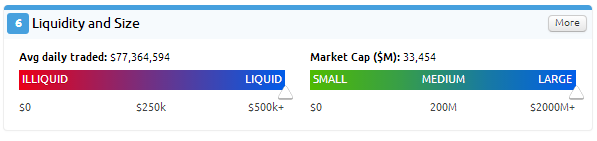

At some point an investor will wish to sell their share investment. To ensure they can sell the entire holding at any time, we suggest that the average 'daily volume traded' figure is at least five times the exposure level.

Ideally, investors should look for stocks that have much higher liquidity levels to ensure they can safely enter and exit, especially given that other Stock Doctor members may also be exposed to the same security.

We will generally not analyse a stock if its average daily traded is less than $200,000.

Traditionally larger stocks tend to be less volatile and have a greater volume traded than your portfolio. Often considered as “Blue Chip”, they tend to have broad revenue streams and be more mature businesses with higher income distributions.

|

Golden Rule #6 - Market capitalisation plays an important role in the selection process for investors who are volatility averse and are usually income seeking investors. Volatility averse investors value the inherent strength larger business provide them with the diverse revenue streams and historical performance. While a company being big should not be the sole reason it is considered safe, it does provide a degree of comfort for those who may be concerned by smaller companies where share price shifts can be more volatile. |