Unlike physical assets, the value of a company is extremely hard to quantify and highly subjective because it relies on numerous forward assumptions.

Our Star Stock selection process dictates that we believe investors should be comfortable paying a premium price for a for a high-quality business. Those stocks that trade at significant discounts to consensus price targets are usually stocks with poor Financial Health and high active risks which could instigate further share price falls and downward price target revisions in the future – this phenomenon is often called “value traps”.

Stock Doctor includes a variety of valuation metrics for clients.

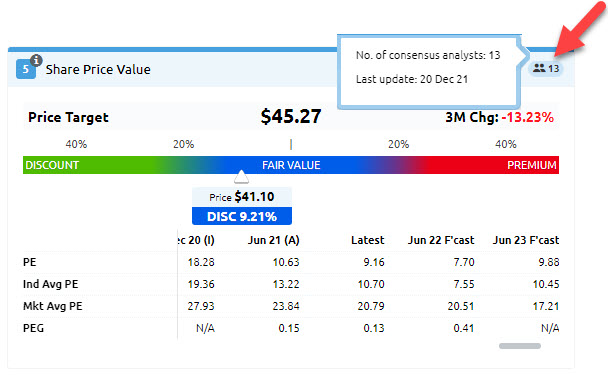

Consensus Price Target – the average of target prices provided by analysts in the industry.

3M Chg (Change in consensus price target over the last 3 months) - the consensus price target revision measures the change in the median analyst price target estimates over the last three months. Revisions to price targets provides a good gauge of analyst sentiment but is only available for stocks with analyst research coverage. Price target revisions have shown to be a more effective factor in contributing to portfolio alpha (excess returns above benchmark) than relying on the share price premium or discount alone. A 3-month period is used because this timeframe represents the ideal balance in capturing more recent price target trends without generating too much short-term signals.

PE (Price Earnings) – Investors can determine value by comparing the price-earnings multiple to its historical levels or the industry or market average.

PEG (Price Earnings Growth) – the price-earnings multiple to the forward growth rate. In theory, a company with a higher growth rate should have a higher P/E.

The consensus price target indicates the anticipated stock price 12 months in advance for companies where consensus data is available. In addition, traditional PE and PEG ratios can be used to assess Share Price Value. A PE ratio of less than the industry average indicates the potential for share price appreciation if the first three Golden Rules are met.

Where the PE is greater than the industry average, the PEG ratio (PE/EPS Growth) is used to determine whether earnings growth justifies the premium price. Lincoln’s benchmark is a PEG ratio of less than one. An alternative is to use a company's forecast PEG, which attempts to justify the premium currently being paid against its expected earnings.

Clicking the  icon displays when the valuation was last updated and the number of analysts in the industry the valuation was derived from.

icon displays when the valuation was last updated and the number of analysts in the industry the valuation was derived from.

Relying on valuations alone as your buy and sell trigger is risky and is not an easy task because:

- Value is a subjective measure, and valuation models rely on numerous assumptions.

- Stocks that trade at discounts to valuation tend to have a higher risk to earnings and could be considered value traps.

Hence it is important for investors to fully understand the risks associated with investing in a stock trading at a discount to valuation.

However, there will also be times when a company’s share price trades at a premium to its valuation, particularly with Star Stocks. Due to its strong corporate history, stability of earnings and/or its future growth prospects with the market attributing a value to management’s ability to keep the earnings momentum going. If the investor is confident that earnings momentum can continue, they may choose to purchase or keep a full or a reduced holding in the stock even though it is considered overvalued.