs to be paid in the short term.

OCFTAI: Operating Cash Flow to Total Tangible Assets

Operating cash flow pertains to the cash generated from the operations of a company, generally defined as revenues less all operating expenses, plus depreciation. It is a better measure of a company’s profitability than net income because it deducts only the actual cash expenses and therefore shows the strength of its operations. Consistent negative operating cash flow implies a business is going backwards in relation to its ordinary operations. A negative operating cash flow is a drain on the businesses assets, which can not only be used to support ongoing business, but is also vital for it to be a going concern. This ratio shows what percentage of assets is supported by the cash flow.

OCFCL: Operating Cash Flow to Current Liabilities

This ratio is significant because it shows the ability of a company to meet short-term commitments from internally generated cash flow. The higher the value of this ratio, the lower the level of risk because it implies that the company has more cash from its operations to cover short-term liabilities. A lower value for OCFCL denotes higher risk.

PDACL (formerly CFBCL): Profit before Depreciation and Amortisation to Current Liabilities

Profit before depreciation and amortisation is defined as net operating profit before tax plus non-cash charges. This is a powerful ratio because it depicts the margin of safety to meet short-term commitments from cash flow generated from trading operations. Lower risk companies have a higher margin of safety, whereas higher risk companies have a lower margin of safety.

QACA: Quick Assets (Current Assets - Stock) to Current Assets

The “immediate liquidity” of a firm is measured by this relationship. Implied in this ratio is the relationship between stock and more liquid assets. The higher the value of this ratio, the lower the level of risk because the company has more claims to immediate liquidity than is the norm for the industry. The lower the value for QACA, the higher the risk.

QLCL: Quick Liabilities (Current Liabilities - Short-term Bank Finance) to Current Liabilities

This ratio describes the relationship between trade and short-term bank finance. The lower the value of this ratio, the higher the level of risk, because there is a limit to the amount of short-term funds available from a bank. The closer a company gets to that limit, the less likely additional funds will be available, should they be required.

RPTAI: Retained Profits to Total Tangible Assets

The extent of funding from profit retention is a factor determining a company’s financial standing. Lower risk companies have a higher proportion of their funds being sourced from profit retention. A high value would indicate a mature company with a history of good profits and a conservative dividend payout ratio.

TLTAI: Total Liabilities to Total Tangible Assets

This is the gearing ratio: the relationship between liabilities and equity. The higher the value of this ratio, the higher the level of risk because the more a company borrows, the more susceptible it is to financial difficulties in the event of a downturn in trading.

The ratios are combined and weighted to produce a health score, which is then correlated to a point on a scale of Financial Health from 0 to 1.