Fairfax Media demerged their Domain operations as a new company Domain Holdings Limited (DHG) on 17th of November 2017. Eligible shareholders received 1 DHG security for every 10 FXJ shares they held at a market value of $3.69. Instructions below are for FXJ investors who have acquired and held FXJ shares on or after 20 September 1985 (implementation of CGT).

- Click on the 'Portfolio’ tab and then click on the appropriate under ‘My Portfolio(s)’, which includes the FXJ shares.

- Under the ‘Securities Held’ section, find the row Fairfax Media Limited (FXJ).

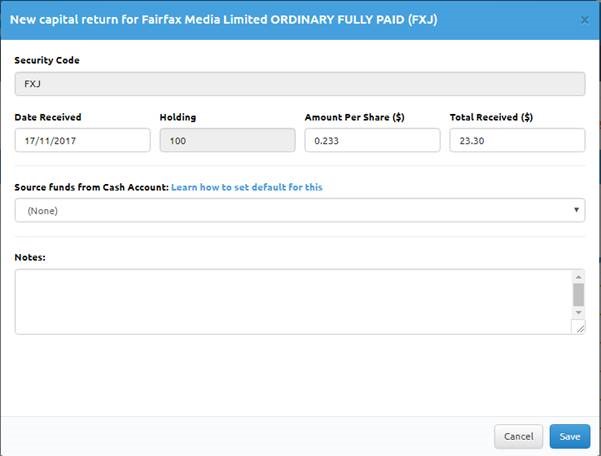

- Click the drop down button next to ‘Transactions’ on the same line, and select ‘New Capital Return’.

- In the new pop-up window, enter the ‘Date Received’ as 17/11/2017 and ‘Amount Per Share’ as ‘$0.233’.

- Click on ‘Save’ at the bottom; the pop-up window should close and your FXJ cost base has now been adjusted for the demerger.

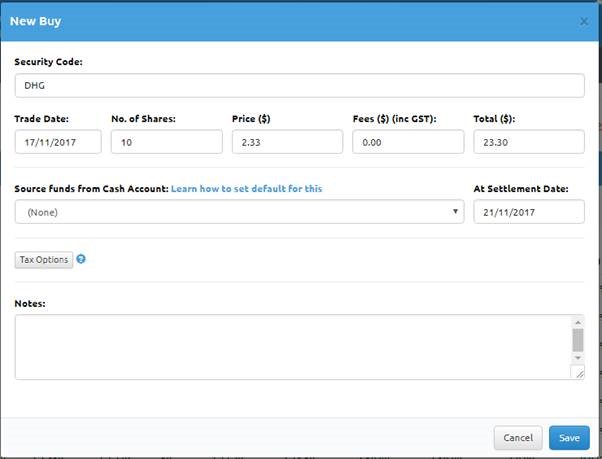

- Click on the ‘New Buy’ button either under ‘Securities Held’ section.

- In the new pop-up window, enter ‘Security Code’ as DHG, the ‘Trade Date’ as 17/11/2017, ‘No. of Shares’ as the DHG securities received as per statement (demerger was on a 1 for 10 basis), ‘Price ($)’ as $2.33 and ‘Fees ($)’ as $0.00. (Note that the ‘Total ($)’ and ‘At Settlement Date’ fields will automatically populate). Please check against your holding statement for the number of DHG securities you ultimately received. This will be rounded up to the nearest whole number.

- Click on ‘Save’ at the bottom; the pop-up window should close and the additional DHG securities from the demerger have now been accounted for.