The issues relating to the tax treatment of SMSF’s in Pension phase and the recent changes to the balance cap and CGT relief are complex and quite detailed, with significant importance placed on the date of implementation of any changes. Be sure to speak to your certified accountant or financial planner before making any changes. Lincoln Indicators and / or its associates are not permitted to provide any tax advice and therefore anything we say should not be taken as advice.

From 1 July 2017, the government introduced a $1.6 million cap on the total amount that can be transferred into the tax free retirement phase for account-based pensions.

These pensions are commonly provided by defined benefit funds, but may be provided by other funds, including self managed super funds.

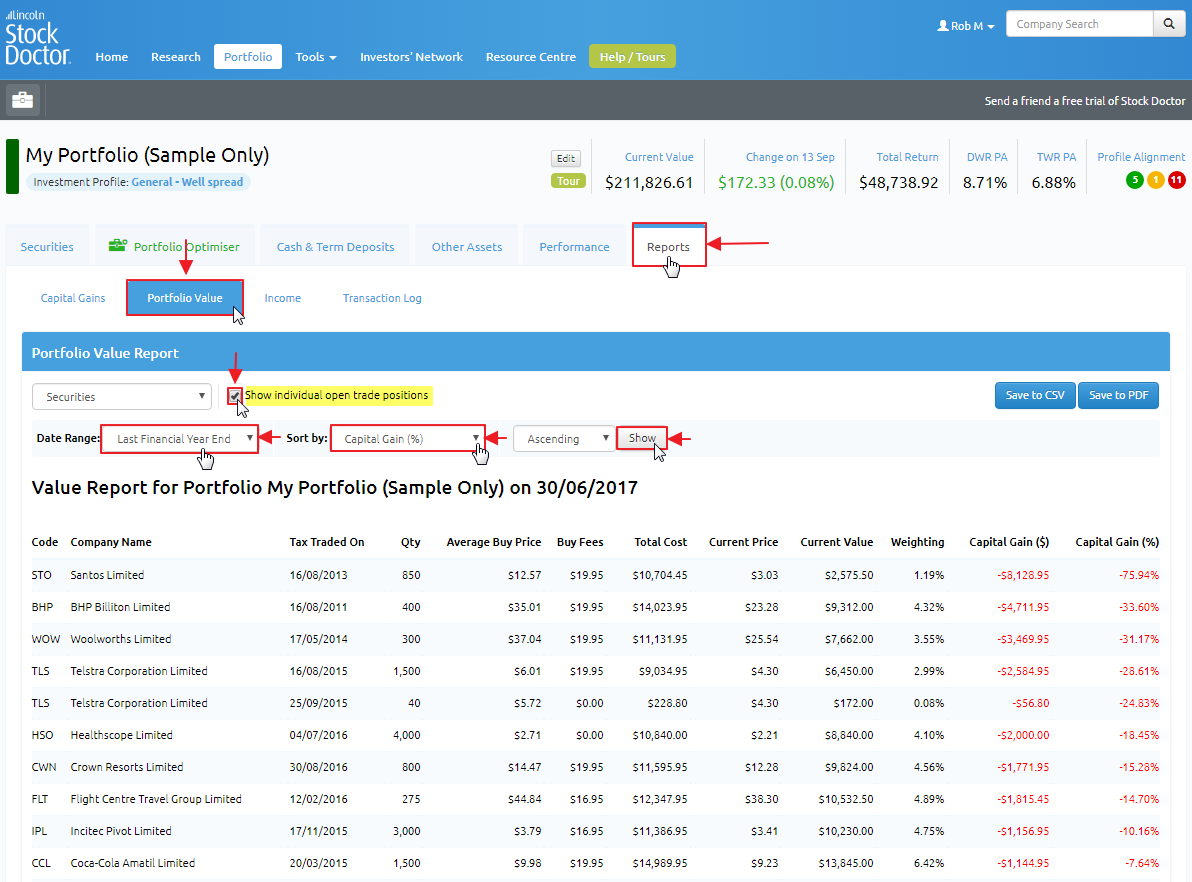

To aid members in restructuring their SMSF, so that only $1.6 million remains in the tax free retirement phase account, we have introduced a Value Report of Individual Open Trade positions that's sortable by Capital Gains (%).

This report helps identify parcels to transfer from retirement phase over to accumulation and nominate parcels for CGT relief.

For more information on self-managed super fund changes, please see:

https://www.ato.gov.au/individuals/super/super-changes/New-transfer-balance-cap-for-retirement-phase-accounts/

How to run a Value Report on Individual Open Trade positions

- From within the Portfolio Manager, select the ‘Reports’ tab.

- Select 'Portfolio Value' tab.

- Tick the box ‘Show individual open trade positions’.

- Select a Date Range: (eg. ‘Last financial year end’).

- Sort by: 'Capital Gain (%)'.

- Click ‘Show’.