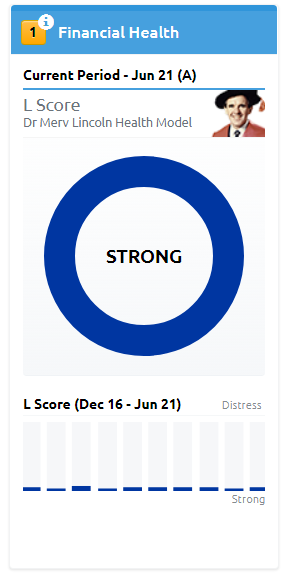

Lincoln Indicators’ unique quantitative Financial Health score (L Score) is the first and most important golden rule in the Stock Doctor quantitative bottom-up stock selection framework.

The L Score was developed in 1982 by Lincoln founder, academic and former Olympian Dr Merv Lincoln. Lincoln's unique Financial Health score is derived using proprietary algorithms that analyse companies financial accounts and calculate industry-specific profit, debt, asset, equity and cash flow ratios.

Ultimately, the Financial Health score is a powerful screening mechanism that enables investors to confidently focus their attention on financially healthy businesses and avoid potential disasters.

Passing Golden Rule 1, Financial Health is a Stock Doctor Star Stock requirement.

It is our firm belief that without understanding the true fundamental quality of a business, you are purely speculating and at risk of serious loss.

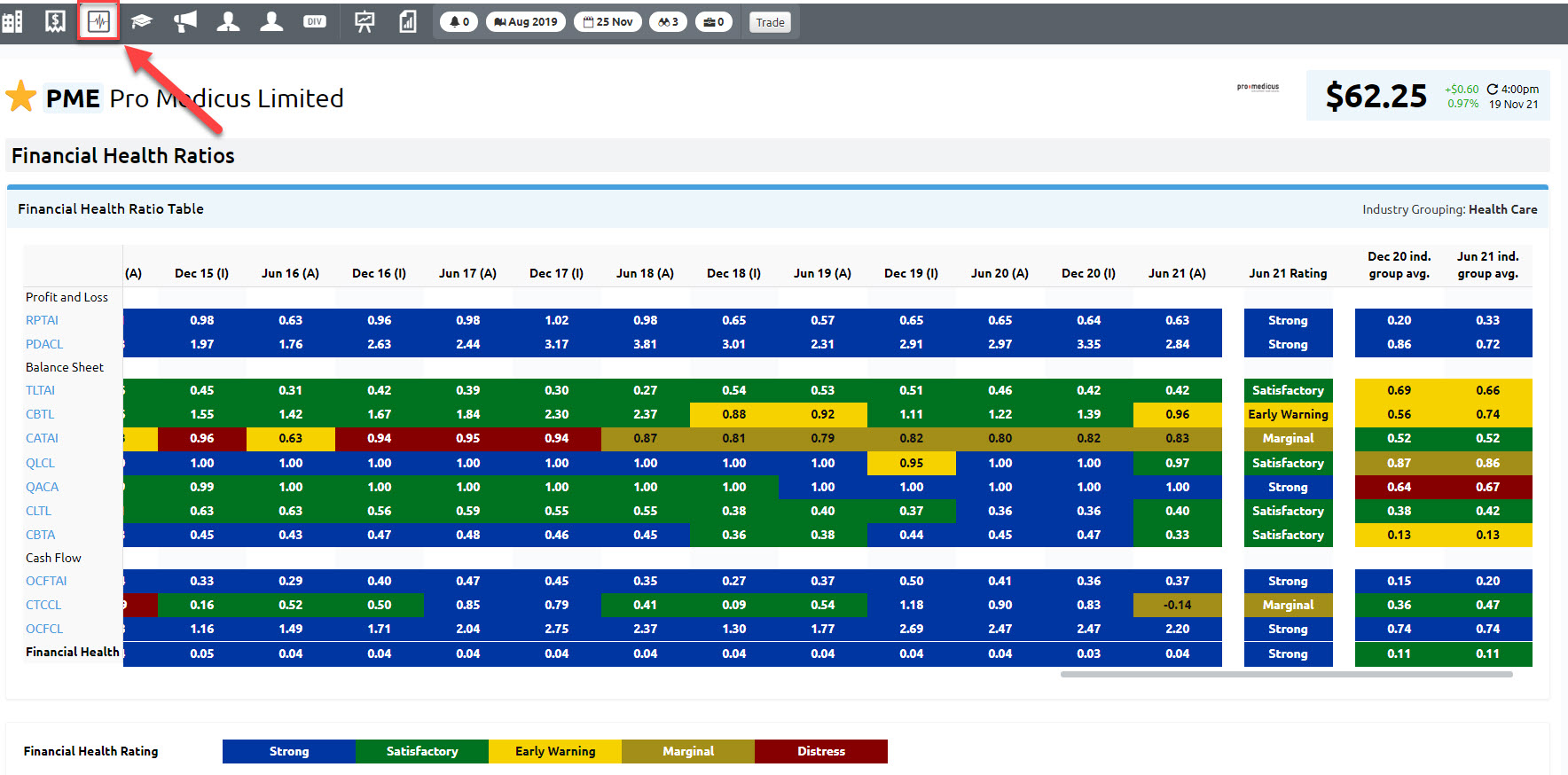

Lincoln’s Financial Health methodology, derived from Dr Lincoln’s PhD thesis, used a multivariate approach, whereby a unique set of financial ratios are calculated, combined and weighted to produce an insolvency risk score representing the overall Financial Health of a company.

Dr Lincoln selected these ratios after analysing thousands of failed and successful companies to separate low-risk companies from high-risk companies and isolate indicators of potential failure.

The model was refined and revalidated in 2007 under the guidance of Assoc Professor Neville Norman using newer multivariate modelling techniques to take into account new ratios that were previously unavailable but are now accessible because of new accounting regulations and reporting standards. (Click here to learn more about Lincoln’s Financial Health Ratios)

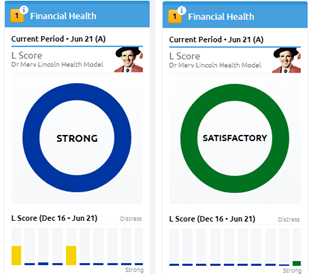

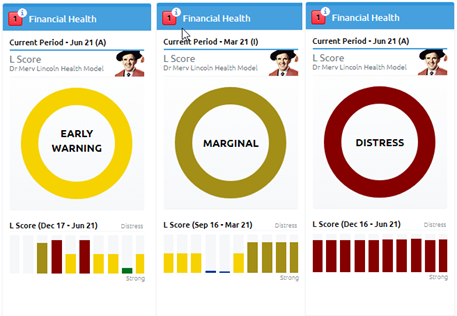

Financial Health is measured on a scale of Strong (blue) to Distress (red).

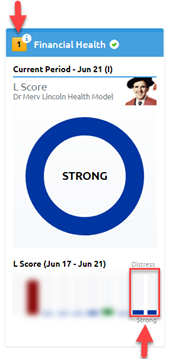

A company must have two consecutive reporting periods of Strong or Satisfactory Financial Health to meet the criteria. It is not sufficient for a stock to be healthy for solely one period due to the possibility of a once-off capital raising which could artificially improve the balance sheet.

If a company passes a primary golden rule, it’s flagged on our 9 Golden Rules page by a gold-coloured number:

Tip: Click on any golden rule number to be provided with a definition of the rule.

Interpreting Financial Health

While complex in its application, we make understanding the true quality and Financial Health of a business very easy.

There is no need for investors to perform any calculations. Simply follow our overall rating and colour coding to understand the level of financial risk a company is exposed to.

Strong (Blue) and Satisfactory (Green)

Companies rated Strong or Satisfactory pass our first screen and therefore represent the best opportunity for investment consideration, as their balance sheets demonstrate sufficient borrowing capacity and adequate cash levels to finance growth. A healthy business will also generate consistent profits and produce strong operating cash flows, underpinning their operational strength.

Their ability to absorb a future ‘shock’ to their business, such as regulatory change, economic cycle shift, or poor sales figures, means management can focus on the essential task of managing their business rather than try to ensure its survival.

Early Warning (Yellow), Marginal (Brown) and Distress (Red)

Companies rated as Early Warning, Marginal or Distress display qualities of failed entities and are therefore not investment grade. They fail our first screen because they have elevated financial risk exposure with a combination of substantial weaknesses across its profit and loss, balance sheet and cash flow statements. While they may continue as a trading entity due to capital raisings from unsuspecting shareholders, substantial changes are needed for the company to remain an ongoing entity.

Bank and Insurance Stocks

Stock Doctor analyses Bank and Insurance companies separately because they operate under a different financial structure to other ASX listed companies. Hence, the Financial Health for the companies in this sector is assumed to be ‘Strong’ as they are already subject to rigorous prudential and liquidity standards and requirements.

For more information on the Financial Health Model, refer to Lincoln Indicators’ Financial Health Whitepaper.